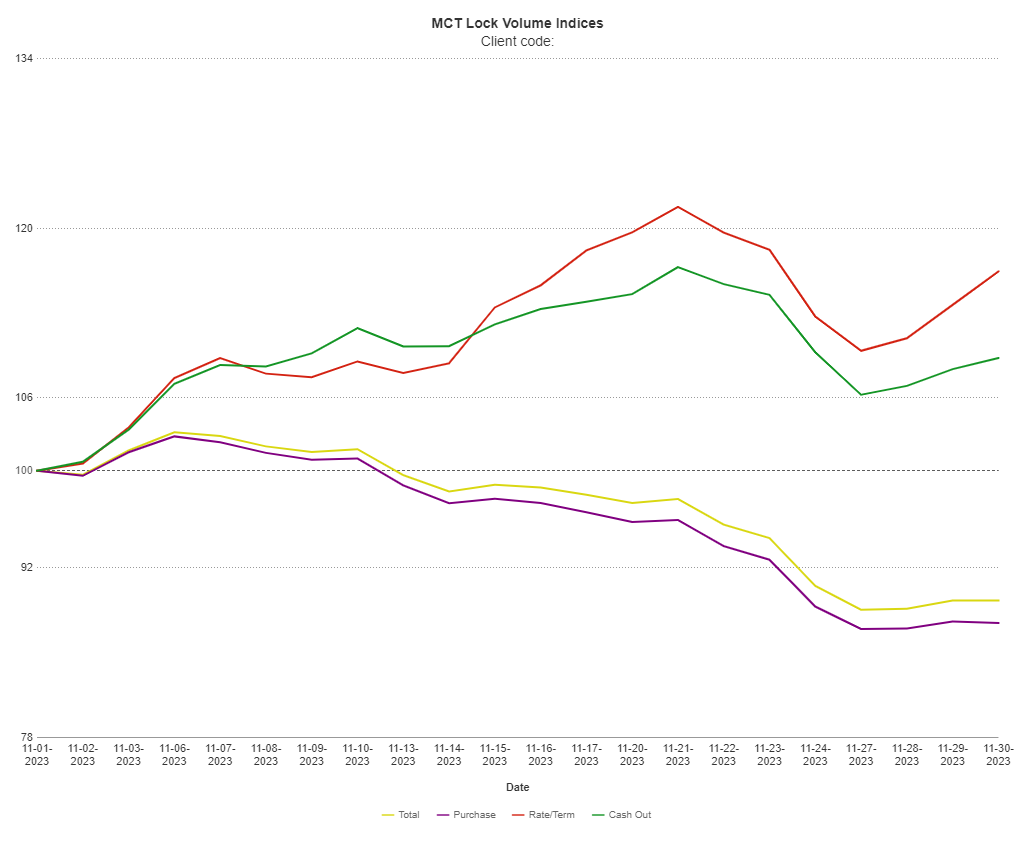

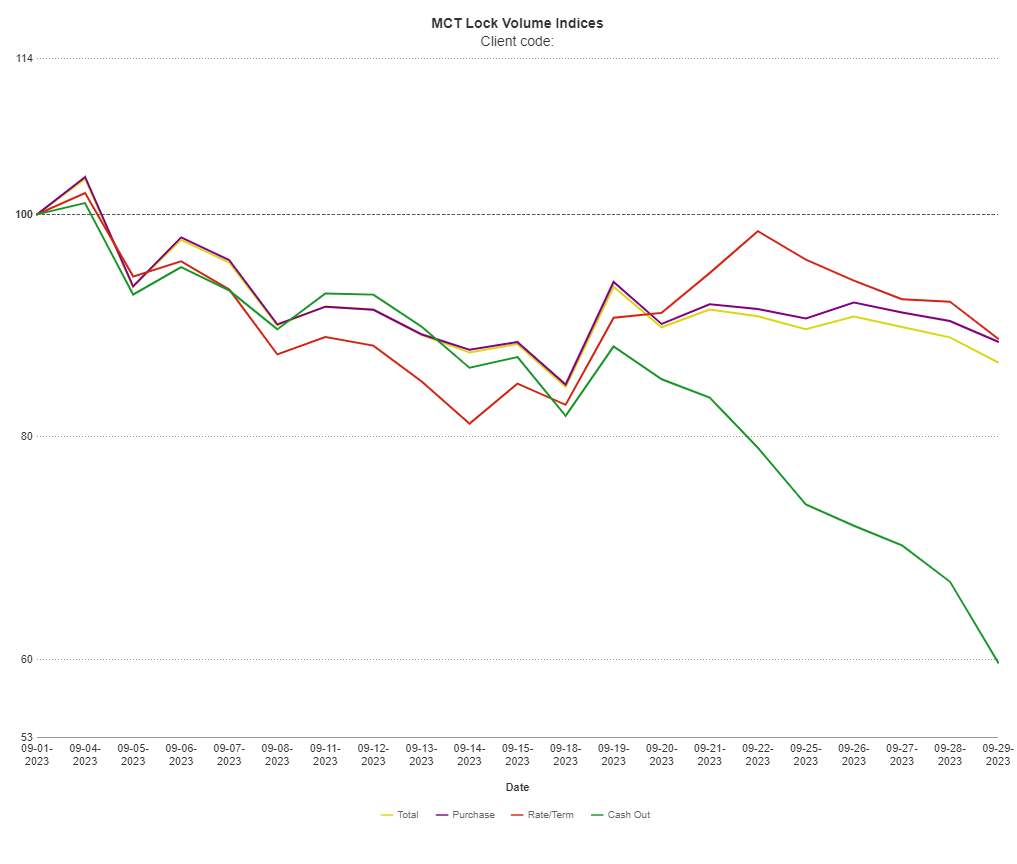

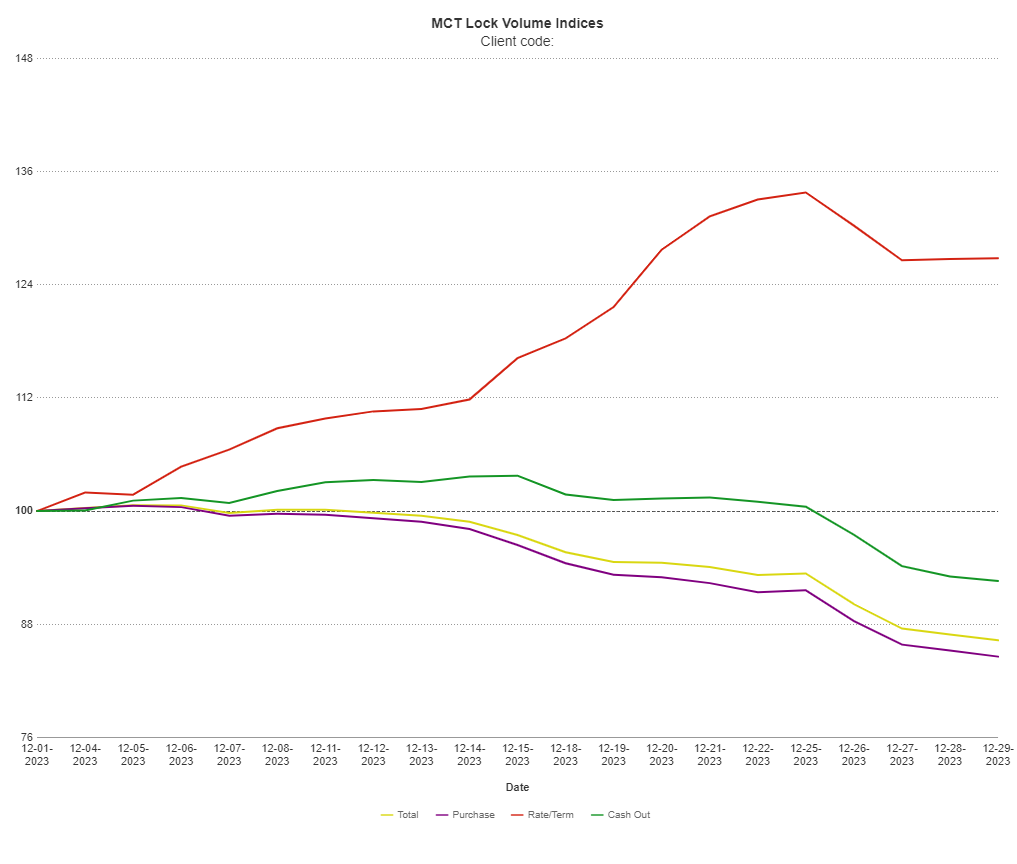

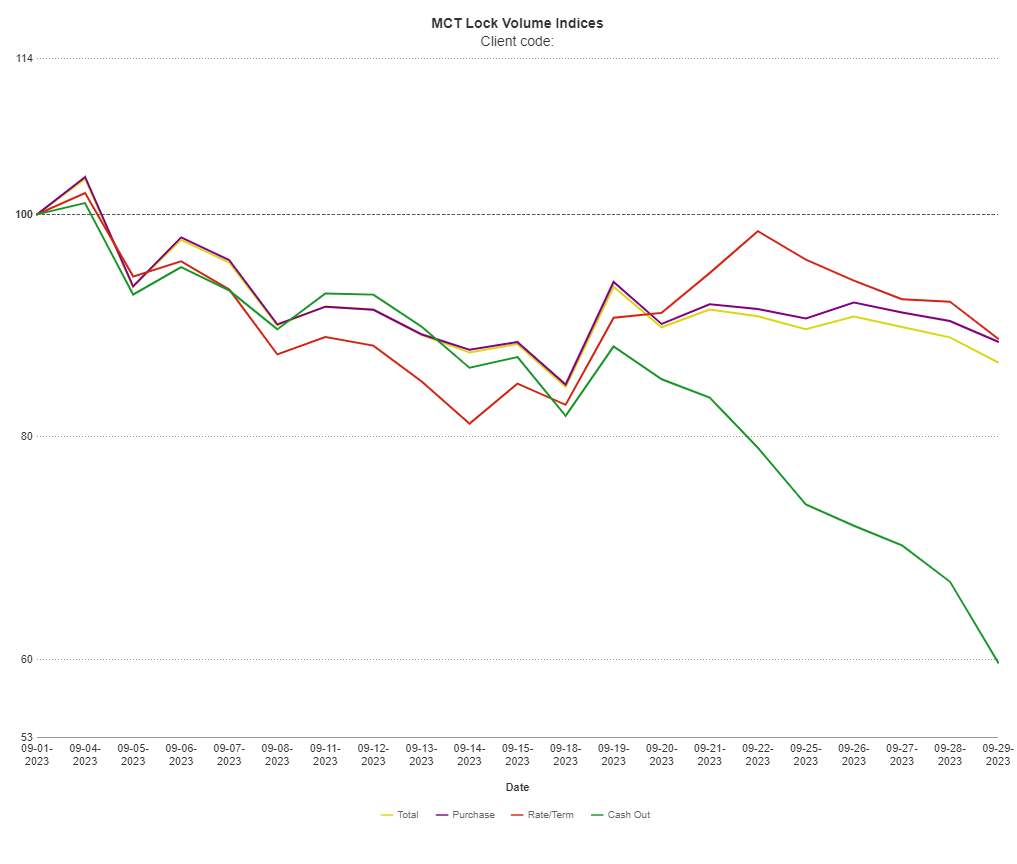

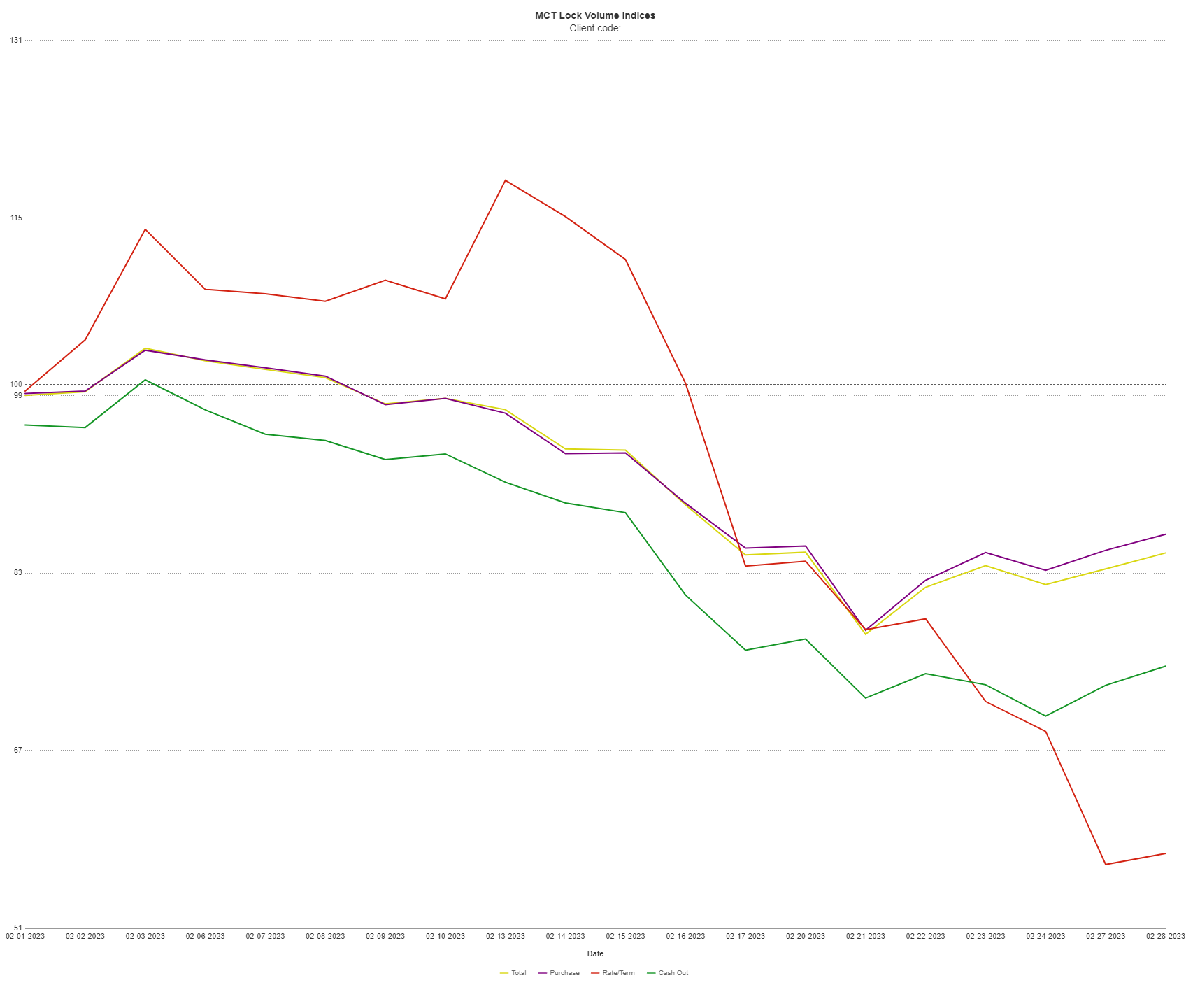

Mortgage Capital Trading, Inc. (MCT®), a leading mortgage hedge advisory and secondary marketing software firm, revealed today a 13.71% decline in mortgage lock volume compared to the previous month. To gain comprehensive insights into the market dynamics, industry professionals and enthusiasts are invited to download the complete report.

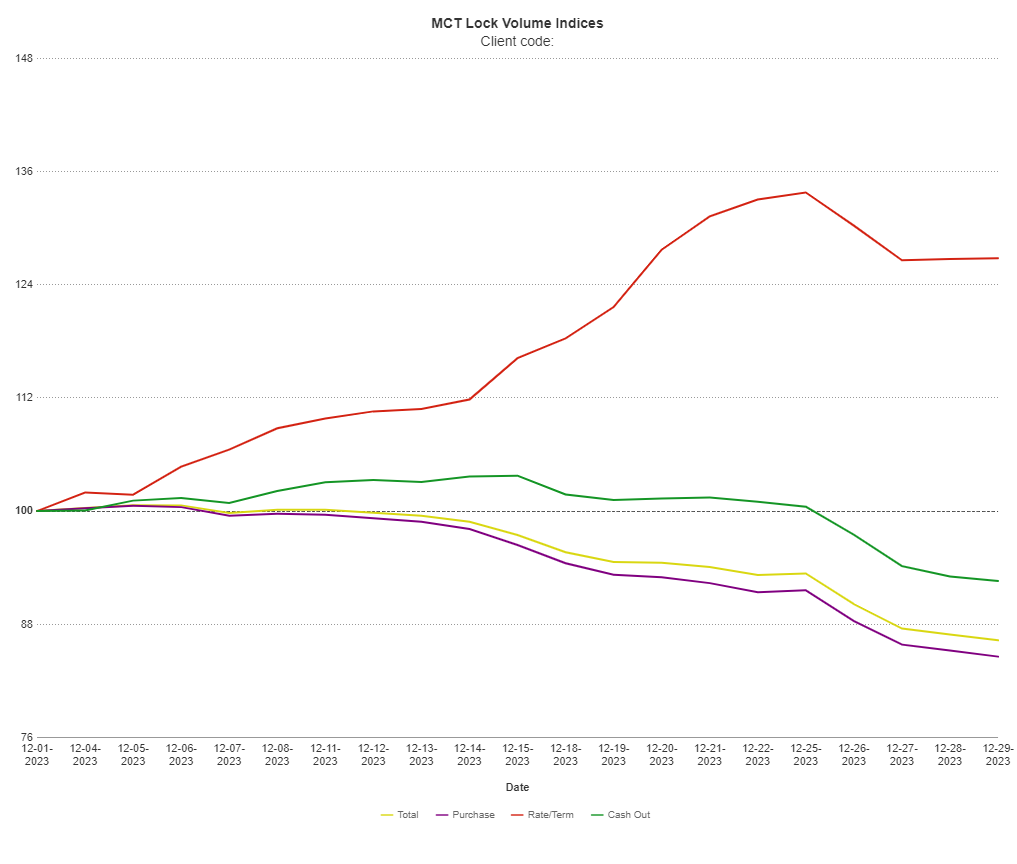

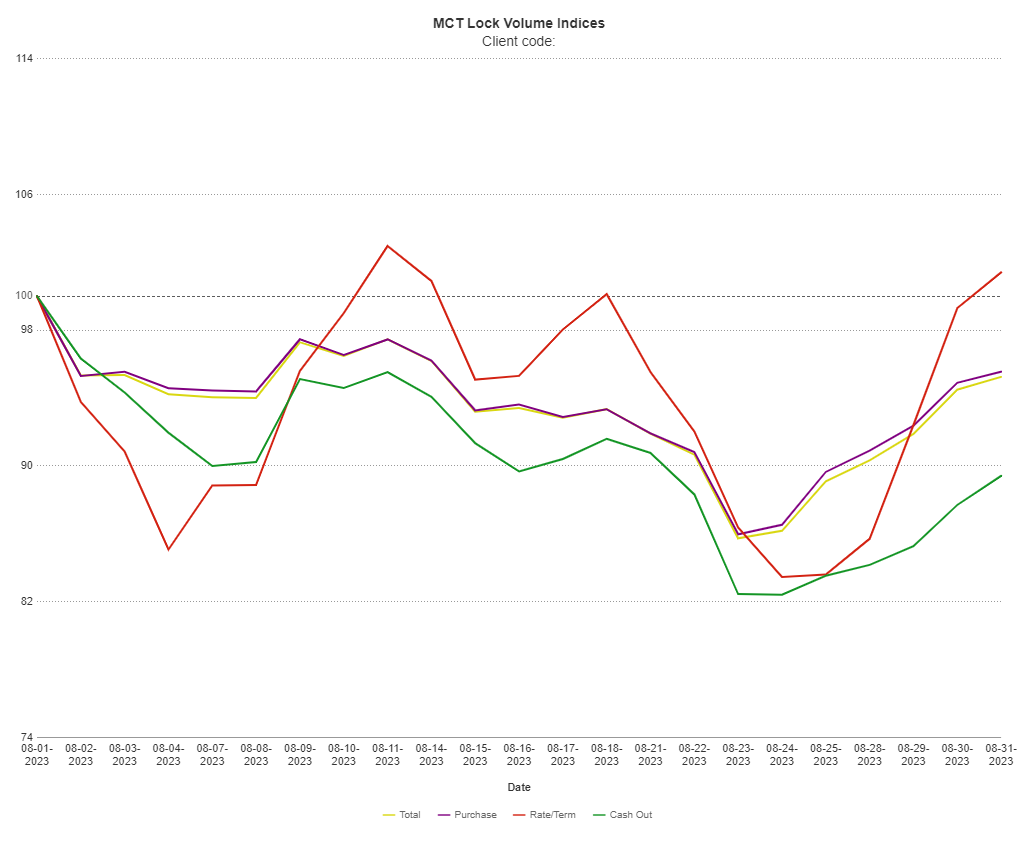

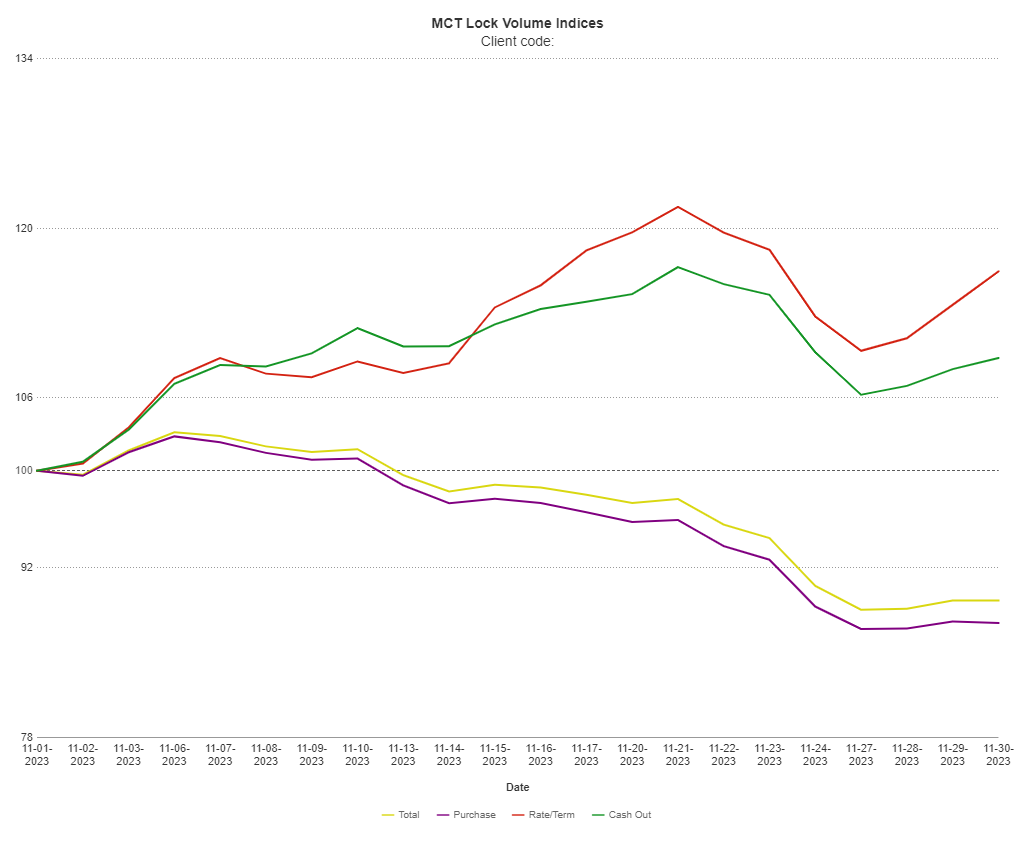

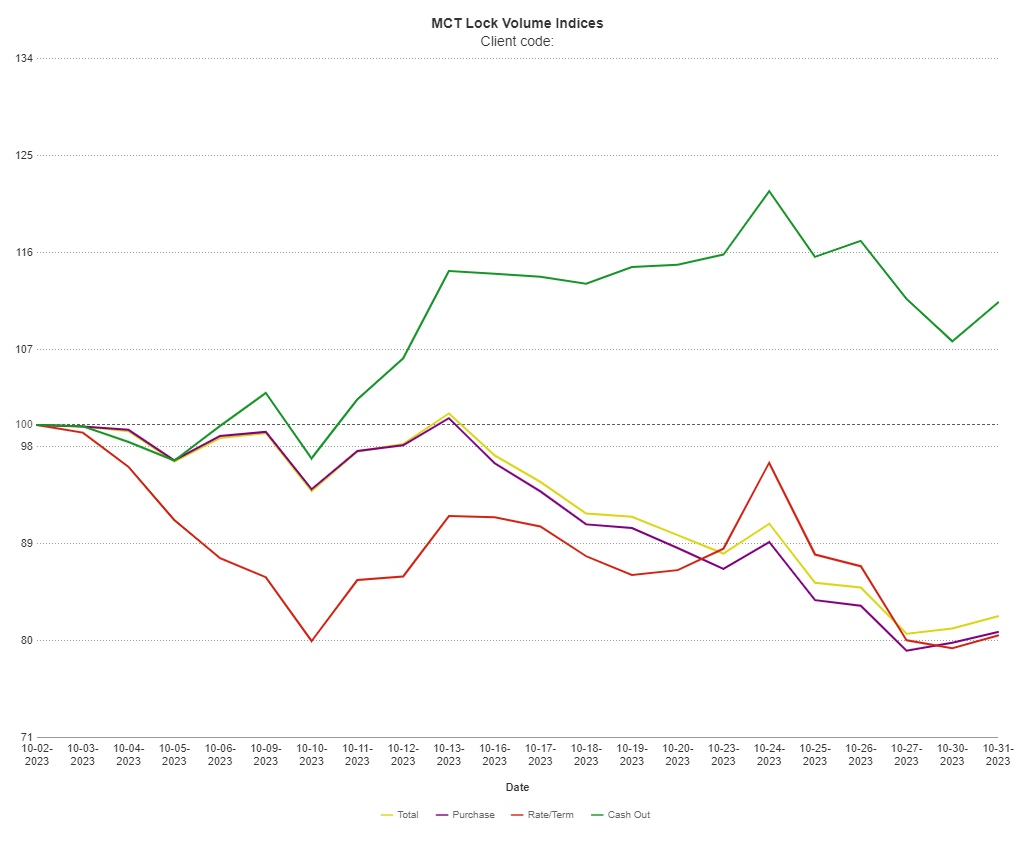

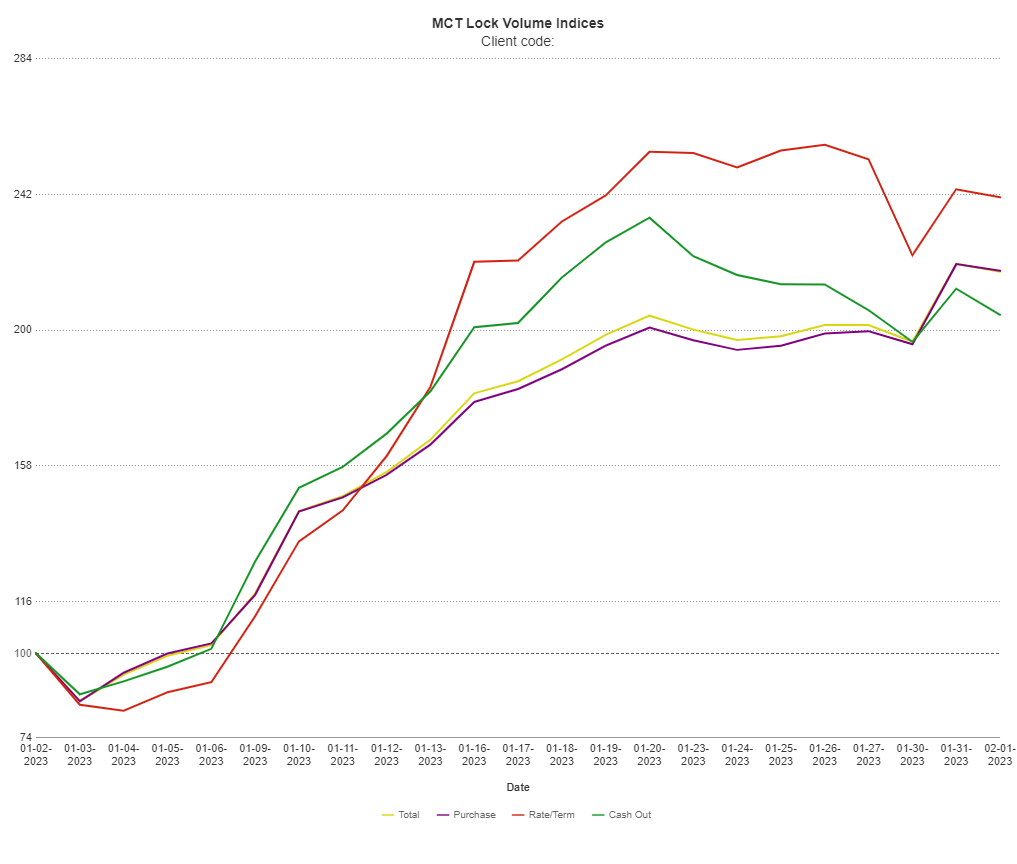

Mortgage Capital Trading, Inc. (MCT®), a leading mortgage hedge advisory and secondary marketing software firm, today announced a 10.7% decrease in mortgage lock volume compared to the previous month. This revelation comes as part of MCT’s monthly Lock Volume Indices report, offering valuable insights into the dynamic landscape of the residential mortgage industry.

This whitepaper reviews the intricate world of margin management, a pivotal driver of success in the ever-transforming mortgage industry. Learn how analyzing market share dynamics and volume trends becomes a strategic compass for effective margin management.

In this webinar, Phil Rasori and Andrew Rhodes will share analysis on the current market, comparison to relevant historical precedent, and new MCT software functionality to equip lenders in this challenging market.

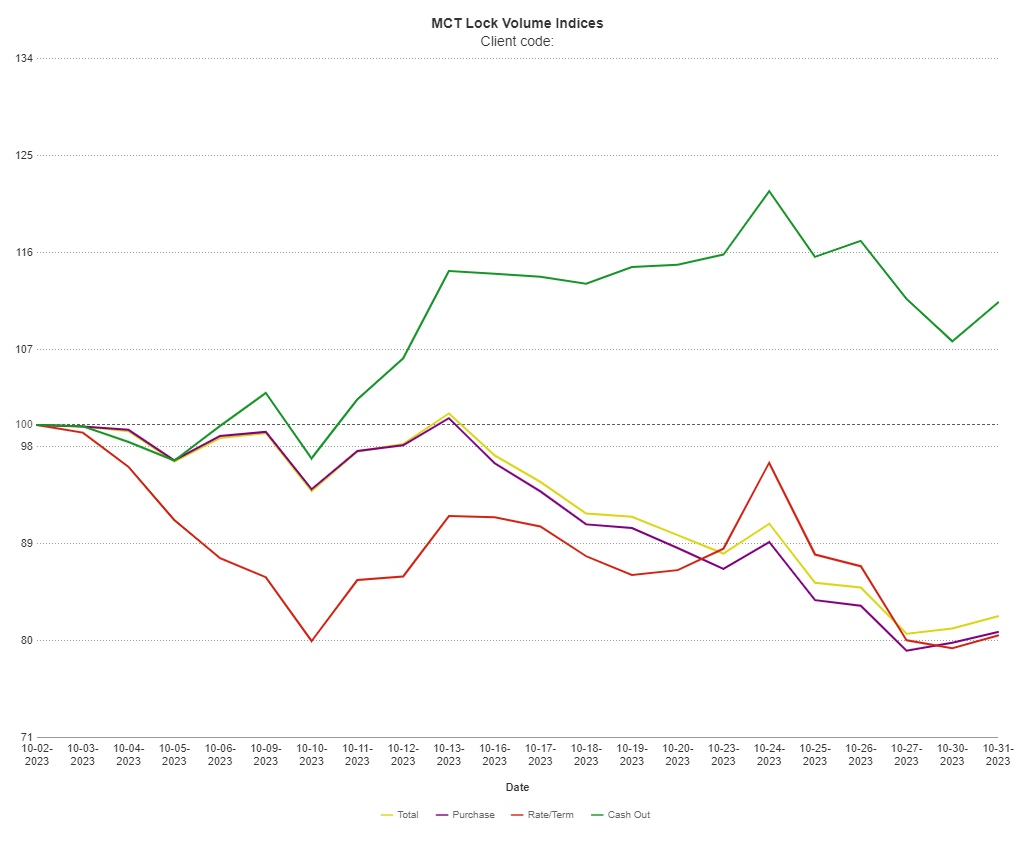

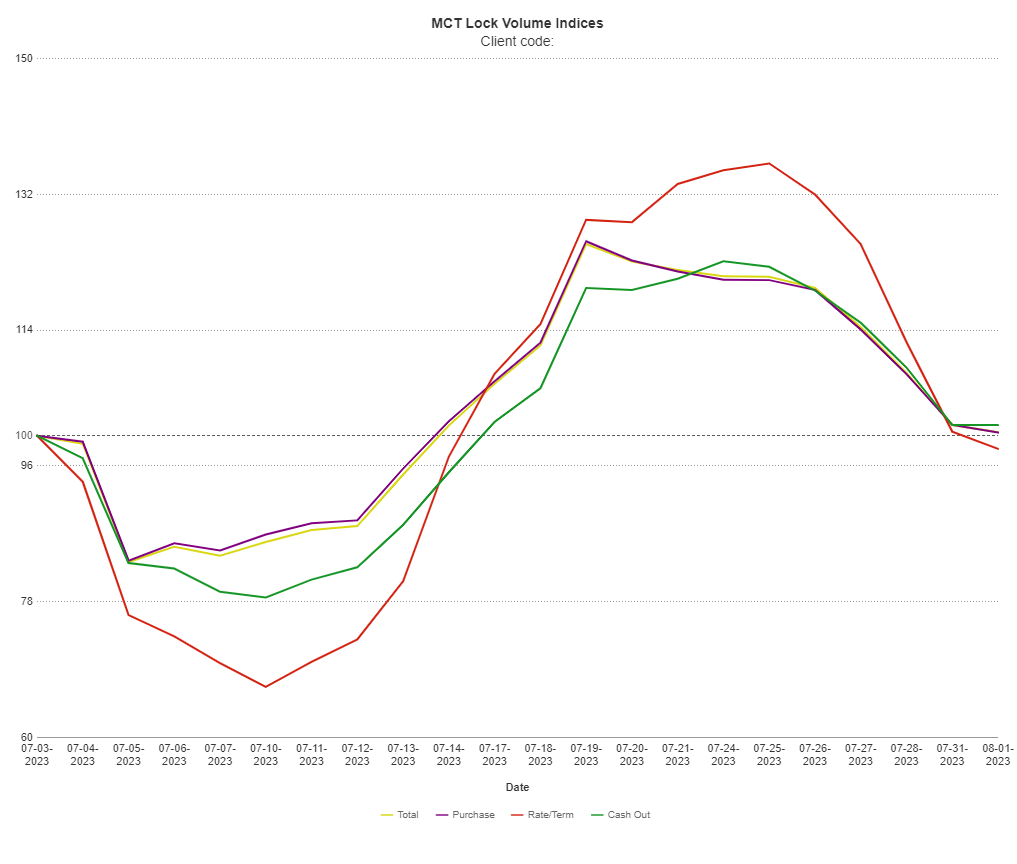

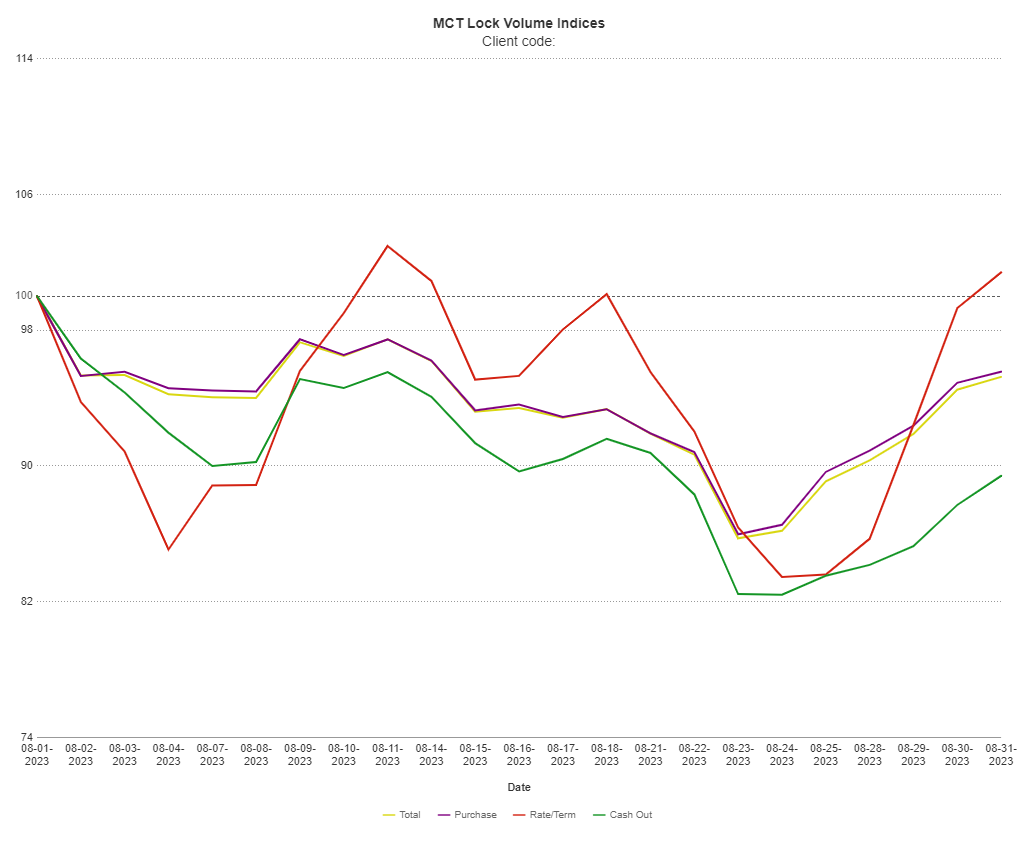

Mortgage Capital Trading, Inc. (MCT®), a leading mortgage hedge advisory and secondary marketing software firm, reported today a drop of 17.76% in mortgage lock volume over the prior month. Complete the form to download the full report.

– Mortgage Capital Trading, Inc. (MCT), the de facto leader in innovative mortgage capital markets technology, announced that Cara Krause, VP, Northeast Regional Sales, has been selected as one of the Powerful Women of Mortgage Banking 2023 by Mortgage Banker Magazine. The annual awards recognize successful women who are shattering the glass ceiling and making significant impact in the industry.

What Gets You Through Down Cycles in the Mortgage Market? In this new MCT series, we are asking secondary market professionals topical questions you’re also probably pondering as well.

With limited mortgage volume, you need to make the most of every loan trade. MCT Marketplace is the largest mortgage asset exchange for the U.S. secondary market that is pushing the industry forward with new efficiencies and executions. View this webinar featuring MCT’s Phil Rasori, Paul Yarbrough, and Justin Grant for a practical guide to maximizing your loan trading profits.

MCTlive! Mortgage Lock Volume Indices covers the period from September 1 to September 30, 2023, and represents a broad and balanced cross section of several hundred lenders of various sizes and business models in the mortgage industry across retail, correspondent, wholesale, and consumer direct channels.

Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, announced that it has been named one of the Best Places to Work 2023 by the San Diego Business Journal (SDBJ).

MCTlive! Mortgage Lock Volume Indices covers the period from August 1 to August 31, 2023, and represents a broad and balanced cross section of several hundred lenders of various sizes and business models in the mortgage industry across retail, correspondent, wholesale, and consumer direct channels.

Determining what execution is most efficient and profitable will have a big impact on the bottom line. This whitepaper reviews several key considerations to apply a strategic best execution analysis.

This whitepaper outlines why having a Fannie Mae, Freddie Mac, or Ginnie Mae approval adds value to a mortgage company or depository and offers some important tips on how to obtain that valuable approval.

SAN DIEGO, Calif., Aug. 10, 2023 – Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, today announced the appointment of Steve Pawlowski as Managing Director, Head of Technology Solutions.

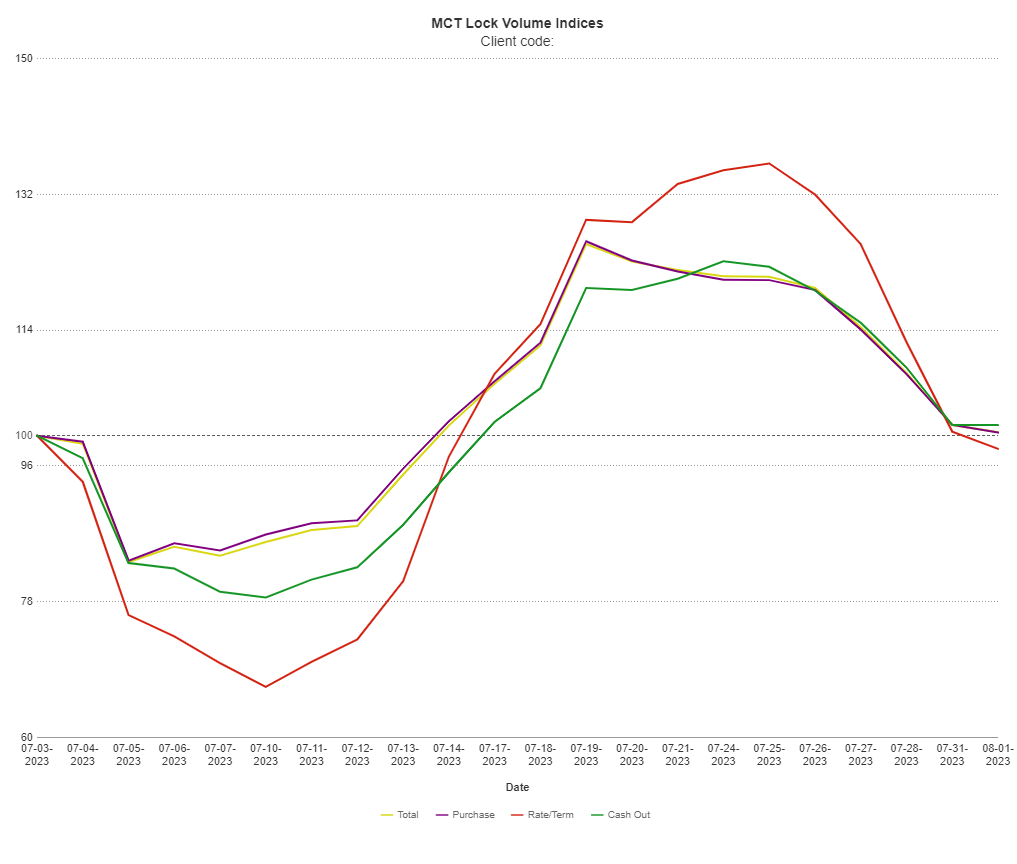

MCTlive! Mortgage Lock Volume Indices covers the period from July 1 through July 31, 2023, and represents a broad and balanced cross section of several hundred lenders of various sizes and business models in the mortgage industry across retail, correspondent, wholesale, and consumer direct channels.

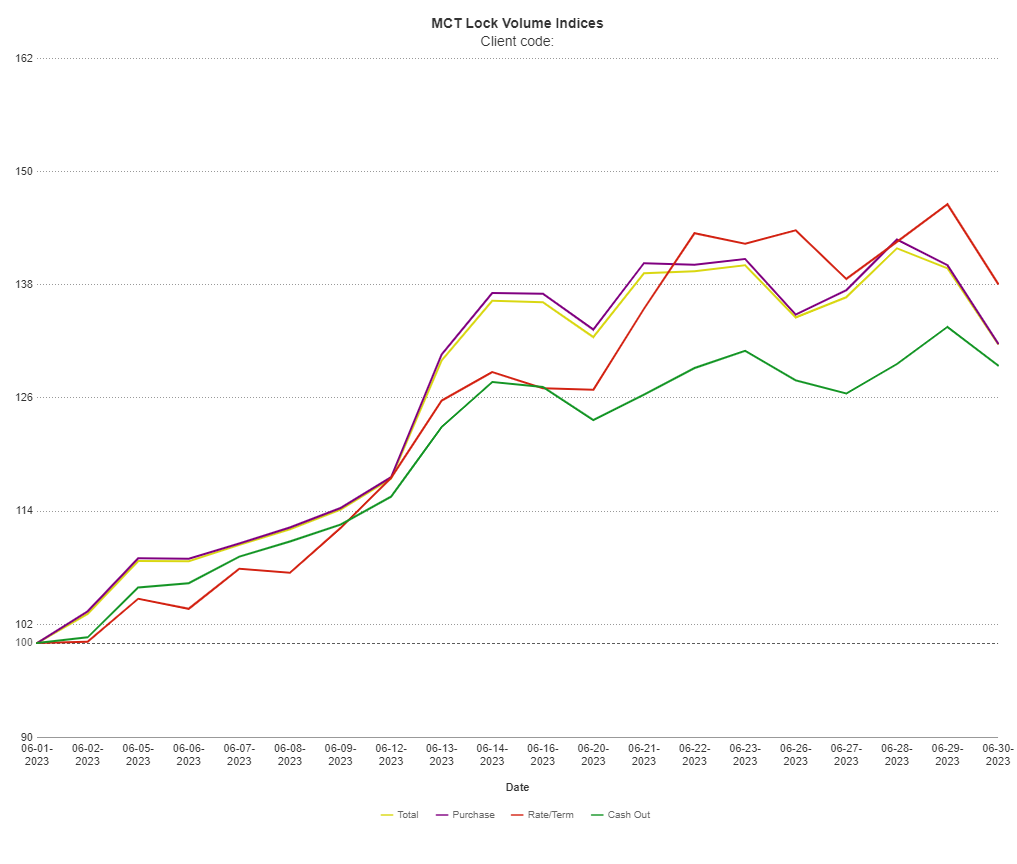

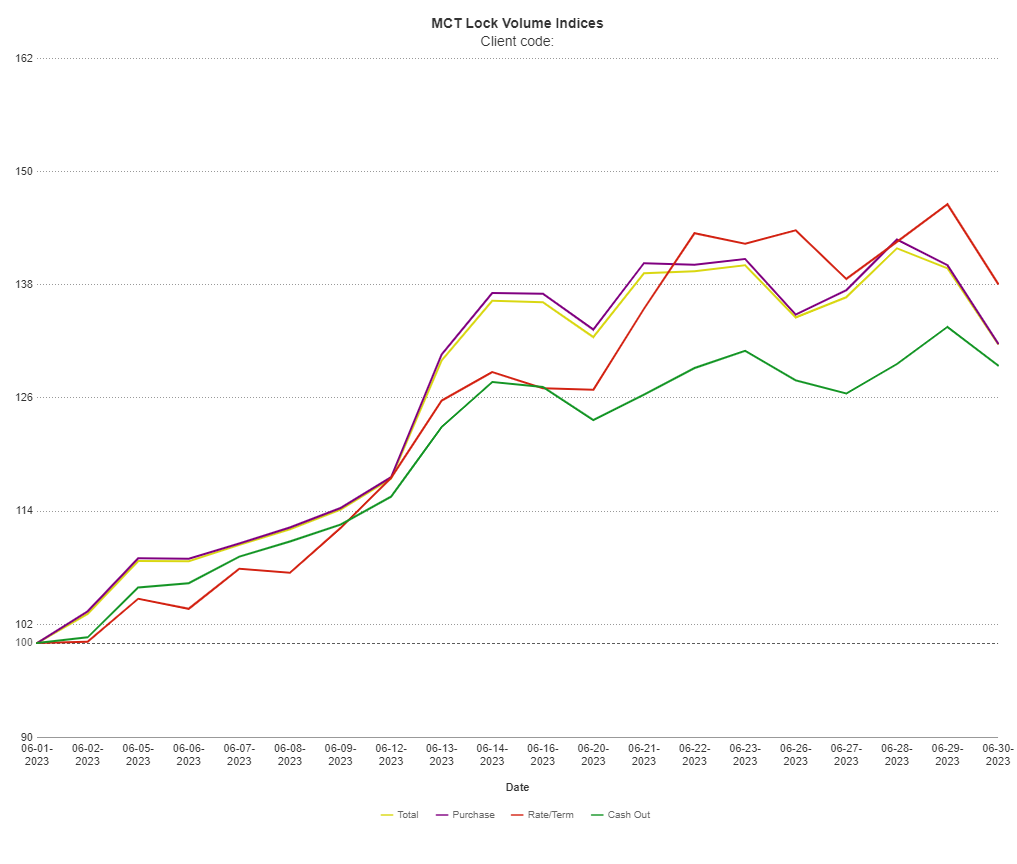

MCTlive! Mortgage Lock Volume Indices covers the period from June 1 to June 30, 2023, and represents a broad and balanced cross section of several hundred lenders of various sizes and business models in the mortgage industry across retail, correspondent, wholesale, and consumer direct channels.

In this case study, Ajay Timothy and Thia Kaleta of NBH Bank describe their process getting started with MCT and how they were able to get mortgage pipeline hedging and best execution loan sales up and running in just ten days.

In this webinar, MCT’s Phil Rasori and Paul Yarbrough will provide a current market overview and include actionable insights to improve profitability for lenders. Attendees will receive key hedging, trading, best execution, and MSR recommendations, as well as how to leverage technology to improve profitability and efficiency.

MCTlive! Mortgage Lock Volume Indices covers the period from April 1 through April 30, 2023, and represents a broad and balanced cross section of several hundred lenders of various sizes and business models in the mortgage industry across retail, correspondent, wholesale, and consumer direct channels.

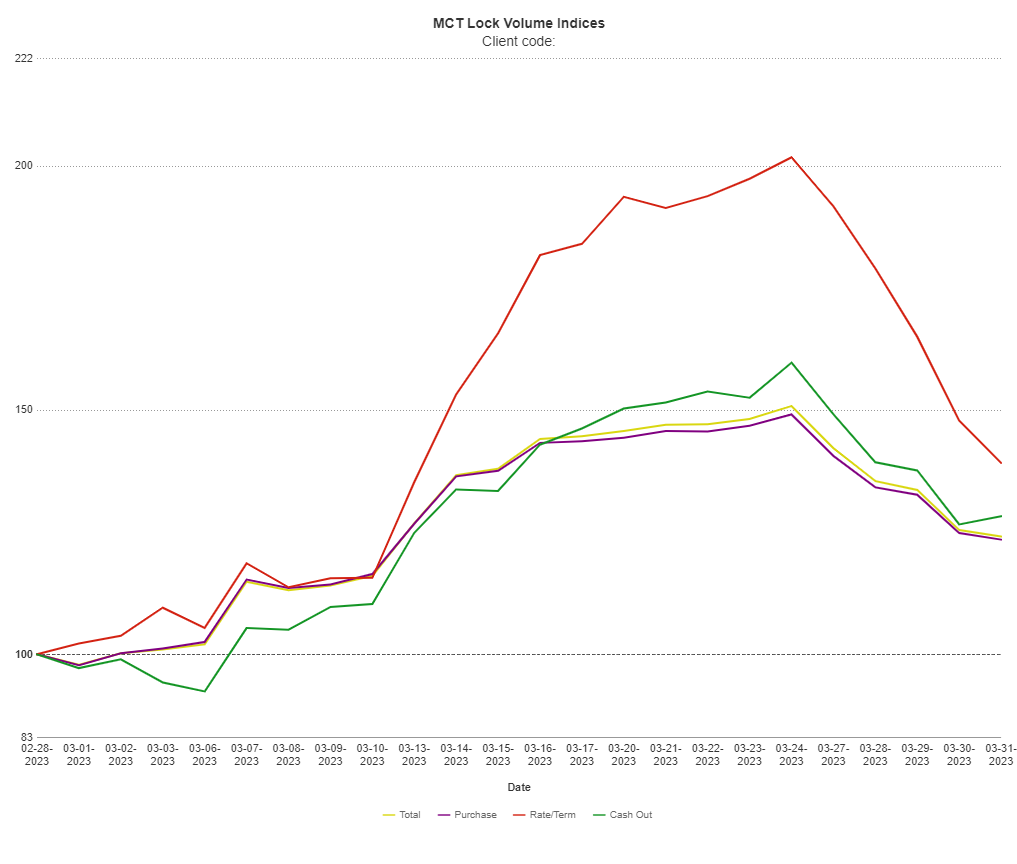

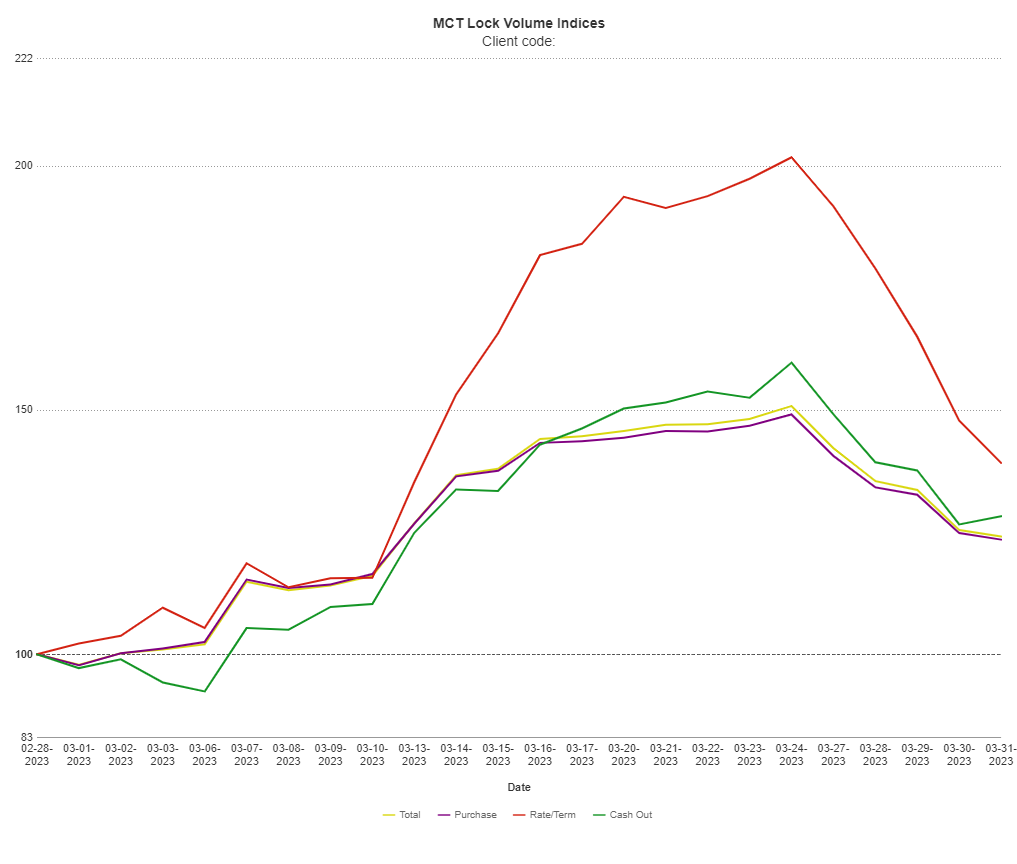

MCTlive! Mortgage Lock Volume Indices covers the period from March 1 through March 31, 2023, and represents a broad and balanced cross section of several hundred lenders of various sizes and business models in the mortgage industry across retail, correspondent, wholesale, and consumer direct channels.

Unless you live under a rock, or in an increasingly blissful state of ignorance, you have likely noticed that government-bond yields have fallen the most since 2008

BSI Financial Services (BSI) has become the latest investor to join BAMCO, MCT’s new marketplace for co-issue loan sales. BAMCO brings co-issue transactions directly into MCT’s whole loan trading platform and improves price transparency by connecting unapproved sellers to live executions from potential buyers.

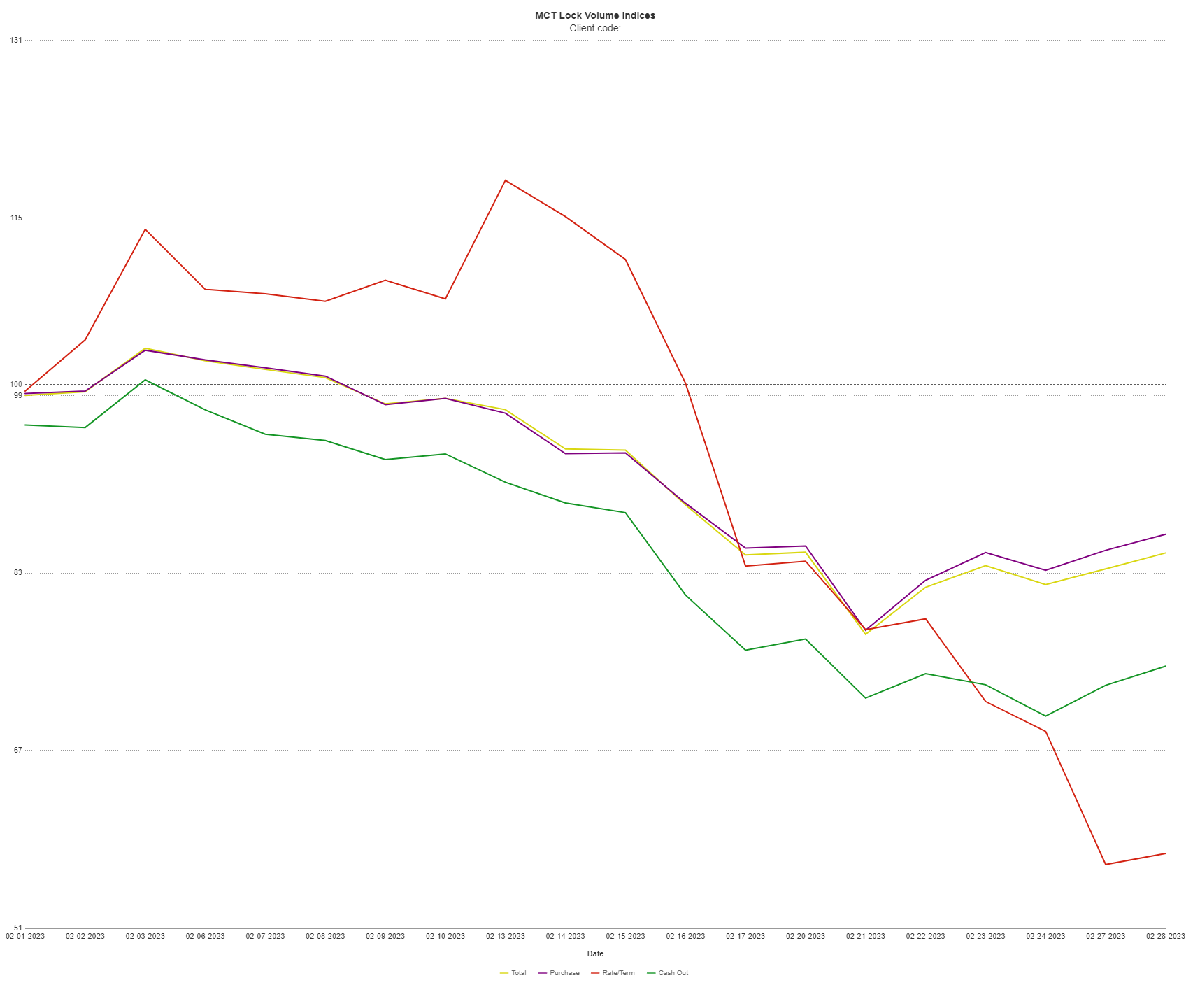

MCTlive! Mortgage Lock Volume Indices covers the period from February 1 through February 28, 2023, and represents a broad and balanced cross section of several hundred lenders of various sizes and business models in the mortgage industry across retail, correspondent, wholesale, and consumer direct channels.

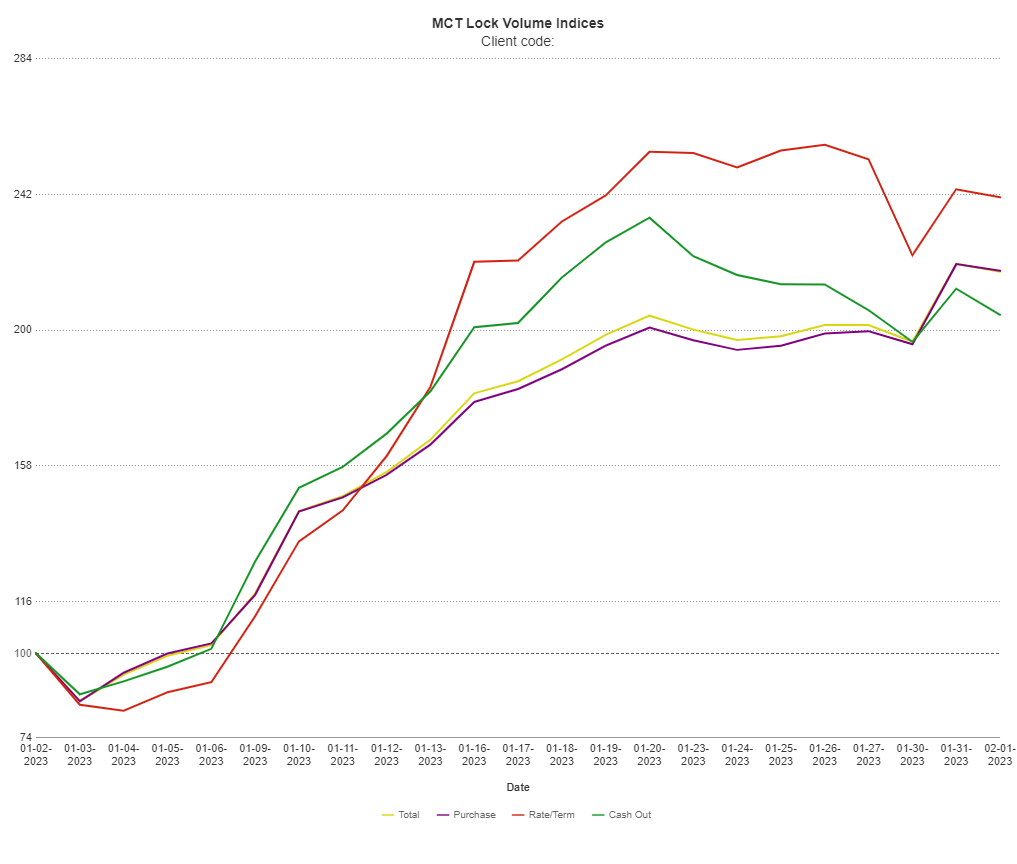

MCTlive! Mortgage Lock Volume Indices covers the period from January 1 through January 31, 2023, and represents a broad and balanced cross section of several hundred lenders of various sizes and business models in the mortgage industry across retail, correspondent, wholesale, and consumer direct channels.

Page 2 of 8«12345...»Last »