Mortgage Capital Markets Insights & News by MCT

Leverage secondary market strategies, daily market commentary, and mortgage indices from the MCT Learning Center to elevate your performance and your career.

Filter By Solution

Filter by Type

Filter by Topic

Filter by Learning Level

Learn how to respond to mortgage-backed securities market movement and how to protect margins during volatility using tools in MCTlive!

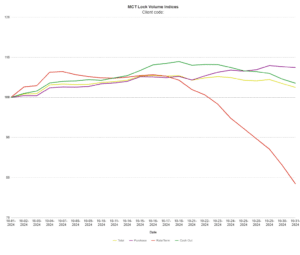

MCT’s July Lock Volume Indices show steady growth across all loan types, with rate/term refis up 9.89% and surprising market stability after a strong jobs (…)

The originations market struggled over the last few weeks while mortgage rates continued to hover around 7%, but now some relief is in sight. Read (…)

Discover how Mortgage Equity Partners improved execution and scaled efficiently through their partnership with MCT’s secondary marketing platform and support.

MCT helps Waterstone Mortgage scale efficiently with custom support, responsive service, and a true partnership tailored to their unique IMB-bank structure.

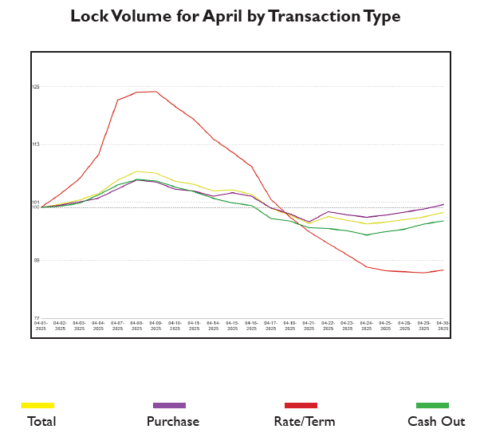

MCT reports June purchase lock volume held nearly flat, signaling steady housing demand amid high rates, as refis drop sharply due to rate volatility.

Mortgage rates and most other rate indices have risen during the month of May. MCT’s mortgage rates model reflected an increase in rates of about (…)

Watch how an expert MCT trader discusses the ease of onboarding to the platform, the quality of data, and our commitment to communication

Watch how Pike Creek Mortgage uses MCT's generative AI, Atlas, to request and act on a live hedge recommendation in the MCTlive! platform.

MCT’s Atlas AI becomes first generative AI to inform a live hedge execution, marking a groundbreaking step in AI-driven mortgage capital markets technology.

MCT’s May Lock Volume Indices show flat mortgage activity amid market volatility, with rate/term refis down 13% and total volume up 11% year-over-year.

Learn how correspondent lending drives homeownership, why it’s key for market liquidity, and how mandatory loan sales can help you scale as a correspondent lender.

Join the MCT Newsletter

Keep up with industry-changing innovations, MBS market movements, and growth opportunities that impact your mortgage capital markets operation.

Read Latest MCT Market Commentary

Take the Next Step for Your Company & Career

Find your secondary mortgage market growth stage and top educational content to take advantage of the next opportunity. Click on the related box for additional learning.

Semi-Autonomous Hedging & Loan Sales

Have a specific question?

Track the Market with MCT’s Mortgage Lock Volume Index

As the leader in mortgage capital markets technology, MCT supports more lenders than any other single provider. This privileged position supports analysis of a meaningful population of data into macro insights. MCT’s mortgage lock volume indices are based on actual locked loans, not applications, and are therefore a more accurate indication compared to alternatives.