In the mortgage industry, AOTs (assignment of trade) are an increasingly popular practice among three counterparties: mortgage originators, mortgage investors, and broker-dealers. One of the main benefits of AOT execution for lenders is the savings of the bid-offer spread on the to-be-announced mortgage-backed security (TBA) trades used to hedge their open mortgage pipeline. With MCT’s recent automation of digital TBA trade assignments, it is now easier than ever to leverage this strategy. This automation streamlines the process of AOT loan sale executions for all three counterparties which makes for a faster, more convenient, and more accurate transaction. We anticipate further growth of AOT executions beyond the record $20B which MCT lenders executed in 2023.

In this blog post, MCT experts delve into the nature of an AOT execution, the impact of bid tape AOT on TBA positions, how automation has improved the AOT process, and how bid tape AOT affects the best execution strategy. Read on to learn all about the AOT process and why it is a must-have strategy in the current mortgage market climate.

- What is Bid Tape Assignment of Trade (AOT)?

- What are the benefits of AOT execution?

- How does modern bid tape AOT compare to legacy AOT executions?

- How does bid tape AOT affect the best execution strategy?

- How does automation improve the AOT process?

- Which investors offer bid tape AOT programs?

- Where are bid tape AOT transactions conducted?

By the Numbers: AOTs by MCT Clients in 2023

Avg. Bid/Offer Spread (BPS)

Avg. Client Savings ($)

Total Client Savings ($M)

Bid tape AOTs are an increasingly popular industry practice that involves three counterparties – mortgage originator, mortgage investor, and broker-dealer – in which the originator (seller) transfers loan collateral and hedge positions to a mortgage investor (buyer) and all counterparties execute a tri-party agreement.

Once a bid is accepted, the seller transfers ownership of the loans to the investor while simultaneously assigning the corresponding hedge position(s). The tri-party agreement (which is a standard SIFMA agreement) informs the TBA broker-dealer that a particular TBA position will move from the lender’s TBA account to the investor’s TBA account. The mortgage investor then updates the final price of the seller’s loans with an adjustment that offsets the gain or loss on the trade they are being assigned. This allows the lender to avoid having to pair out of the hedge and creates one cash experience since it effectively wraps the hedge gain or loss into the price of the loan being purchased.

Overall, bid tape AOT is an important mechanism for facilitating liquidity and price efficiency in the secondary mortgage market, making it an essential tool for originators and investors who wish to stay competitive.

Bid tape AOT is an efficient and effective strategy for both originators and investors. Because investors tend to be larger organizations, they can take advantage of their size and ability to pool loans to trade more efficiently. Offering AOT allows them to pass these economics through to their sellers, making them more competitive without having to lower margins, which is an extremely valuable tool given the current competitive landscape.

For sellers, AOT’s provide a way to avoid the bid/ask spread, which is the pricing difference between establishing and closing the hedge. As volatility and rates have increased over the last two years, some key coupons have become illiquid and as a result, the bid/ask spreads have remained elevated from prior years when the Fed was supporting the market. This can easily amount to 3 to 9 basis points on par coupons and often much more on higher, less liquid coupons.

Originators and investors that are not leveraging this execution strategy are leaving a substantial amount of money on the table and impacting their P&L. Another advantage with the new bid tape AOT programs is that there are no required trade tolerances on the loans being assigned, which makes it much easier for sellers to assign a larger percentage of their loans.

AOT Benefits for Buyers

- Allows buyers to be more competitive relative to their peers who do not accept AOTs, without having to lower margins

- Sellers place a premium on investors who offer AOT due to the cash benefits in both rising and declining rate environments

- Complete automation of the tri-party agreement helps to streamline the back-office process

AOT Benefits for Seller

- Allows sellers to largely avoid the bid/ask spread on their hedge positions, thus reducing their overall hedge cost

- Creates one cash experience at the time of sale which provides for better cash flows in both rising and declining interest rate environments

- Reduces the need to cross-hedge less-liquid coupons and take on added risk

Significant technological enhancements have made the AOTs of today more accessible and streamlined compared to legacy AOTs. Historically, it was common for investors to require a 1-2% tolerance on any trade assignment, meaning that a lender had to have a group of loans that totaled somewhere between the trade volume +/- the tolerance. On a $500K trade that is somewhere between $490-510K which is a very narrow window, making it extremely hard for lenders with lower volumes to take advantage.

Investors also used to only allow assigning a portion of a larger trade and would not allow the combination of smaller trades into one, which was another reason it was harder for smaller lenders to take advantage of AOTs. For instance, if you had $2.2M in loans slotting into a FNMA 6 coupon and did not have a corresponding $2M trade, lenders would have had to break up the sale into smaller increments to a tolerance level that could be assigned. With modern bid tape AOT programs, sellers can assign a combination of their smaller trades against that volume and get a weighted-average price.

Fifteen years ago, MCT would have recommended that clients hold off on making smaller trades and wait until there was enough to do a larger trade so that it could be assigned down the road to make the tolerances. With the flexibility of modern bid tape AOT, that is no longer needed and lenders can minimize their risk by making smaller trades throughout the day.

Another big impact on TBA positions with bid tape AOT is the immediate acceptance of the trade. In the past, investors wanted to see at least half, or even all, of the committed loans delivered before the trade was accepted, but now that is no longer the case. This provides both the originator and investor greater certainty of their position shortly after a sale and drastically reduces the chances for error.

Lastly, as AOTs continue to gain in popularity, lenders are prioritizing their broker-dealer relationships with those who are approved by an array of investors to maximize their assignment potential. This means it is essential for dealers to make sure they are working with a large mix of investors if they wish to stay competitive and in a lender’s constant rotation.

When lenders are evaluating bids from an investor who offers AOTs, it is important for them to consider the cost savings associated with assigning the trade. The best execution strategy for incorporating the bid/ask savings is to adjust the investor’s bid price by the amount saved from not having to pair out of the applicable trade. To get that appropriate amount, adjust the theoretical economic value of the bid/offer savings at the time of sale on the trade being assigned. For the best execution calculation, the goal is to look at the total bid/offer savings of the assigned trade and apply it to the corresponding loans accordingly. These calculations are handled automatically in MCTlive!

If we think about assigning $750K in loan volume and we’re able to assign a $1M trade, we’re relieving ourselves of the cost of $1 million in pair-offs. We’re not getting rid of the pair off, but we’re relieving ourselves of the cost of the bid-offer spread on the $1M. That means a lender’s savings are not going to be just the bid-offer spread on the loan volume, as they are allowing themselves to save the spread on the full $1M. Just like we incorporate an investor’s file fee by adjusting their bid price down for ranking purposes, the net adjusted bid price of loans in an assignment will be biased up by the basis points saved from not having to pair off the trade. This is what allows an investor who offers AOT to be more competitive relative to their peers who do not offer AOT as an option.

During periods of significant market fluctuation where trades can have large gains or losses, lenders may prioritize cash flow and place a higher value on the ability to execute with investors that offer AOTs. When rates have moved up and trades are in the money, lenders who assign their trades receive their cash faster compared to pairing out and waiting until the settlement date, which occurs once each month. On the other hand, when rates have dropped quickly and trades are out of the money, lenders may choose to leverage the AOT to assign away trades with certain broker-dealers in order to relieve mark-to-market thresholds and avoid a potential margin call. In both scenarios where lenders prioritize cash flow management, investors who offer AOT tend to benefit more relative to those who do not, and win more loans even when they do not offer the best price.

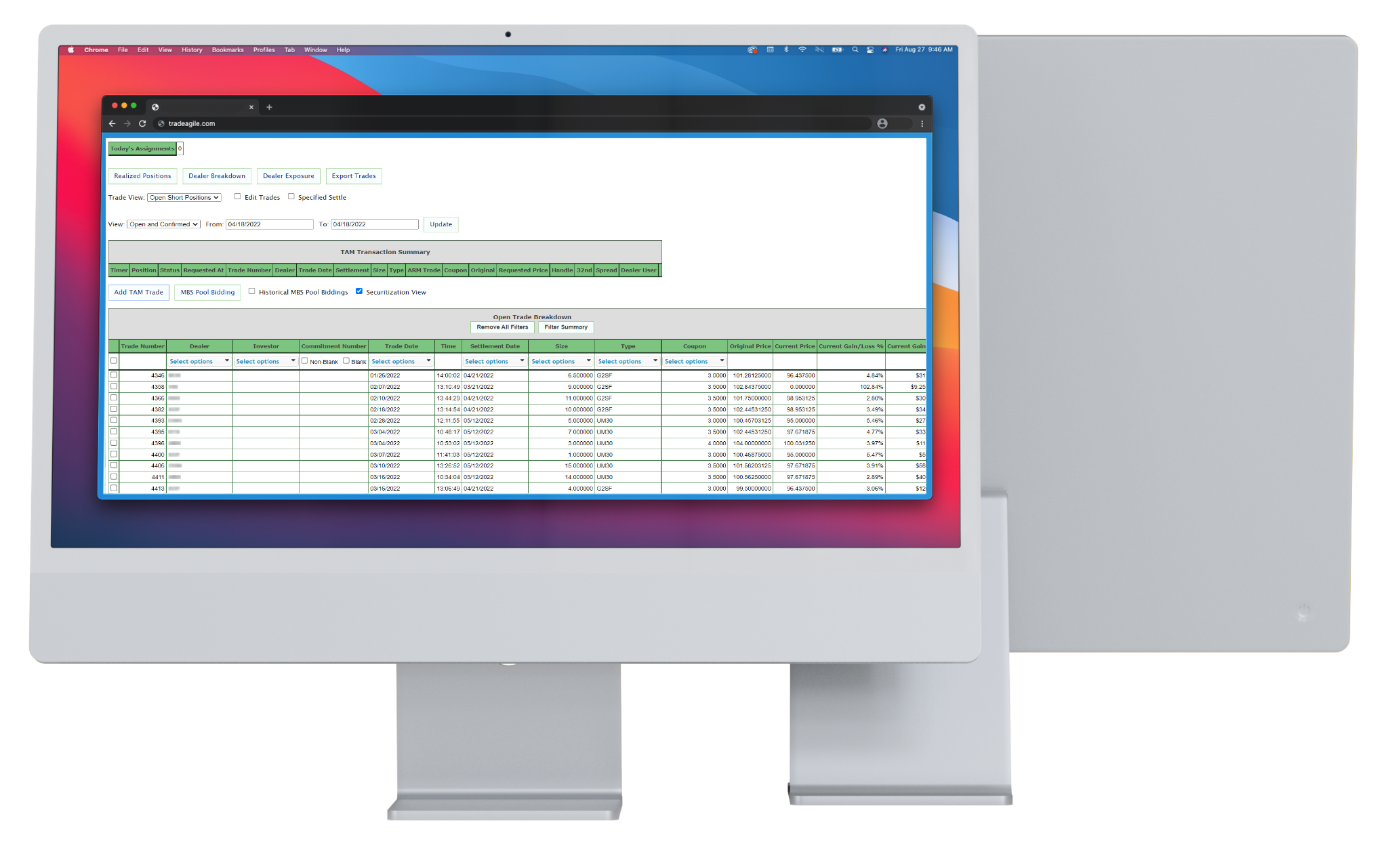

Automation significantly improves the AOT process by utilizing advanced software to quickly and accurately summarize bid tapes from appropriate buyers and electronically transmit the applicable AOT information. This automation can greatly reduce the time and effort required for manual analysis, which leads to a faster and more efficient loan sale process involving AOTs. While the AOT process has been automated for MCT mortgage originators for several years, recent improvements have extended this functionality to participating correspondent investors and broker-dealers via an integration with Agile’s TBA platform.

The original process was to manually enter the trade information into Schedule A of the tri-party agreement, along with the names and signatures of the assignor and assignee before sending it off to the corresponding dealer. Now, with the implementation of E-signatures the entire process is automated for sellers, investors, and brokers/dealers. While efficiency is important, the removal of human error is even more significant. No question that putting the wrong price, volume, or coupon into a tri-party agreement is extremely problematic, causing processing delays, or even worse, a mismatch in positions on notification date.

Another benefit of automation is that the tri-party agreement is transmitted at the time of commitment request. In MCT’s comprehensive loan trading platform, MCT Marketplace, there are four communication points.

- First, the MCT client will post a bid tape to the platform.

- The investor will then upload their bid levels on that bid tape and the best execution analysis will be performed.

- The third data transfer will be a request for a commitment on loans the corresponding investor won.

- The fourth communication will be the confirmation of those commitments returned from the investor.

For AOTs, a seller executed tri-party agreement is transmitted to the investor when the lender requests a commitment and then the corresponding tri-party agreement is automatically updated with the buyer signature once the investor loads their confirmation for the commitments. After the buyer confirms the commitment, a notification is sent to the corresponding broker dealer and the tri-party is immediately exposed to them in Agile via MCT’s integration. This connection with Agile closes the gap between all three parties and allows the dealer to confirm their acceptance of the tri-party within the system and finalize the transaction. Additionally, this automation puts all three parties on the same database of record which allows them to leverage a consistent interface to manage and track their assignments as opposed to email and internal spreadsheets, which is an industry-first!

![justin-grant-1[2]](https://mct-trading.com/wp-content/uploads/2022/10/justin-grant-12.jpg)

“During a time of extreme pressure on profit margins industry-wide, we’re proud of the impact AOT automation has had for our lender and investor clients,” shared Justin Grant, Senior Director, Head of Investor Services at MCT. “Based on our conversations with investors who offer AOTs, we estimate MCT lenders represent around ninety percent of AOT executions in the market today.”

Contact the Investor Services team to view the most up-to-date investor list.

How Agile Supports MCT’s AOT Automation

AOT executions on MCT Marketplace are supported by Agile, a platform that brings lenders and dealers of all sizes together to digitize the historically phone-based communication processes of TBA trading and MBS pooling.

Automated broker-dealer execution of lender-generated tri-party agreements

Trade blotter for tracking and managing assigned trades

Centralized database of record increases data integrity and reduces errors

Bid tape AOT transactions are conducted in MCT Marketplace, the largest mortgage exchange for the U.S. secondary market. MCT Marketplace was born out of a need for security in bid tapes and moving away from emails. In this context, it’s provided a strong platform to work with investors to automate the AOT process. There are pieces like the tri-party and the transmission of the trade that are resource-intensive and can also be problematic from a human error standpoint. MCT is proud to be the first organization to automate the tri-party process, as AOTs are providing liquidity and efficiency to the market at a crucial time.

MCT Marketplace connects buyers and sellers in a unique, digital auction regardless of counterparty approval status. Through patent-pending technology, sellers have access to the most robust set of take-outs, while buyers are seamlessly connected to the largest community of sellers in the U.S. This platform is now being used to fully automate the tri-party agreement between the lender, investor, and broker/dealer in AOT transactions. AOT automation within MCT Marketplace is rapidly changing the best execution landscape.

In conclusion, assignment of trade (AOT) is a growing trend in the mortgage industry that offers many benefits for mortgage originators, investors, and broker-dealers. By automating and streamlining the process, lenders can easily leverage AOTs to save money and more efficiently manage their cash flows, while buyers can become more competitive in the market.

The bid tape AOT strategy allows buyers to be more competitive and allows sellers to reduce hedge costs by avoiding the bid/ask spread on their hedge positions. Overall, AOT offers a convenient and cost-effective solution for mortgage professionals, and its use is likely to continue growing in the future.

Bid tape AOT programs at MCT are supported in MCT Marketplace; the only marketplace with complete automation of the pricing calculations and tri-party agreements involved in the AOT process.

MCT’s Investor Services division offers a software suite of tools for correspondent investors that facilitate offering and automating an AOT channel. MCT automates the process of pricing bid tapes with our embedded bid tape pricing tools. Investor Analytics within MCT provides you with unique reporting designed to optimize pricing and win market share.

Contact Our Team to Learn More

Interested in learning more about how bid tape AOT may impact your cash flow and execution? Contact us today for a one-on-one consultation with a secondary marketing expert.

Related Articles

- Housing Market Predictions 2024: Will Housing Prices Drop?

- MCT Whitepaper: Mortgage Pipeline Hedging 101

- How the 10-Year U.S. Treasury Note Impacts Mortgage Rates