When mortgage bankers sell their loans on the secondary market, most begin using the best efforts loan sale delivery method. As volume begins to pick up, mandatory loan sale delivery becomes attractive for the increased profits… but how do you manage the risk?

When mortgage bankers sell their loans on the secondary market, most begin using the best efforts loan sale delivery method. As volume begins to pick up, mandatory loan sale delivery becomes attractive for the increased profits… but how do you manage the risk?

In this post, we will provide an overview for implementing mandatory loan sale delivery and how mortgage bankers like Andrew Stringer at First Bank were able to capture a +52 bps pickup over best efforts.

“Since implementing pipeline hedging and best execution loan sales with MCT, First Bank has realized a total net profitability increase of 52 basis points … and their suggestions have improved my margins by 30 bps on government and all in execution by 12-13 bps.” – Andrew Stringer Director of Secondary/Capital Markets at First Bank

Read Full Case Study

First Bank was able to improve their net profitability by managing risk, maximizing profit, and ensuring their business operations were adapted to their new delivery method.

Table of Contents

Managing Risk with Pipeline Hedging

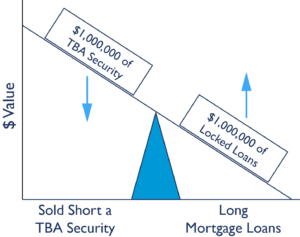

The two primary risks to consider with mandatory loan sales include market changes and loans that are promised but not delivered. To combat market changes, mortgage bankers hedge their pipeline of open loan applications, often using to-be-announced (TBA) securities. Mortgage bankers managing and measuring loan fallout can rely on the accuracy of their pull-through rate to manage risk.

Make Mandatory Commitments Only on Completed Loans

You want the pickup for mandatory commitments and loan sales, but what if the borrower walks away? You would incur a financial penalty from the investor, who may also deteriorate your pricing in the future because of loans you promised but did not deliver.

The key is to wait to make the mandatory commitment until after the loan has been completed, and you have 100% confidence in delivery. But this also means you will need to manage the risk of market changes yourself, rather than offloading that risk to the investor with a earlier commitment.

Hedging Your Pipeline with TBAs

Interest rates can change between the time a borrower locks their interest rate to when the loan is actually funded which can leave you at risk.

To protect yourself from interest rate fluctuations, it is recommended to hedge the loans in your pipeline using to-be-announced (TBA) mortgage backed securities (MBS).

For example, an increase in rates after the loan is locked will decrease the value of that loan. However, since the TBA trade was shorted/sold, the mortgage banker can buy back the TBA trade at a discount to what she originally sold it for. The mortgage banker would lose on the loan sale, but gain on the hedge, netting out the influence of market changes!

Measure Pull-Through Rates & Hedge Appropriately

Mortgage bankers who work with borrowers understand that some loans never end up funding. To ensure you don’t use TBA’s for loans that do not fund, you’ll need to calculate and hedge using your pull-through rate.

Your pull-through rate is an estimate on how many loans are expected to close and fund. If your rate is 80%, for example, then you will need to hedge 80% of the total dollar amount in your pipeline.

A highly accurate pull-through rate will ensure you’re not over or under protected. MCT specializes in calculating, measuring, and optimizing pull-through rates at the loan level. Learn more about pull-through in The Mortgage Professional’s Handbook, Vol.3 Ch.3 by Phil Rasori.

Maximizing Loan Sale Profitability

Adding mandatory loan delivery to your toolkit helps you earn more on your loan sales and offers another option in your best execution analysis. When delivering mandatory loans, there are additional tactics you can use to make sure you’re maximizing profitability. Here are tips on increasing accuracy, number of investors, and pipeline evaluation.

Conduct Loan Sale Best Execution Analysis & Take Advantage of the Mandatory Pickup

The pickup over best efforts is the primary metric used by lenders to measure the success of their mandatory loan sales. Phil Rasori, COO at MCT, shares from his experience over the years that typical lenders will see a “20 basis point pickup on Conventional volume and a 40 basis point pickup on Government volume.” Adding mandatory loan sales to your best execution analysis will have a direct and immediate impact on your loan sale profitability.

Optimize Your Investor Set

The number of best efforts and mandatory investors that you are approved to sell to is another important factor in maximizing profitability. The more buyers you have competing for your loans, the more likely you are to receive a better price for your loans. Furthermore, some investors are willing to pay more for certain characteristics of a loan. If your investor set is not tailored to the characteristics of your portfolio, you may be leaving money on the table.

First Bank's bps pickup from investor set optimization

Evaluate Pipeline and Market Conditions Daily

Evaluating the current market conditions will also help you earn more on your mandatory loan sales. Daily monitoring can help you identify trends that could affect profitability expectations and manage pull-through during interest rate cycles. This monitoring will also help you reduce the time in a hedge position, which reduces costs.

Keep in mind, you don’t need to “time the market” for your loan sales if you’ve implemented a successful pipeline hedging strategy.

Our Introduction to Mandatory Loan Sale Slidedeck is a great resource for learning more about mandatory loan sales. If you have additional questions, please feel free to Contact Us.

Operational Changes Needed for Mandatory Delivery

When switching to mandatory, there are several key operational changes to consider. The fundamental changes will affect your lock desk, underwriters, and accountants. Contact us to learn how we can make this transition flawless.

Lock Desk

Adding mandatory loan sale delivery to your toolkit is only as good as your best execution analysis. Your team will need to determine which loans to sell through best efforts and which to sell through mandatory delivery. You may also consider using our outsourced lock desk services.

Underwriting

Delivering your best efforts loan to a single investor meant that you were only underwriting to the investor that purchased the loan. Now that you’ve identified which loans will be sold through mandatory delivery, your underwriting team will need to underwrite your loans to all eligible investors.

Accounting

Your accounting department will be affected by the buying and selling of TBAs and will need to implement fair-value accounting practices. Fair-value accounting uses the market price of an asset, or similar assets, to keep records of TBAs on your books. Make sure they are prepared for this transition.

By hedging your pipeline and understanding how market changes affect your pull through rate, you will be better protected from the risks associated with mandatory loan sales.

Improvements in the accuracy of your pull-through rate, optimizing your investor set, and monitoring your pipeline will help you earn more on your loan sales when done correctly. Mandatory loan sale delivery will also require operational changes in your business. If you can blend these strategies and implement necessary changes, you will increase profitability on your loan sales!

First Bank's net bps pickup switching to mandatory

Download Introduction to Mandatory Loan Sales Slidedeck

We encourage you to visit our secondary marketing definitions page and download this Slidedeck designed to quickly bring you up to speed on mandatory loan sales. There are many benefits to hedging your loan sales that outweigh the risks associated. At a time when mortgage lenders are looking everywhere to increase profits, may this information support your goals of eventually switching from best efforts to mandatory delivery.