Mortgage Lock Volume Indices

MCT’s rate lock activity indices are based on actual locked loans, not applications, and are therefore a more accurate indication of industry lock activity than other potential stats. MCT-collected statistics are unique to the industry given the diversity of lender sizes, products/services offered, and business models across our national footprint.

Filter By Solution

Filter by Topic

Filter by Learning Level

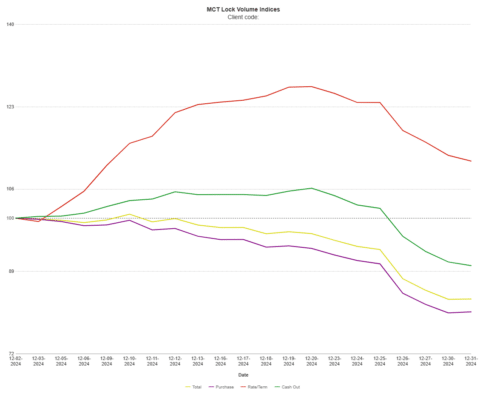

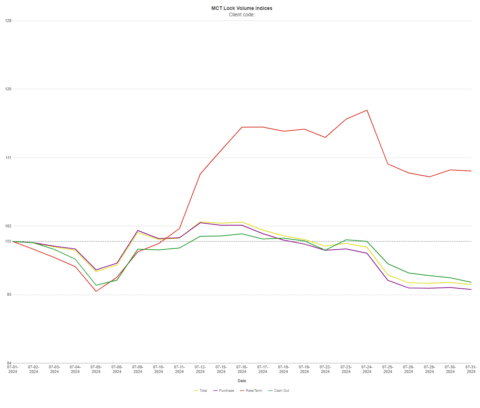

MCT’s July Lock Volume Indices show steady growth across all loan types, with rate/term refis up 9.89% and surprising market stability after a strong jobs (…)

MCT reports June purchase lock volume held nearly flat, signaling steady housing demand amid high rates, as refis drop sharply due to rate volatility.

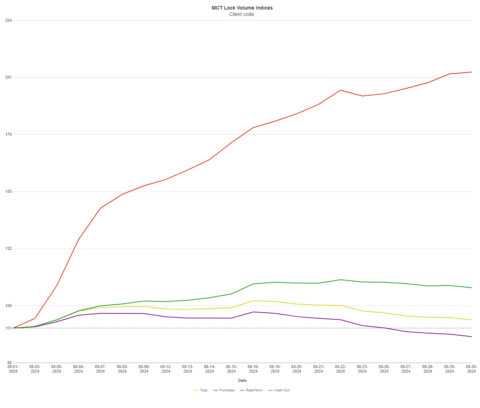

MCT’s May Lock Volume Indices show flat mortgage activity amid market volatility, with rate/term refis down 13% and total volume up 11% year-over-year.

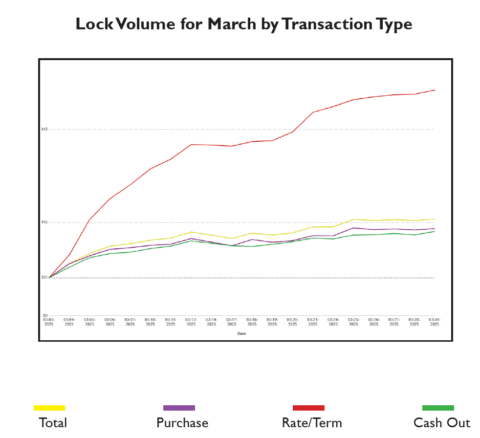

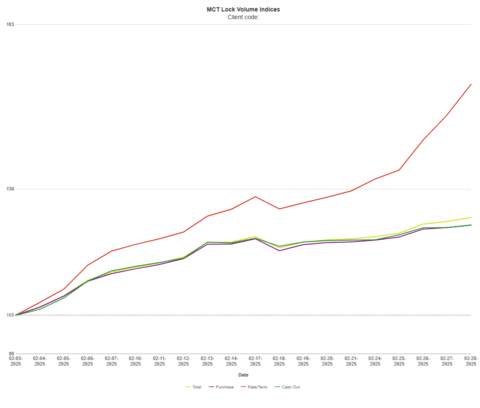

MCT reports a 17% rise in mortgage lock volume as early homebuying strengthens amid tariff concerns, low consumer confidence, and rising recession risks.

Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, today announced a 27.91% increase in mortgage lock volume compared (…)

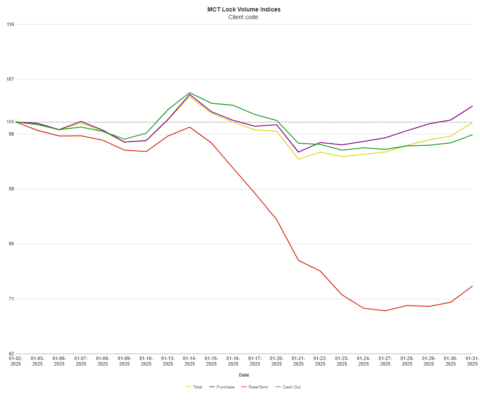

Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, announced today a 0.12% decrease in mortgage lock volume compared (…)

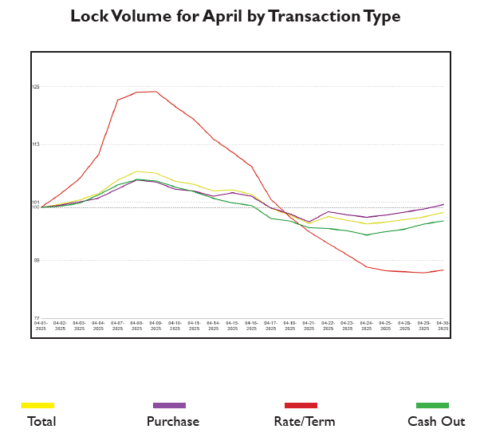

Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, announced today a 16.7% decrease in mortgage lock volume compared (…)

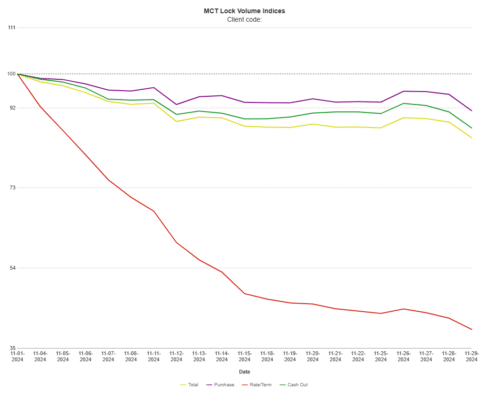

Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, reported a 15% decrease in mortgage lock volume compared to (…)

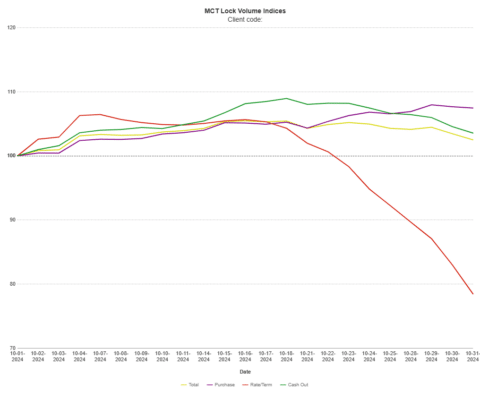

San Diego, CA – November 15, 2024 – Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, reported a (…)

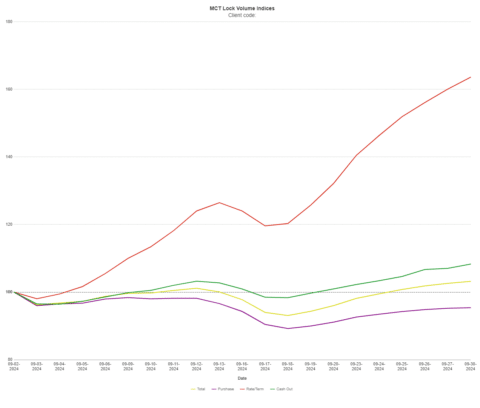

San Diego, CA – October 2, 2024 – Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, announced today (…)

Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, announced today a 3.33% increase in mortgage lock volume compared (…)

Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, announced today a decrease of 5.67% in mortgage lock volume (…)