As the leader in capital markets software and services, MCT supports more lenders with hedging and pipeline management solutions than any other single provider. This privileged position allows us to aggregate and analyze a meaningful population of data and translate it into macro trends and insights.

MCT-collected statistics are unique to the industry given the diversity of lenders (e.g., sizes, products/services offered, business models) across our national footprint.

MCT’s rate lock activity indices are based on actual locked loans, not applications, and are therefore a more accurate indication of industry lock activity than other potential stats. Especially in a tight purchase market, we firmly believe our methodology of using actual loans locked (rather than applications) is a more reliable metric. Why? There is a higher likelihood of having multiple applications per funded loan, and pre-qualifications do not convert at as high of a rate in the current market as has historically been the case – especially when applications are counted at the early stage of entering a property address.

As mentioned, our stats represent a broad and balanced cross section of several hundred lenders across retail, correspondent, wholesale, and consumer direct channels. The lock volume indices break out data by transaction type (purchase, rate/term refinance, and cash out refinance), and the below charts also include year-over-year breakdown of rate lock activity.

April 2023 Rate Lock Data

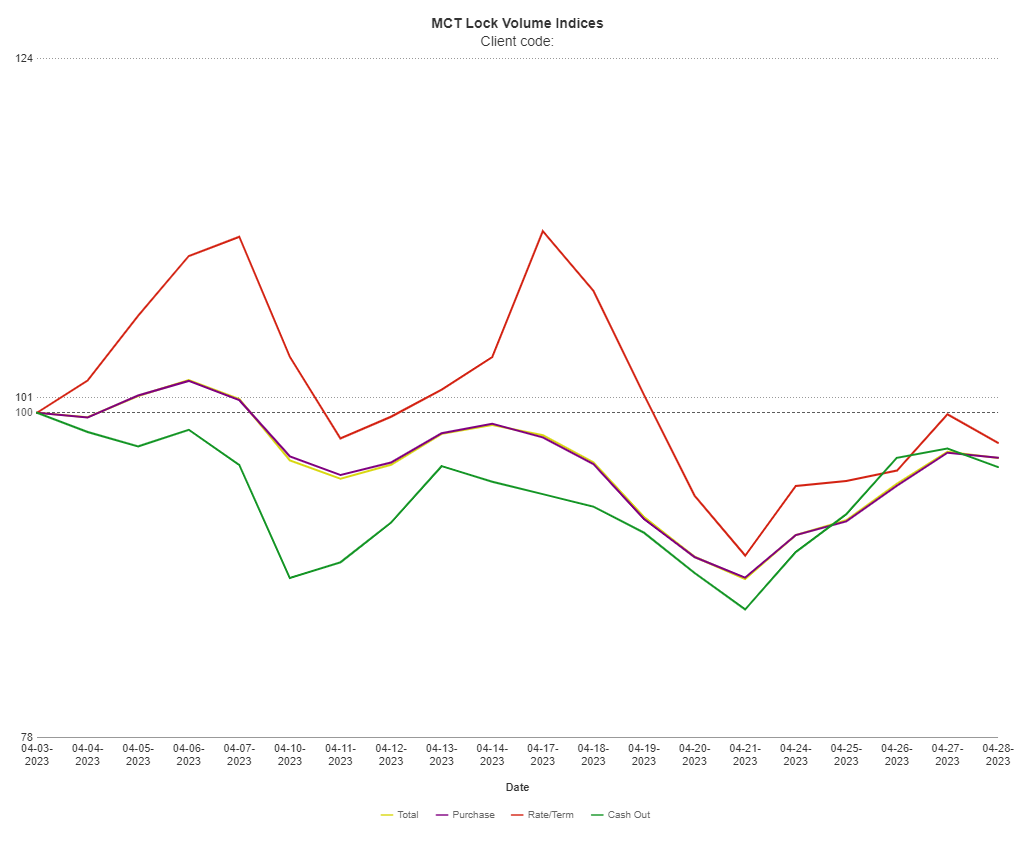

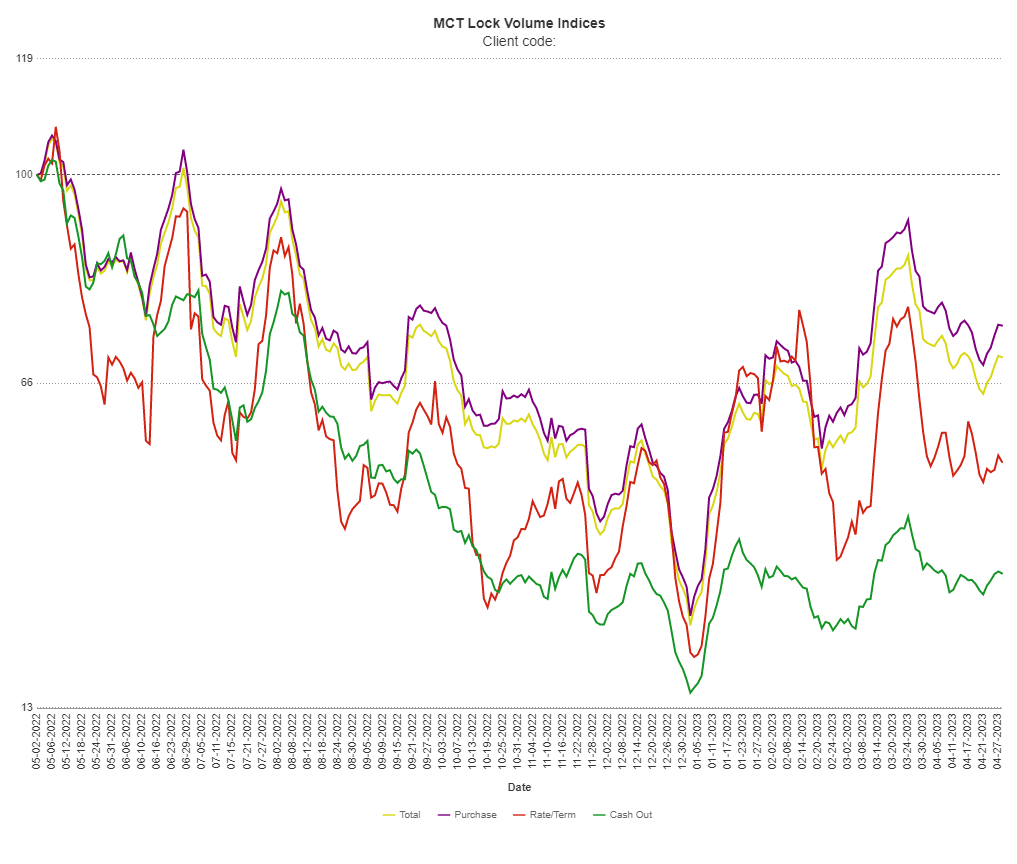

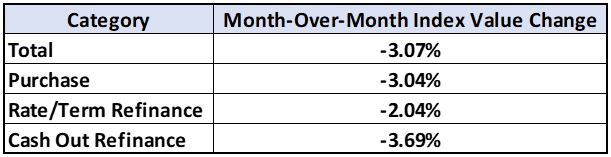

April MCTlive! Lock Volume Indices shows that after an upward trend in March, lock volume decreased slightly across the board for the month. Purchase lock activity was down 3% compared to March, rate/term refinance volume was down 2%, and cash-out refinance volume was down 3.6%. Lock activity in total was down 3% versus March.

While there was a slight downturn in April, we should see lock activity begin to trend upward as the Fed reaches the terminal Fed funds rate and we begin to move into the Spring. As it stands, total lock activity is still down 29.75% from a year ago. That is primarily due to a drop off in refinance demand, as purchase lock activity sits 24.6% lower than at the same point last year. Rate and term refinance volume is down 56.87% from one year ago, and cash-out refinance volume is down 65% over that same period.

About MCT

Founded in 2001, Mortgage Capital Trading, Inc. (MCT) has grown from a boutique mortgage pipeline hedging firm into the industry’s leading provider of fully integrated capital markets services and technology. MCT’s offerings include mortgage pipeline hedging, best execution loan sales, business intelligence and analytics, outsourced lock desk solutions, MSR valuation, hedging, and bulk sales, and the world’s first, truly open marketplace for loan sales. MCT supports independent mortgage bankers, depositories, credit unions, warehouse lenders, and correspondent investors of all sizes within its award-winning digital platform, MCTlive!. Headquartered in sunny San Diego, MCT also has offices in Healdsburg, CA, Philadelphia, PA and Texas. For more information, visit https://mct-trading.com/ or call (619) 543-5111.

- Growing for Your Needs – Since 2001, MCT has grown from a pipeline hedging services specialist into a fully integrated provider of capital markets services & software.

- Capital Markets Expertise – Through a combination of unparalleled industry experience and relentless focus on data, MCT is pioneering the future of capital markets technology. From MCTlive!, to MSRlive!, to our award-winning MCT Marketplace – MCT pushes the envelope to exceed client expectations.

- Clients & Employees Agree – MCT delivers unparalleled customer service and prides itself on being a regular winner of San Diego’s “Best Place To Work” Award.