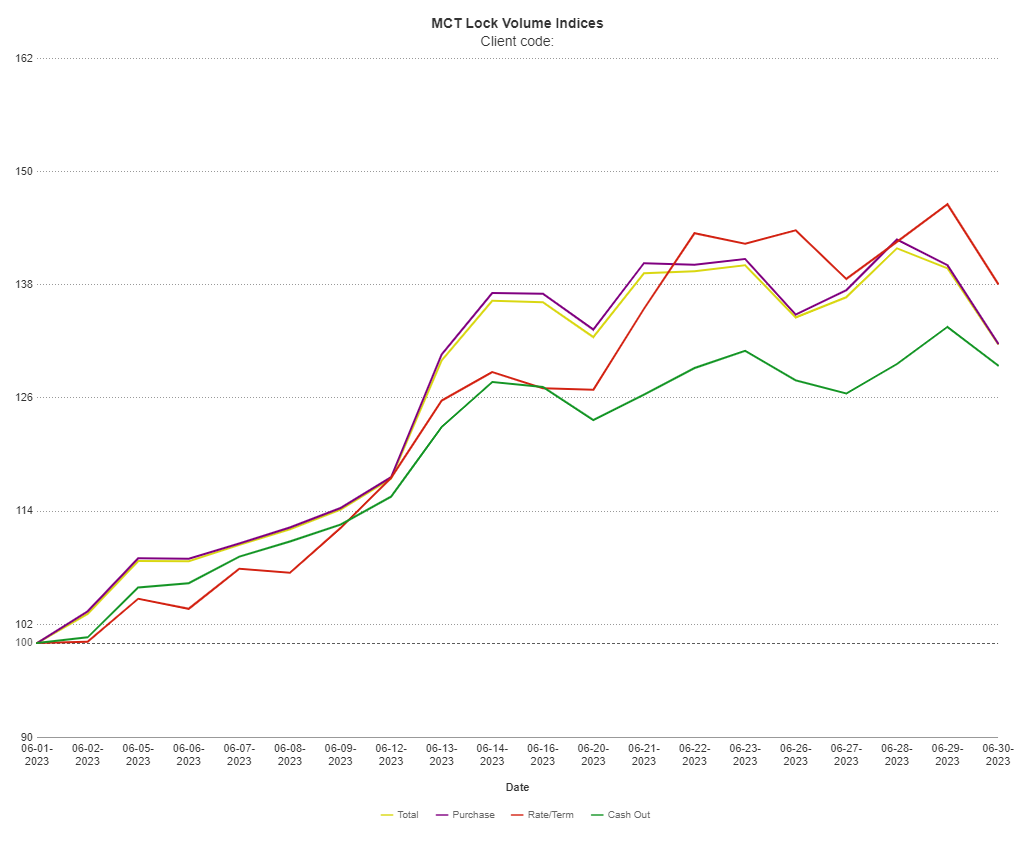

SAN DIEGO, Calif., July 6, 2023 – Mortgage Capital Trading, Inc. (MCT®), a leading mortgage hedge advisory and secondary marketing software firm, reported today a 31% increase in mortgage lock volume in June over the prior month. Complete the form to download the full report.

The increase in June’s lock volume activity, which is based on actual locked loans, comes after a 15% drop in May’s total locked production. “We saw originations toward the end of May slow down, so this is likely a summertime pickup in originations,” said Andrew Rhodes, Senior Director, Head of Trading at MCT. “High rates, low housing supply, and lack of affordability will continue to be the forces behind the lack of new originations.”

While the Federal Open Market Committee meeting minutes from June’s decision to pause rate hikes show some disagreement, additional rate hikes are expected and may continue to keep origination volume at a depressed new normal. “The current commentary coming from the Fed puts the market on its heels as there is a potential for another two rate hikes this year,” said Mr. Rhodes. “With this new narrative, rates will continue to push higher especially if we see another strong labor market read coming out on Friday.”

Download MCT July Indices Report

This month’s MCT Indices also shows a nearly 8% drop in total lock volume from this time last year. After hitting lows at the beginning of this year for purchase, rate/term refinance, and cash out refinance, each production type continues to creep slowly upward.

As we look into the future, economic reports will continue to have a big impact on the Fed’s decision making and associated market movements. “If labor markets cool off, that could give the Fed a reason not to raise rates in July,” Mr. Rhodes continued, “which would provide a nice bounce in the markets, but I’m not holding my breath.”

MCT’s Lock Volume Indices present a snapshot of rate lock volume activity in the residential mortgage industry broken out by lock type (purchase, rate/term refinance, and cash out refinance) across a broad diversity of lenders (e.g., sizes, products/services offered, business models) from MCT’s national footprint.

About MCT:

Founded in 2001, Mortgage Capital Trading, Inc. (MCT) has grown from a boutique mortgage pipeline hedging firm into the industry’s leading provider of fully integrated capital markets services and technology. MCT offers an array of best-in-class services and software covering mortgage pipeline hedging, best execution loan sales, outsourced lock desk solutions, MSR portfolio valuations, business intelligence analytics, mark to market services, and an award-winning comprehensive capital markets software platform called MCTlive! MCT supports independent mortgage bankers, depositories, credit unions, warehouse lenders, and correspondent investors of all sizes. Headquartered in San Diego, California, MCT also has offices in Philadelphia, Healdsburg, and San Antonio. MCT is well known for its team of capital markets experts and senior traders who continue to provide the boutique-style hands-on engagement clients love.

For more information, visit https://mct-trading.com/ or call (619) 543-5111.

Media Contact:

Ian Miller

Chief Marketing Officer

Mortgage Capital Trading

619-618-7855

pr@mctrade.net