Mortgage Capital Markets Insights & News by MCT

Leverage secondary market strategies, daily market commentary, and mortgage indices from the MCT Learning Center to elevate your performance and your career.

Filter By Solution

Filter by Type

Filter by Topic

Filter by Learning Level

Lincoln Federal achieved 99.9% accuracy despite 288% volume fluctuation, saving $12K annually with MCT’s full-service Lock Desk.

In this case study, Tom Bradley, Trader & Senior Correspondent Product & Pricing Analyst at Gateway Mortgage Group, LLC speaks to the benefits of time (…)

Brian Gilpin, CFO and Head of Capital Markets at Embrace Home Loans, sits down to discuss his experience switching to MCT and the level of (…)

Through MCT’s software and services, Vellum Mortgage has improved profitability, efficiency, and added new investors. To accomplish this goal, they rely on BAM Marketplace, MCTlive!, (…)

In this case study, Ajay Timothy and Thia Kaleta of NBH Bank describe their process getting started with MCT and how they were able to (…)

In this case study, MCT sits down with Mr. Sugg to hear how the MCTlive! integration has added efficiency to their loan selling process.

In this case study, MCT sits down with John Collins to hear how the Rapid Commit integration has added efficiency to their loan selling process. (…)

In this case study, On Q Financial's VP of Margin Management, Angela Wooldridge, documents how the company used MCT’s newly-released BAM Marketplace loan exchange to (…)

In this case study, Mr. Miles explains how he is leveraging MCT’s Business Intelligence Platform software to glean impactful insights into rates, pricing, and the (…)

In this case study, Mr. Collins describes how MCT’s BAM Marketplace enabled him to decrease his average approval times with buyers and achieve an impressive (…)

In this case study, Mr. Cassetta describes how MCT’s Rapid Commit enables him to sell loans to Fannie Mae five times faster than his previous (…)

In this case study, Mr. Danilowicz explains how MCT’s MSR team helped Doorway Home Loans successfully facilitated a $1 billion MSR Sale. He also describes (…)

Join the MCT Newsletter

Keep up with industry-changing innovations, MBS market movements, and growth opportunities that impact your mortgage capital markets operation.

Read Latest MCT Market Commentary

Take the Next Step for Your Company & Career

Find your secondary mortgage market growth stage and top educational content to take advantage of the next opportunity. Click on the related box for additional learning.

Semi-Autonomous Hedging & Loan Sales

Have a specific question?

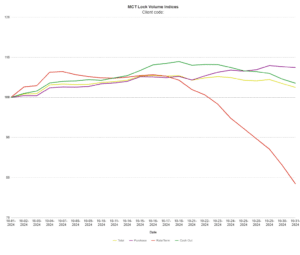

Track the Market with MCT’s Mortgage Lock Volume Index

As the leader in mortgage capital markets technology, MCT supports more lenders than any other single provider. This privileged position supports analysis of a meaningful population of data into macro insights. MCT’s mortgage lock volume indices are based on actual locked loans, not applications, and are therefore a more accurate indication compared to alternatives.