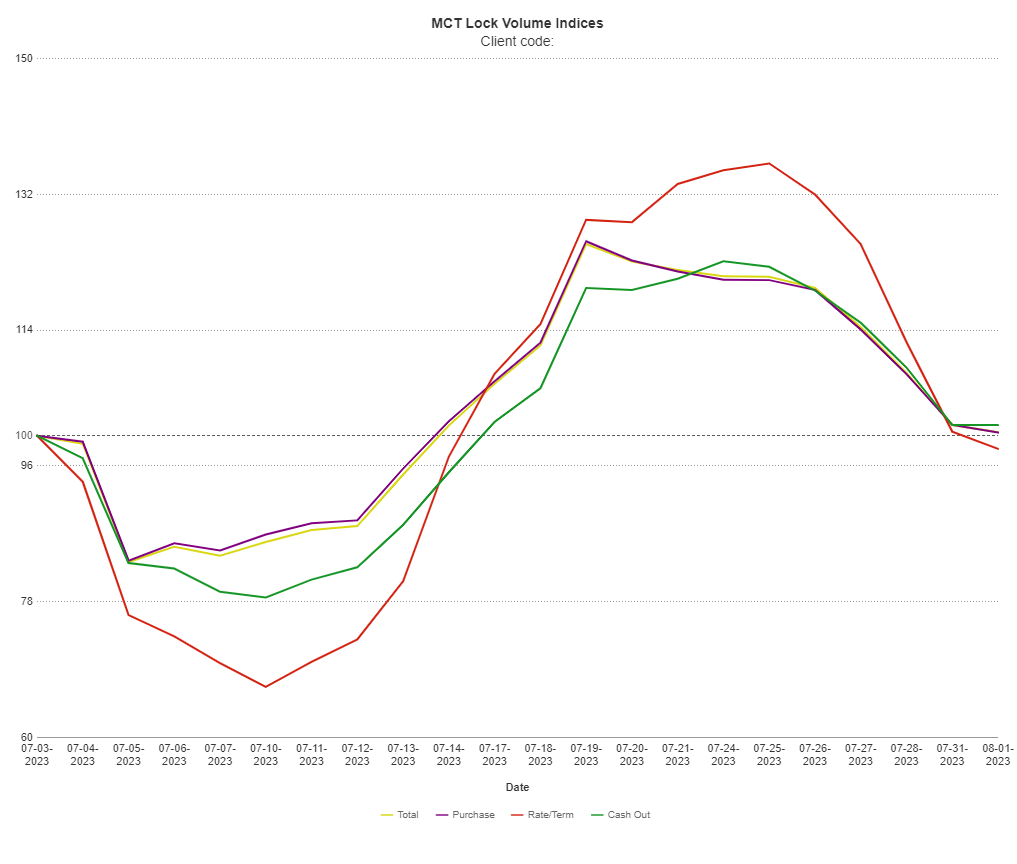

SAN DIEGO, Calif., August 4, 2023 – Mortgage Capital Trading, Inc. (MCT®), a leading mortgage hedge advisory and secondary marketing software firm, reported today a relatively flat .44% increase in mortgage lock volume over the prior month. Complete the form to download the full report.

The relatively flat change in volume is likely attributed to seasonal momentum through Summer. “While July’s mortgage lock volume remained relatively flat, mortgage rates continued to climb through July,” said MCT’s COO, Phil Rasori. “If rates continue to hold or climb from these new levels established in the first week of August, we can expect volume to drop.”

The Fed’s July decision to raise the Federal Funds Rate has contributed to an eight-month high for mortgage rates. This, coupled with the highest 10-year treasury yield in years and Fitch’s recent decision to downgrade the U.S. credit rating, could spell rough seas ahead for the mortgage industry.

This month’s MCT Indices also shows a roughly 13% drop in total lock volume from this time last year. However, this morning’s August Nonfarm payroll report could be offering signs of hope. “If this morning’s indications of a slightly cooling labor market were to persist into the future, this would provide more cover for the Fed to continue to pause and eventually cut rates,” said Mr. Rasori.

Download MCT August Indices Report

MCT’s Lock Volume Indices present a snapshot of rate lock volume activity in the residential mortgage industry broken out by lock type (purchase, rate/term refinance, and cash out refinance) across a broad diversity of lenders (e.g., sizes, products/services offered, business models) from MCT’s national footprint.

About MCT:

For over two decades, MCT has been a leading source of innovation for the mortgage secondary market. Melding deep subject matter expertise with a passion for emerging technologies and clients, MCT is the de facto leader in innovative mortgage capital markets technology. From architecting modern best execution loan sales to launching the most successful and advanced marketplace for mortgage-related assets, lenders, investors, and network partners all benefit from MCT’s stewardship. MCT’s technology and know-how continues to revolutionize how mortgage assets are priced, locked, protected, valued, and exchanged – offering clients the tools to thrive under any market condition.

For more information, visit https://mct-trading.com/ or call (619) 543-5111.

Media Contact:

Ian Miller

Chief Marketing Officer

Mortgage Capital Trading

619-618-7855

pr@mctrade.net