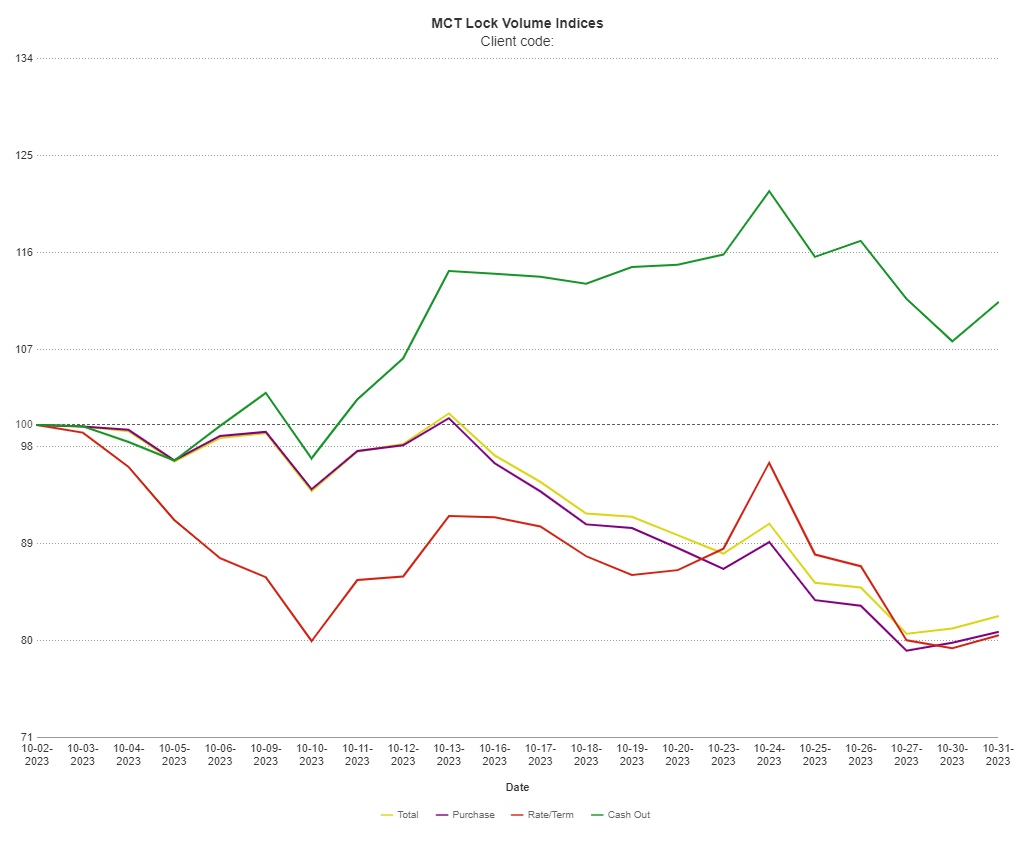

SAN DIEGO, Calif., November 3, 2023 – Mortgage Capital Trading, Inc. (MCT®), a leading mortgage hedge advisory and secondary marketing software firm, reported today a drop of 17.76% in mortgage lock volume over the prior month. Complete the form to download the full report.

Loan originations for October continued to dip as mortgage rates hovered around 8% and lack of housing supply continues to slow origination volume. While overall mortgage lock volume dropped more than 17% in October, cash out refinances did see a boost. “Cash out refinances jumped more than 11% in October from the previous month,” said Andrew Rhodes, Senior Director, Head of Trading at MCT. “However, given that cash out refinances are already at notable lows, I don’t believe it to be statistically significant.”

This trend is expected to play out through 2023 as the Fed paused rates at their November 1st meeting and indicated the potential for another rate hike before the end of the year. “Multiple factors such as an 8% mortgage rate, the Fed’s continued fight against inflation, and the industry’s cyclical winter lull, shows we’ll likely continue to see low origination volume heading into the new year,” said Mr. Rhodes.

Download MCT November Indices Report

MCT’s Lock Volume Indices present a snapshot of rate lock volume activity in the residential mortgage industry broken out by lock type (purchase, rate/term refinance, and cash out refinance) across a broad diversity of lenders (e.g., sizes, products/services offered, business models) from MCT’s national footprint.

About MCT:

For over two decades, MCT has been a leading source of innovation for the mortgage secondary market. Melding deep subject matter expertise with a passion for emerging technologies and clients, MCT is the de facto leader in innovative mortgage capital markets technology. From architecting modern best execution loan sales to launching the most successful and advanced marketplace for mortgage-related assets, lenders, investors, and network partners all benefit from MCT’s stewardship. MCT’s technology and know-how continues to revolutionize how mortgage assets are priced, locked, protected, valued, and exchanged – offering clients the tools to thrive under any market condition.

For more information, visit https://mct-trading.com/ or call (619) 543-5111.

Media Contact:

Ian Miller

Chief Marketing Officer

Mortgage Capital Trading

619-618-7855

pr@mctrade.net