MCT Industry Webinar: Advanced Hedging Strategies

View the webinar recording and slidedeck from this webinar on July 16th at 11AM PT to learn why advanced hedging strategies lenders to achieve greater profitability.

Read the latest articles, event announcements and press releases from Mortgage Capital Trading, Inc.

View the webinar recording and slidedeck from this webinar on July 16th at 11AM PT to learn why advanced hedging strategies lenders to achieve greater profitability.

In this webinar from July 7th at 11AM PT, MCT’s Phil Rasori teamed up with Wells Fargo’s SVP of Correspondent Pricing, Greg Vacura, to discuss recent AOT enhancements.

View the webinar recording and slidedeck from this webinar on June 25 at 11AM PT, where MCT experts discuss the processes for Ginnie Mae approval and delivery.

In this webinar from May 28th at 11AM PT, MCT’s Phil Laren and Bill Berliner discussed current MSR market conditions, cash management and forbearance strategies.

Challenges & Solutions for Correspondent Lending in Crisis Challenges & Solutions for Correspondent Lending in Crisis View Webinar Recordings from April 8th and May 21st View Webinar Recordings from April 8th and May 21st In this post, we have included the...

In this article, we will discuss how to adjust lock desk best practices to transition loan sales to Best Efforts during periods of market volatility. We will also provide some context to explain why switching to Best Efforts loan sales might be a necessity in some cases.

Read MCT’s whitepaper Lock Centralization 101 to learn what operational changes to staff, procedures, and technology will need to be made in order to establish a centralized lock desk for your business.

View the recording from our webinar on March 31st at 11AM PT to learn more about the quarter-end Mark-to-Market reports, recent market events and MCT’s advocacy efforts during market volatility.

In this blog post and story, view recommendations from MCT’s MSR team on how to make speedy and informed retain-release decisions during periods of market volatility.In these times of low but volatile interest rates, mortgage companies are thrilled with the...

View recommendations on how to employ rate renegotiation policies to guide your staff in mitigating profit loss using three example best practices.

Read MCT’s Response to the FHFA’s Proposed Changes, January 2020 to learn how elements of the proposal would be detrimental to the mortgage lending community and MBS market participants.

UPDATE Jan. 23, 2020 – MCT is proud to announce that on December 18th they became the first organization to connect lenders to Fannie Mae’s Loan Pricing API via its Bid Auction Manager (BAM) loan trading platform for live Servicing Marketplace® (SMP) pricing.

Our latest white paper outlines 15 actionable strategies mortgage lenders use to improve profitability. These include secondary marketing strategies, business operations and technology.

In this case study, Mrs. Mohr describes how MCTlive!, BAM, and bid tape AOT have enabled her team to realize time savings and efficiency gains along with improved margins.

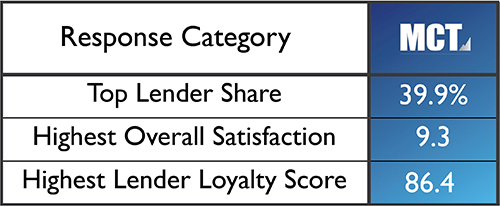

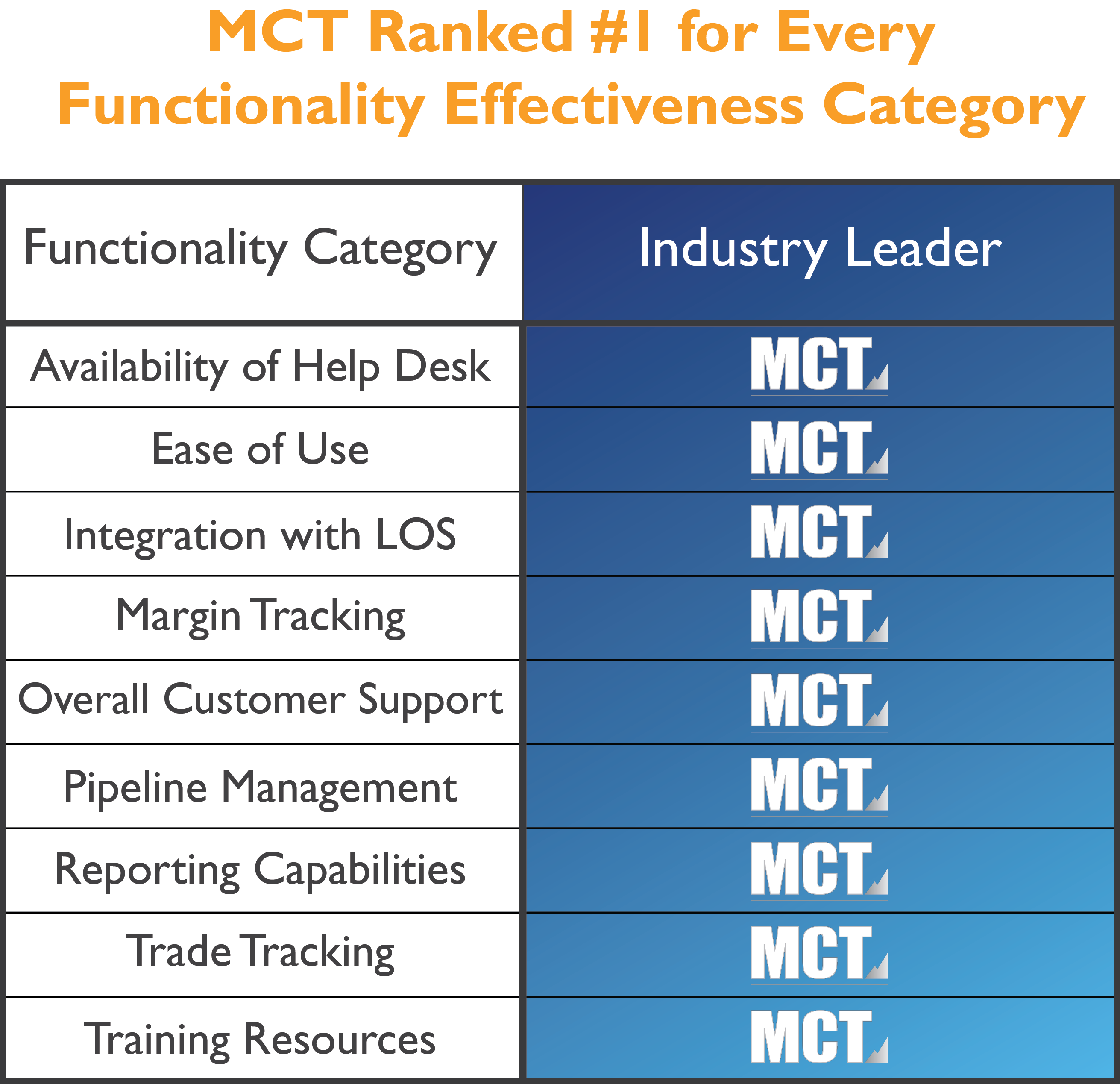

STRATMOR Group’s 2019 Technology Insight Study show MCT as the industry leader in lender share, overall satisfaction, and Lender Loyalty Score® in the Production Pipeline Hedging category.

UPDATE Oct. 10, 2019 – MCT is proud to announce the addition of the Freddie Mac Cash-Released XChange browse price API to the integration between Freddie Mac and the MCTlive! platform. Leveraging the browse price API, MCTlive! lenders can now accurately and conveniently utilize Freddie Mac Cash-Released XChange in their best execution analysis.

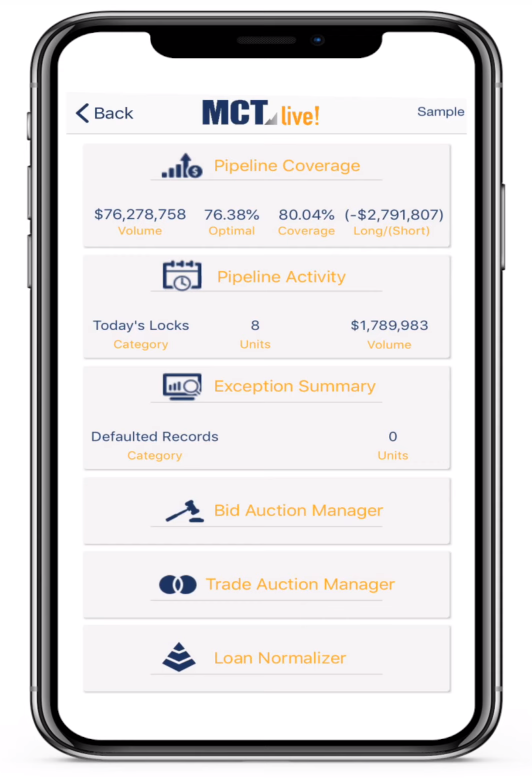

SAN DIEGO, Calif., Sept 18, 2019 – Mortgage Capital Trading, Inc. (MCT), a leading mortgage hedge advisory and secondary marketing software firm, debuted a new MCTlive! mobile application at its MCT Exchange client conference last Friday. The app enables secondary marketing managers to review reporting, manage loan pipelines, and conduct whole loan trading from the convenience of their mobile phone.

We had the pleasure of connecting with one of our clients to understand their experience with MCT. In this case study, we interviewed Cameron Mott and Ryan Krell of KS StateBank.

Current conditions in the MBS market have created an opportunity for depositories to take advantage of their low funding costs to pick up investment income. We encourage our bank and depository clients to consider using the approach outlined in this summary to take advantage of these current unusual conditions in mid-2019.

Join webinar to learn how to determine which MSRs to sell, how to evaluate bids you receive, and tips for negotiating a contract. Topics will also include expected challenges, purchase terms, and timing of the sale.

SAN DIEGO, Calif., February 18, 2019 – Mortgage Capital Trading (MCT®), a leading mortgage hedge advisory and secondary marketing software firm, announced that the 2018 STRATMOR Technology Insight Study rated MCT as the leader in overall satisfaction, lender loyalty,...

Register and attend on February 20, 2019 at 11AM Pacific for actionable tactics that address both short and long-term profitability. The webinar will be moderated by Chris Anderson, CAO of MCT, and feature panelists James Deitch, CEO and Co-Founder of TeraVerde, and Bill Berliner, Director of Analytics at MCT.

Learn the details of how Andrew Stringer at First Bank leveraged MCTlive!, Bid Auction Manager (BAM), and Rapid Commit to improve loan sale pickup and operational efficiencies.

Lenders using MCT’s loan pipeline management software, MCTlive!, received bid tape pricing at the loan level on their open pipeline in year-end mark-to-market reports, a major improvement over the rate sheet and direct trade pricing typically used for this purpose and the first step in addressing a recent crisis in derivative asset pipeline valuation.