MCTlive! Client Profile Tab – Paul’s Tip of the Week

In Paul’s Tip of the Week, we look at the Client Profile tab in MCTlive!, which brings some basic information in an easily accessible spot within MCTlive!

Read the latest articles, event announcements and press releases from Mortgage Capital Trading, Inc.

In Paul’s Tip of the Week, we look at the Client Profile tab in MCTlive!, which brings some basic information in an easily accessible spot within MCTlive!

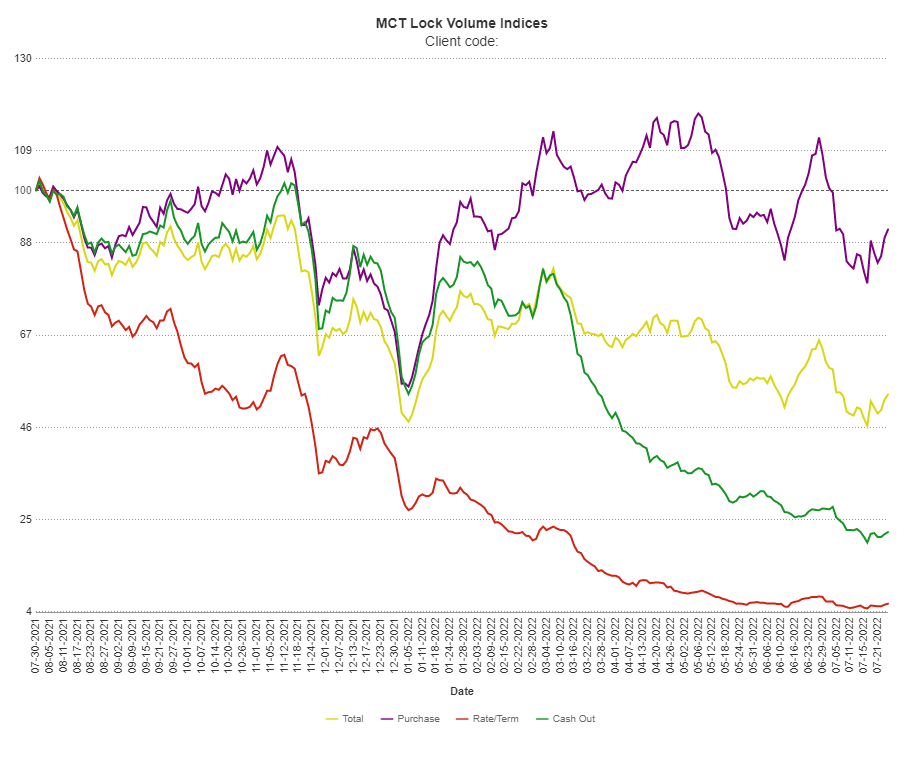

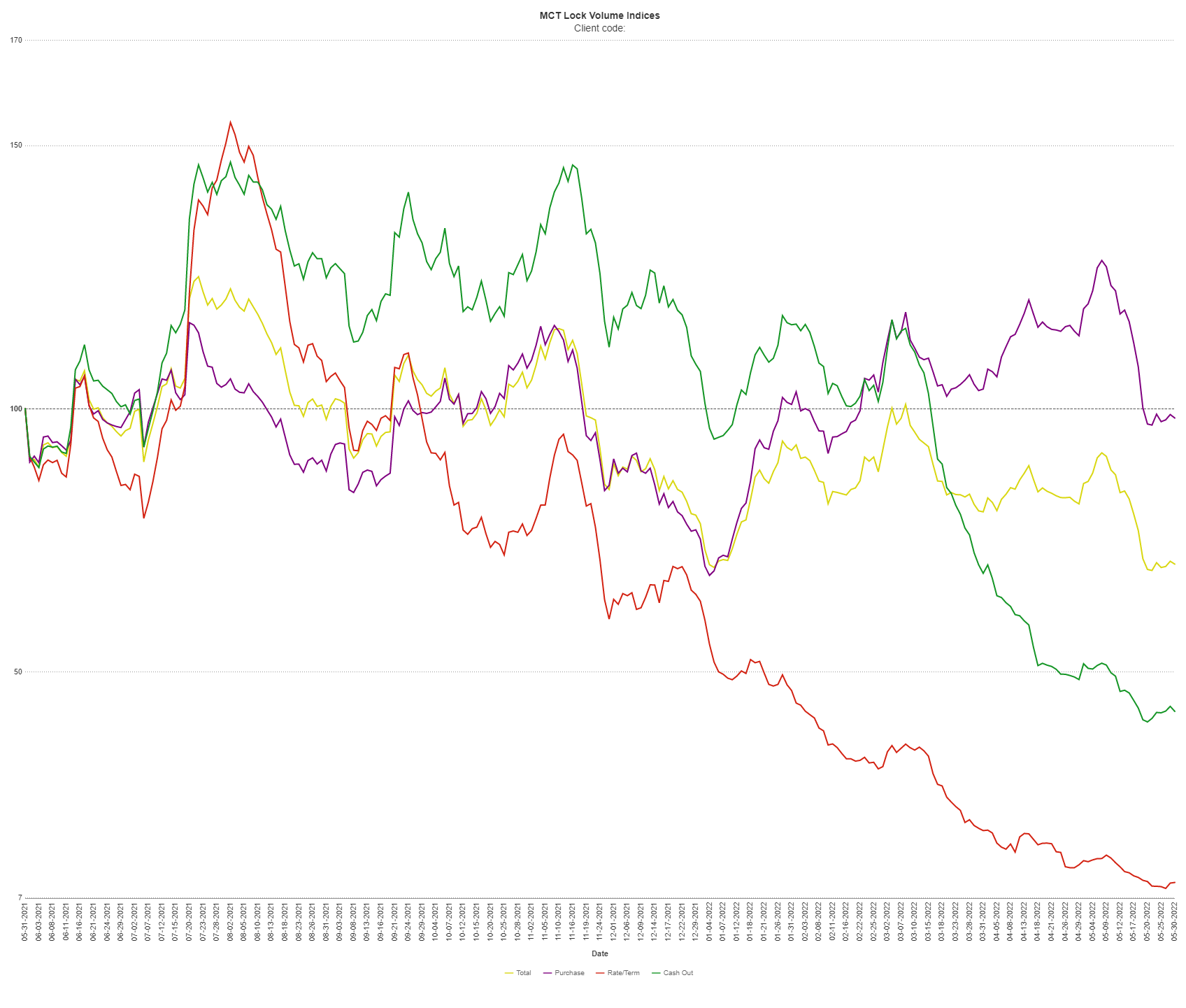

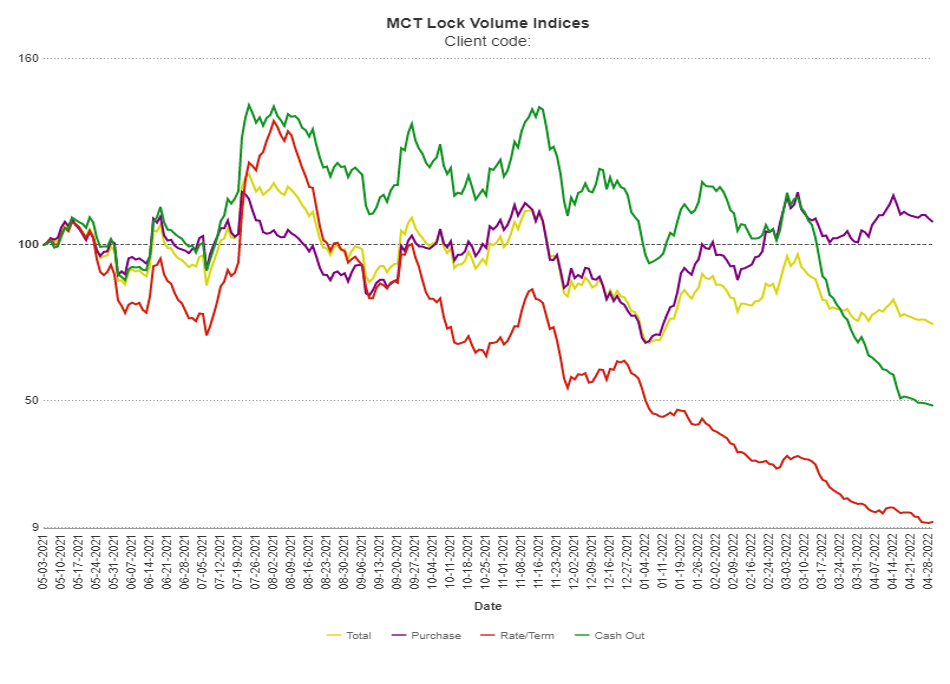

MCTlive! Mortgage Lock Volume Indices covers the period from July 1 through July 31, 2022, and represents a broad and balanced cross section of several hundred lenders of various sizes and business models in the mortgage industry across retail, correspondent, wholesale, and consumer direct channels.

In this article, we will discuss strategies for mitigating risk in a volatile market. The type of volatility that has been experienced by mortgage bankers in 2022 due to a widening basis.

In MCT’s latest installment of Rasori’s Relentless Releases, Phil Rasori covers the new Fannie Mae purchase advice API. View the episode to get the scoop on these timely updates.

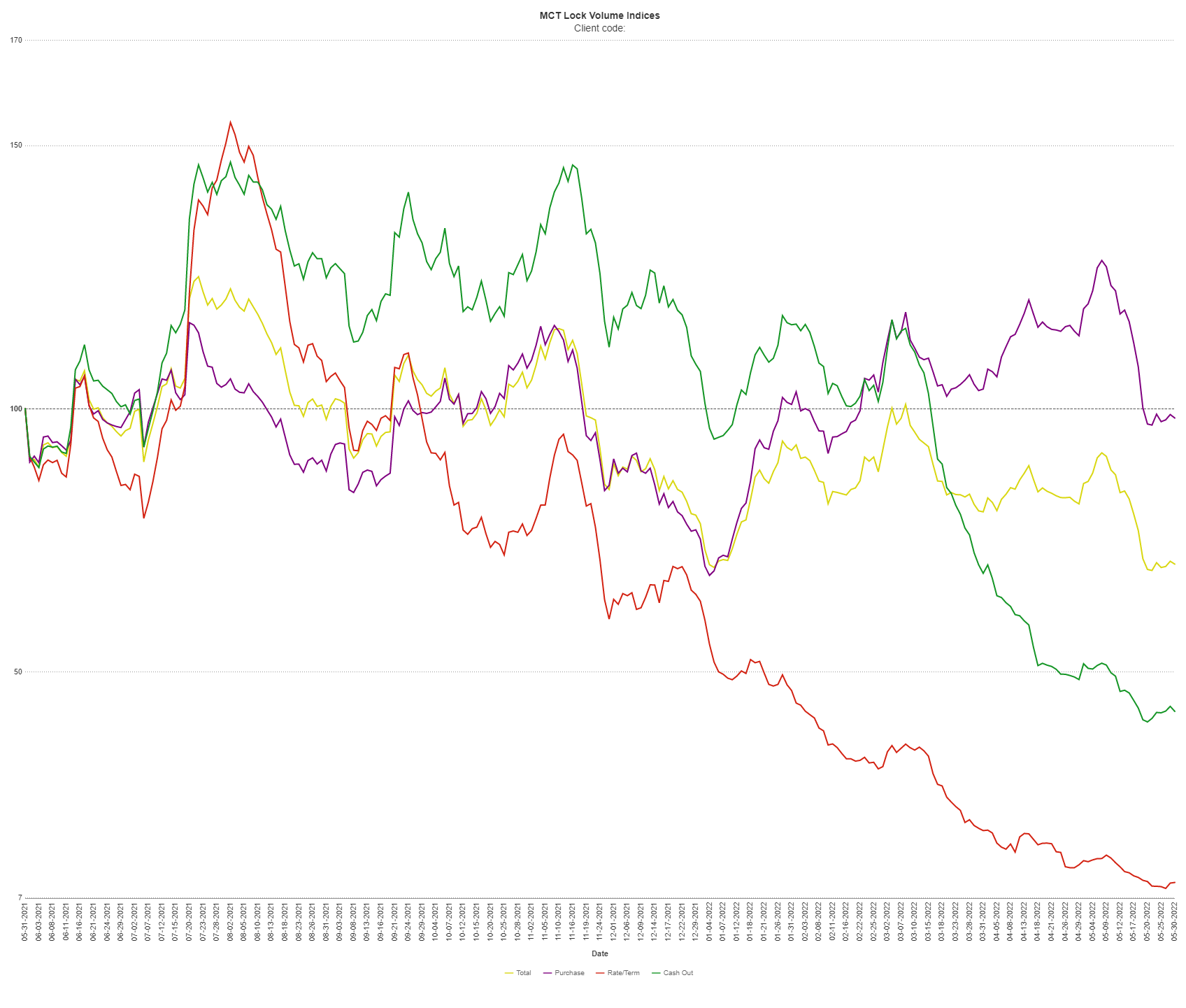

MCTlive! Mortgage Lock Volume Indices covers the period from June 1 through June 30, 2022, and represents a broad and balanced cross section of several hundred lenders of various sizes and business models in the mortgage industry across retail, correspondent, wholesale, and consumer direct channels.

In MCT’s latest installment of Rasori’s Relentless Releases, Phil Rasori covers the features of the MCTlive! Mobile App. View the episode to get the scoop on these timely updates.

Especially in volatile markets, it’s good to have a finger on your pipeline and trade frequently. Our latest whitepaper outlines ways to gain more efficiencies over your TBA trading.

MCTlive! Mortgage Lock Volume Indices covers the period from May 1 through May 31, 2022, and represents a broad and balanced cross section of several hundred lenders of various sizes and business models in the mortgage industry across retail, correspondent, wholesale, and consumer direct channels.

In this case study, MCT sits down with Mr. Sugg to hear how the MCTlive! integration has added efficiency to their loan selling process.

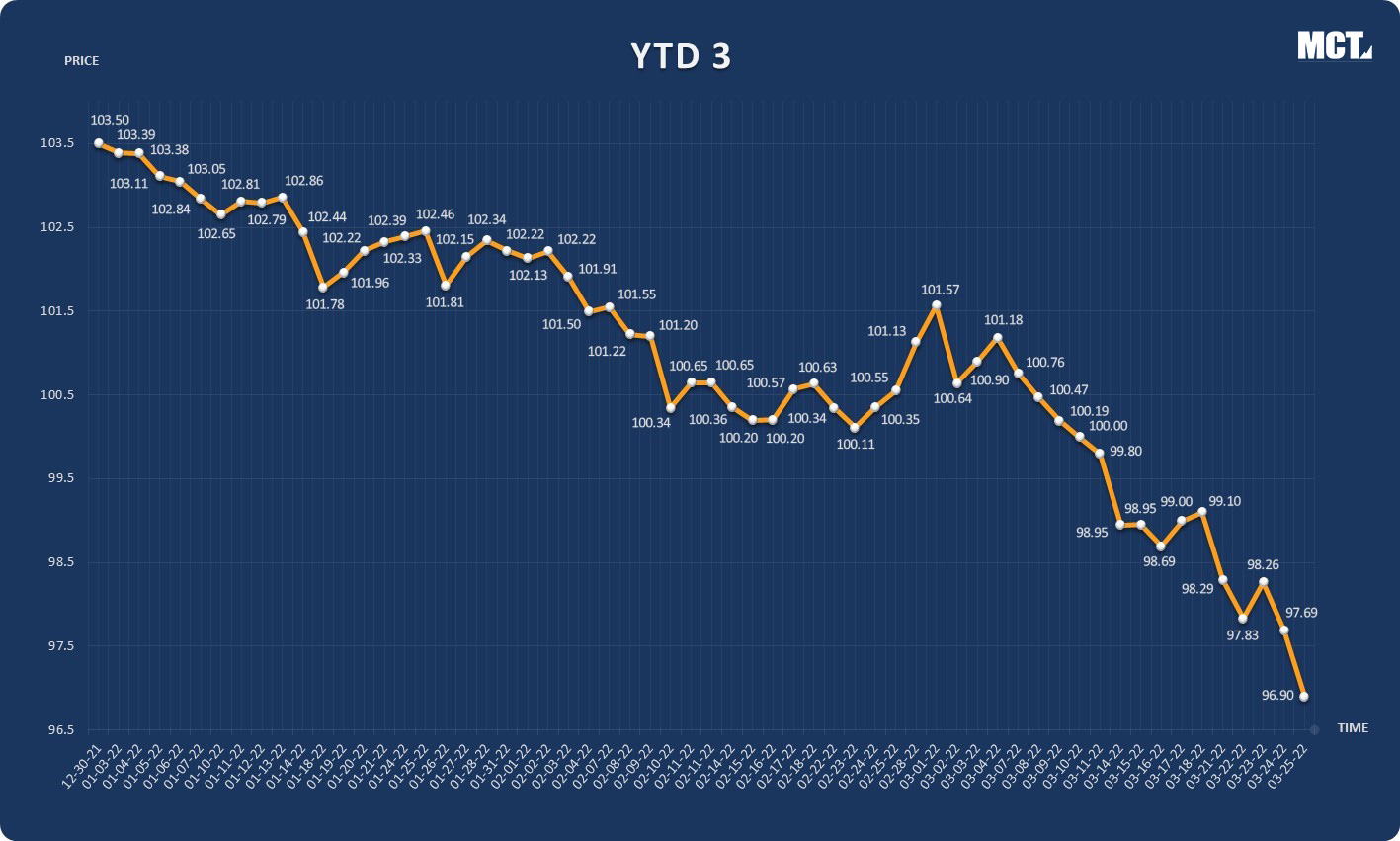

In this article, we will discuss the similarities and differences between the market selloffs in 2013 and 2022. 2022 has had the benefit of a much more orderly move and a healthier marketplace.

MCTlive! Mortgage Lock Volume Indices covers the period from April 1 through April 30, 2022, and represents a broad and balanced cross section of several hundred lenders of various sizes and business models in the mortgage industry across retail, correspondent, wholesale, and consumer direct channels.

In Paul’s Tip of the Week, we look at how MCT completed the first integration to Fannie Mae’s new API for loan sale purchase advices.

In this webinar, MCT’s Phil Rasori, Justin Grant, and Andrew Rhodes explain how MCT is helping clients Bring BPS Back and improve profitability to counter market headwinds.

In this webinar recording, MCT’s Phil Rasori, Justin Grant, and Andrew Rhodes will compare 2013 to 2022 in terms of the deteriorating market, market liquidity in specific coupons, loan sale execution liquidity, and investor pricing performance. They also share actionable recommendations to protect your business and pipeline.

In this case study, MCT sits down with John Collins to hear how the Rapid Commit integration has added efficiency to their loan selling process. Rapid Commit has also reduced the element of human error in putting together the commitments, saving them time, money, and headaches.

The unique interface between the MCTlive! Pool Optimizer and the Agile MBS pool bidding tool. Similarities and differences that exist between agency cash window commitment optimization and pooling optimizations

In Paul’s Tip of the Week, we look at how through custom eligibility and ready for sale identification a user can streamline their best ex in MCTlive!

The mortgage origination space is one of the most cyclical industries in the U.S. economy. Interest rates, origination volume, and profit margins are constantly shifting based on a variety of factors, and it takes an efficient and intelligent operation to stay on top of it all. Most lenders react, rather than act, to week by week or month by month changes in the environment. We advocate acting decisively and in a calculated fashion. This paper will outline a simplified model illustrating mortgage market stages and how lenders can set a foundation of resilience to changing markets.

In this article, we will discuss top-level margin management strategies including 6 business intelligence inputs that are helpful for making educated margin management decisions.

In this webinar, MCT’s COO, Phil Rasori, will team up with MBA’s Chief Economist, Mike Fratantoni, to discuss how lenders can stay on top of changing market cycles in 2022.

In Paul’s Tip of the Week, we look at MTM and Volume limits for clients working with dealers in MCTlive!

In this webinar, MCT’s Curtis Richins, Paul Yarbrough, and Ian Miller discuss the debut of its new Learning Center, a one-stop educational content database for each stage of growth of a mortgage lender in the secondary market.

Rasori’s Relentless Releases Episode 7: BAM Marketplace Bid AOT Published 11/29/2021 In MCT’s seventh episode of Rasori’s Relentless Releases, Justin Grant covers some recent enhancements we’ve brought to BAM Marketplace for buyers and sellers. MCT...

HUD is coordinating with FHFA to ensure fair housing and fair lending across the board. This panel will feature industry trade group leaders talking about the recent FHFA/HUD changes and what lenders can expect as we head into 2022.