SAN DIEGO, Calif., Aug. 10, 2023 – Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, today announced the appointment of Steve Pawlowski as Managing Director, Head of Technology Solutions.

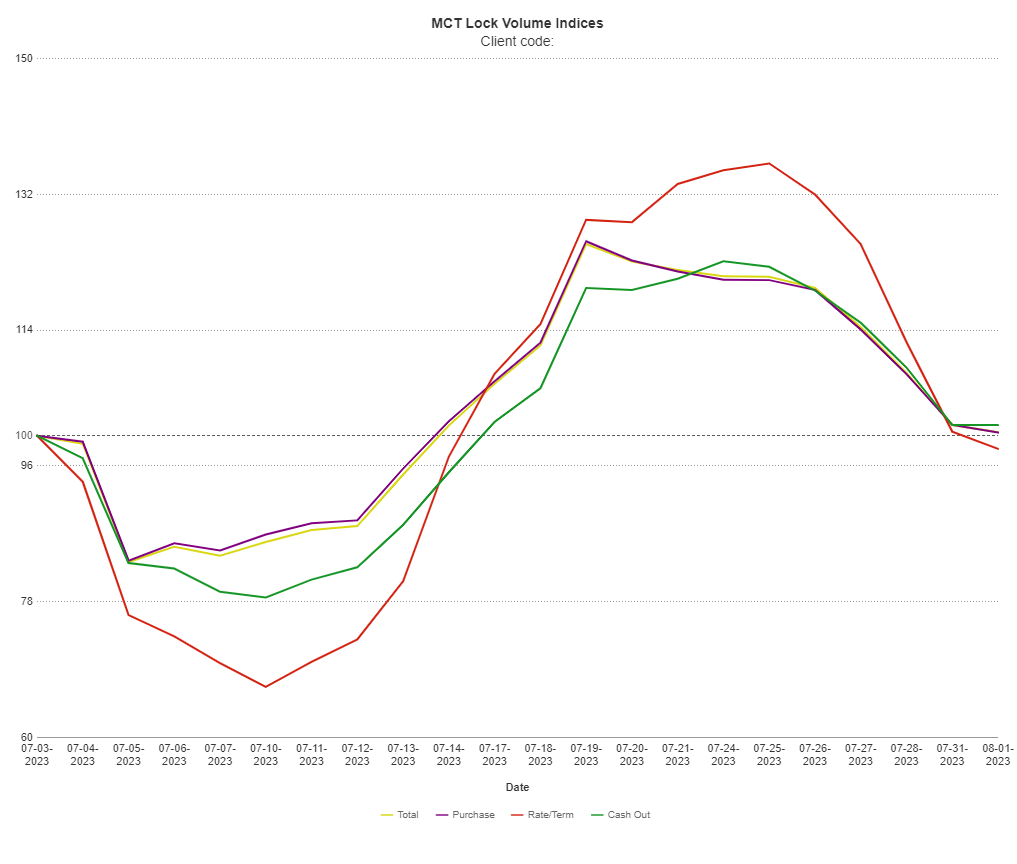

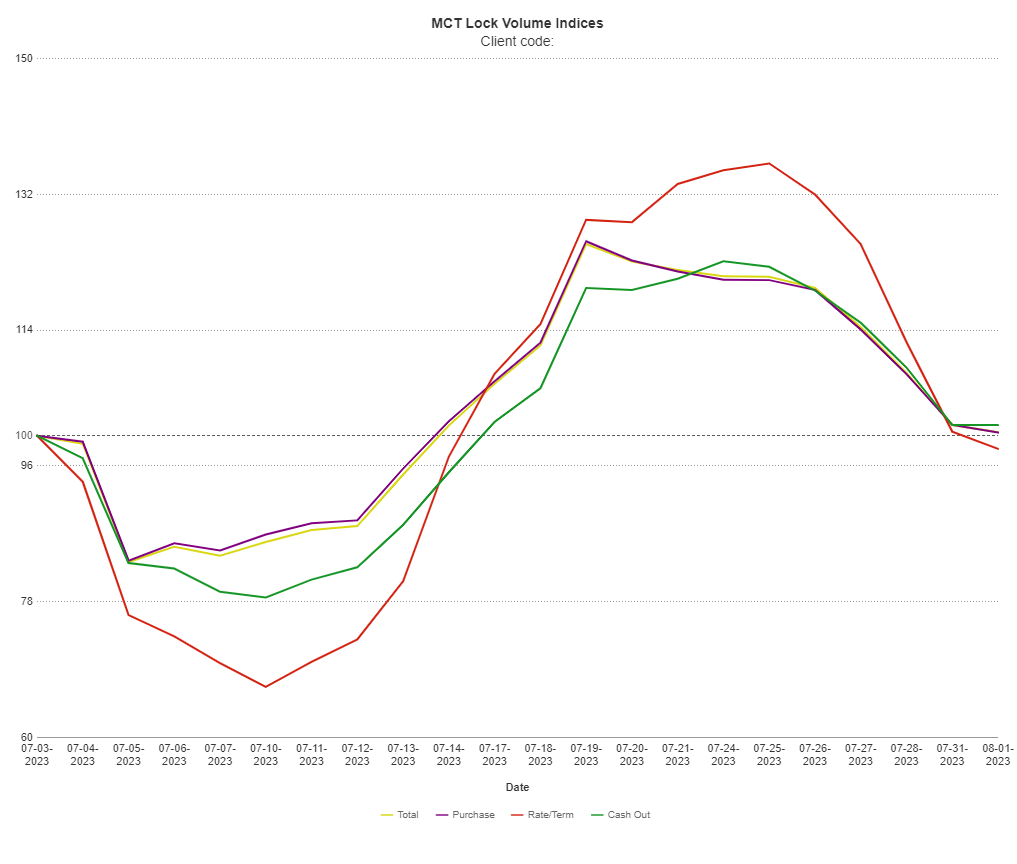

MCTlive! Mortgage Lock Volume Indices covers the period from July 1 through July 31, 2023, and represents a broad and balanced cross section of several hundred lenders of various sizes and business models in the mortgage industry across retail, correspondent, wholesale, and consumer direct channels.

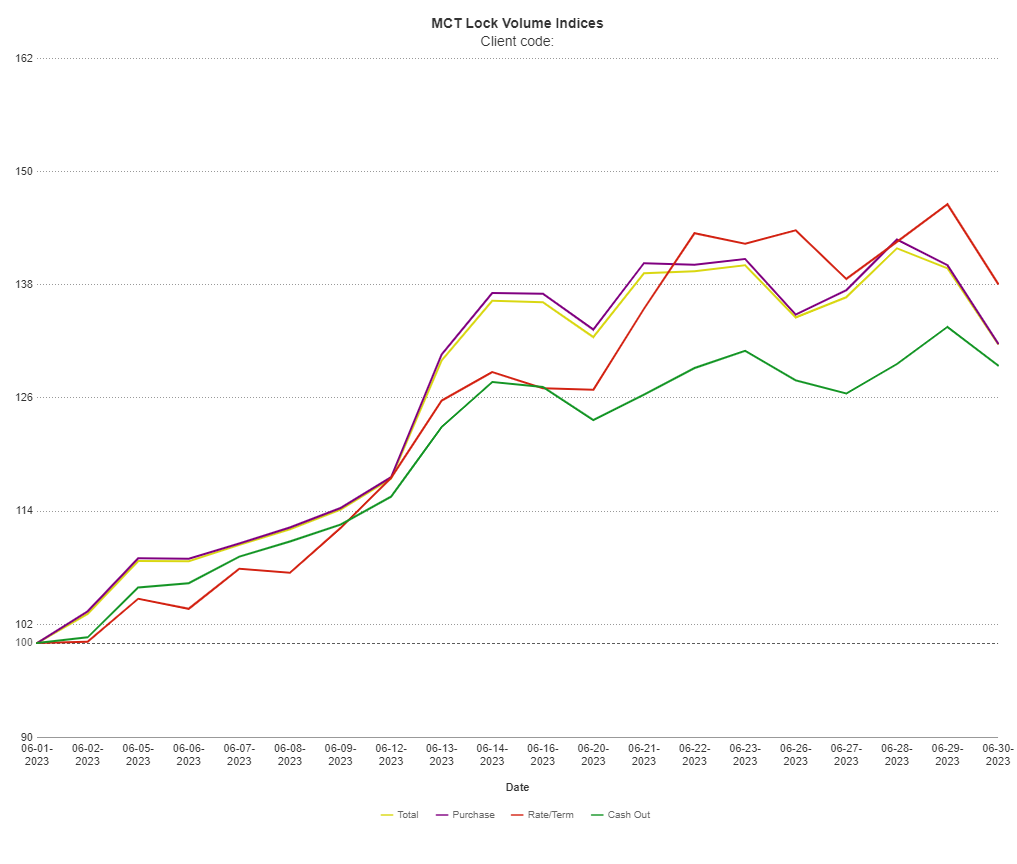

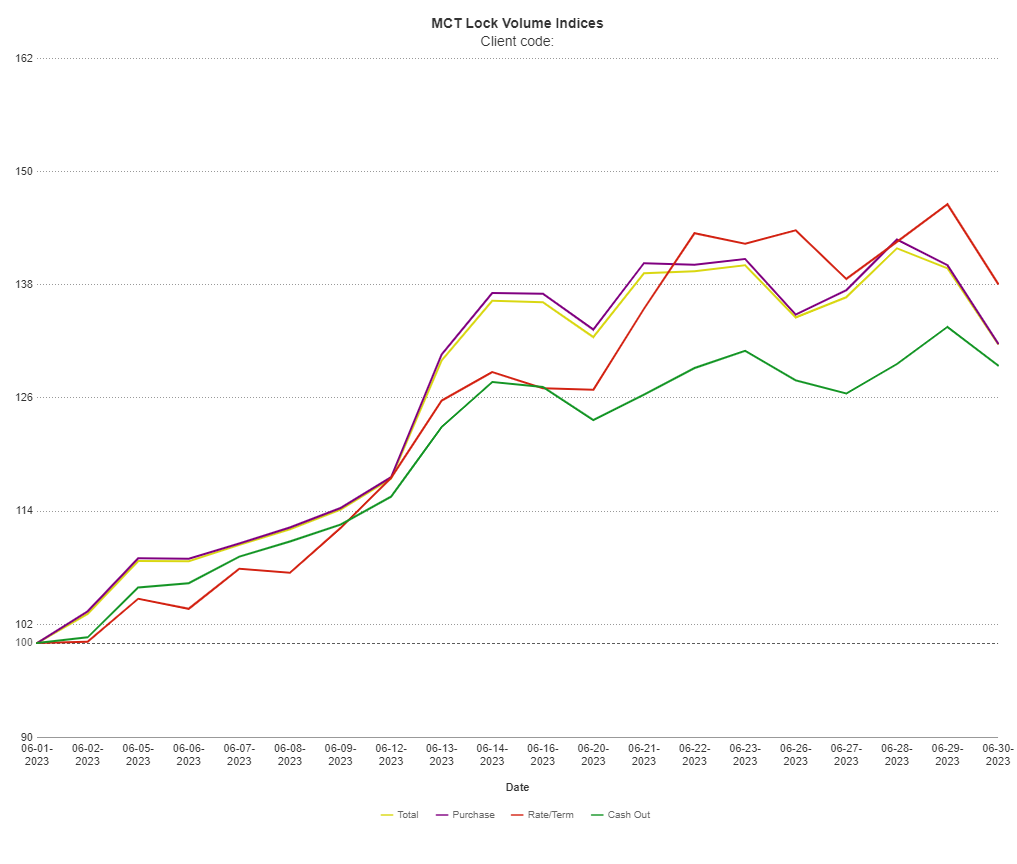

MCTlive! Mortgage Lock Volume Indices covers the period from June 1 to June 30, 2023, and represents a broad and balanced cross section of several hundred lenders of various sizes and business models in the mortgage industry across retail, correspondent, wholesale, and consumer direct channels.

In this case study, Ajay Timothy and Thia Kaleta of NBH Bank describe their process getting started with MCT and how they were able to get mortgage pipeline hedging and best execution loan sales up and running in just ten days.

In this webinar, MCT’s Phil Rasori and Paul Yarbrough will provide a current market overview and include actionable insights to improve profitability for lenders. Attendees will receive key hedging, trading, best execution, and MSR recommendations, as well as how to leverage technology to improve profitability and efficiency.

MCTlive! Mortgage Lock Volume Indices covers the period from April 1 through April 30, 2023, and represents a broad and balanced cross section of several hundred lenders of various sizes and business models in the mortgage industry across retail, correspondent, wholesale, and consumer direct channels.

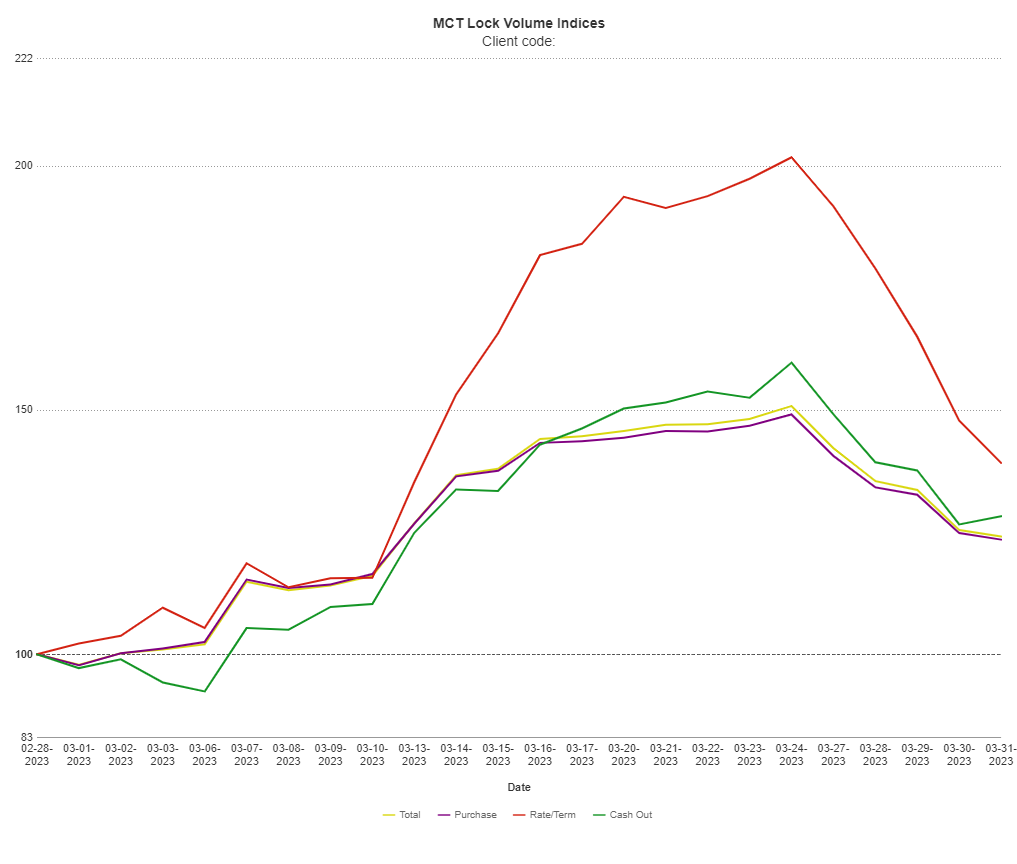

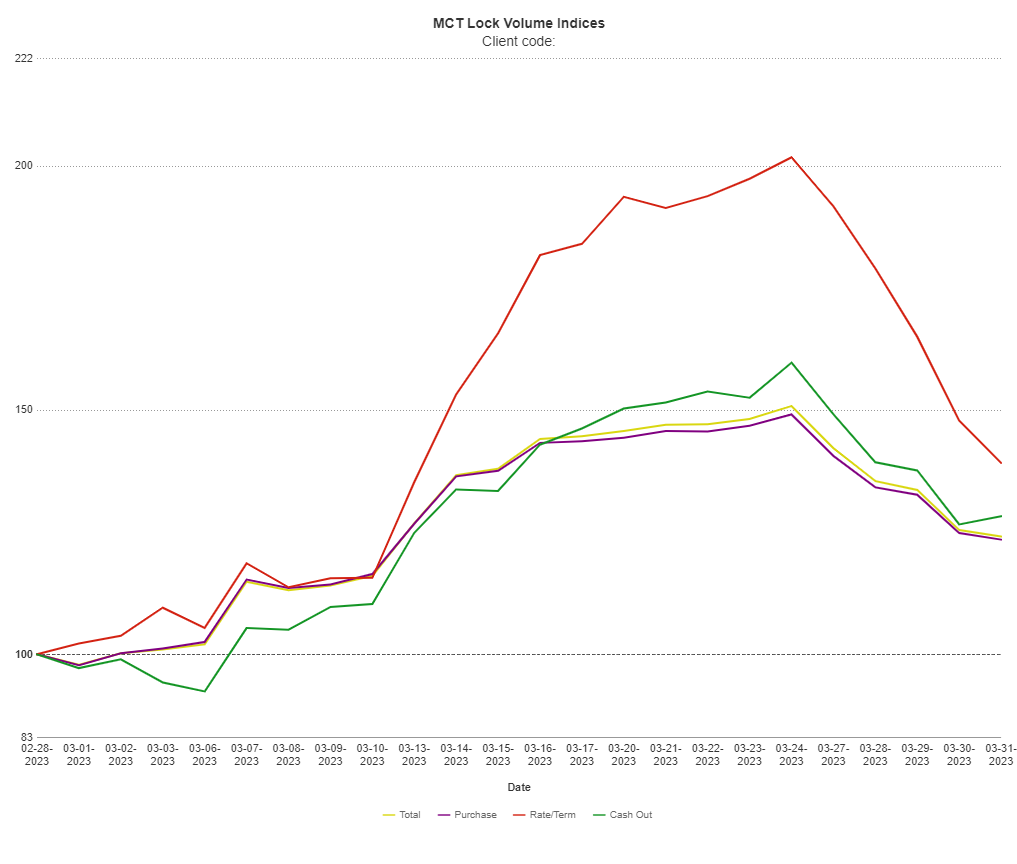

MCTlive! Mortgage Lock Volume Indices covers the period from March 1 through March 31, 2023, and represents a broad and balanced cross section of several hundred lenders of various sizes and business models in the mortgage industry across retail, correspondent, wholesale, and consumer direct channels.

Unless you live under a rock, or in an increasingly blissful state of ignorance, you have likely noticed that government-bond yields have fallen the most since 2008

BSI Financial Services (BSI) has become the latest investor to join BAMCO, MCT’s new marketplace for co-issue loan sales. BAMCO brings co-issue transactions directly into MCT’s whole loan trading platform and improves price transparency by connecting unapproved sellers to live executions from potential buyers.

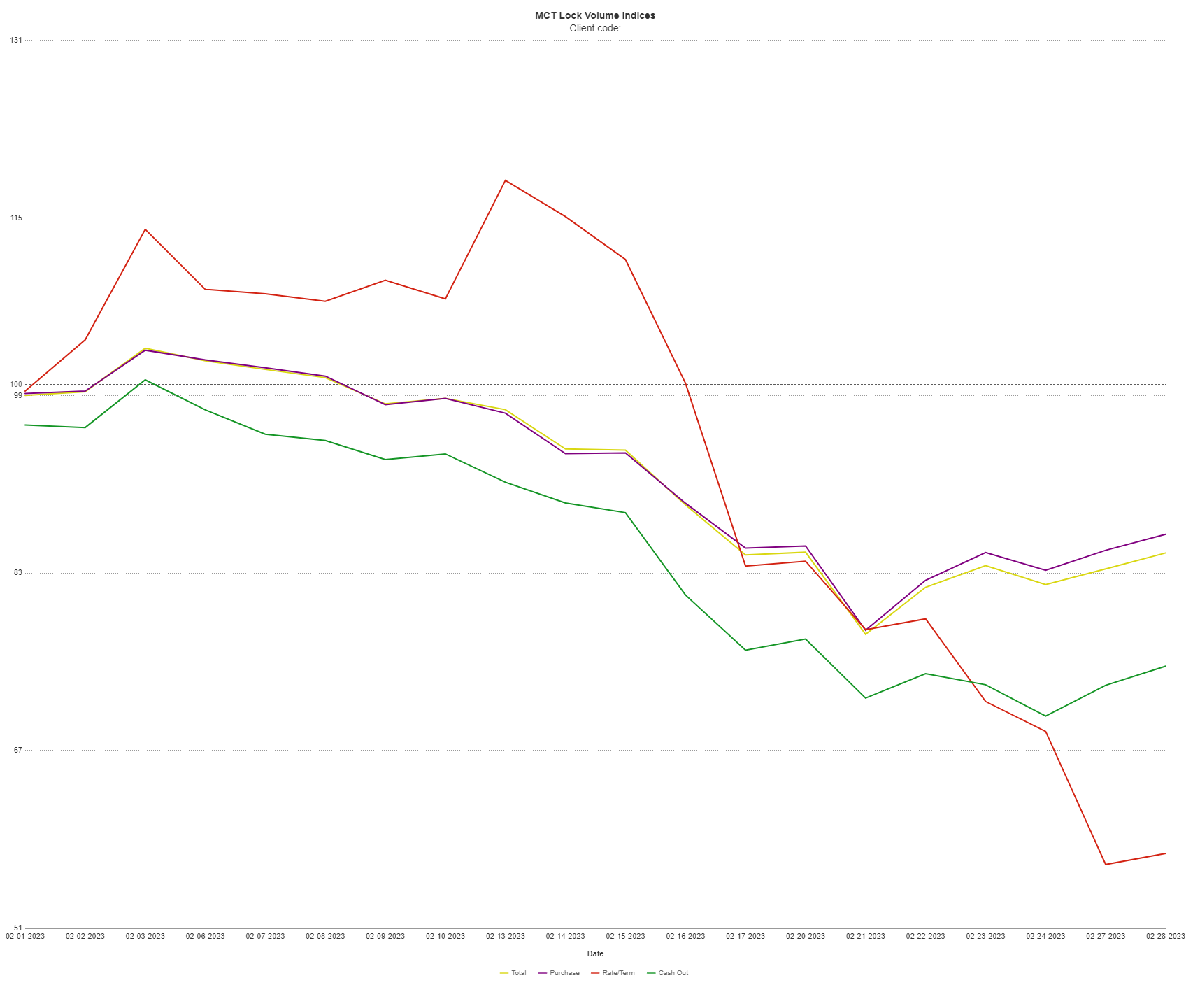

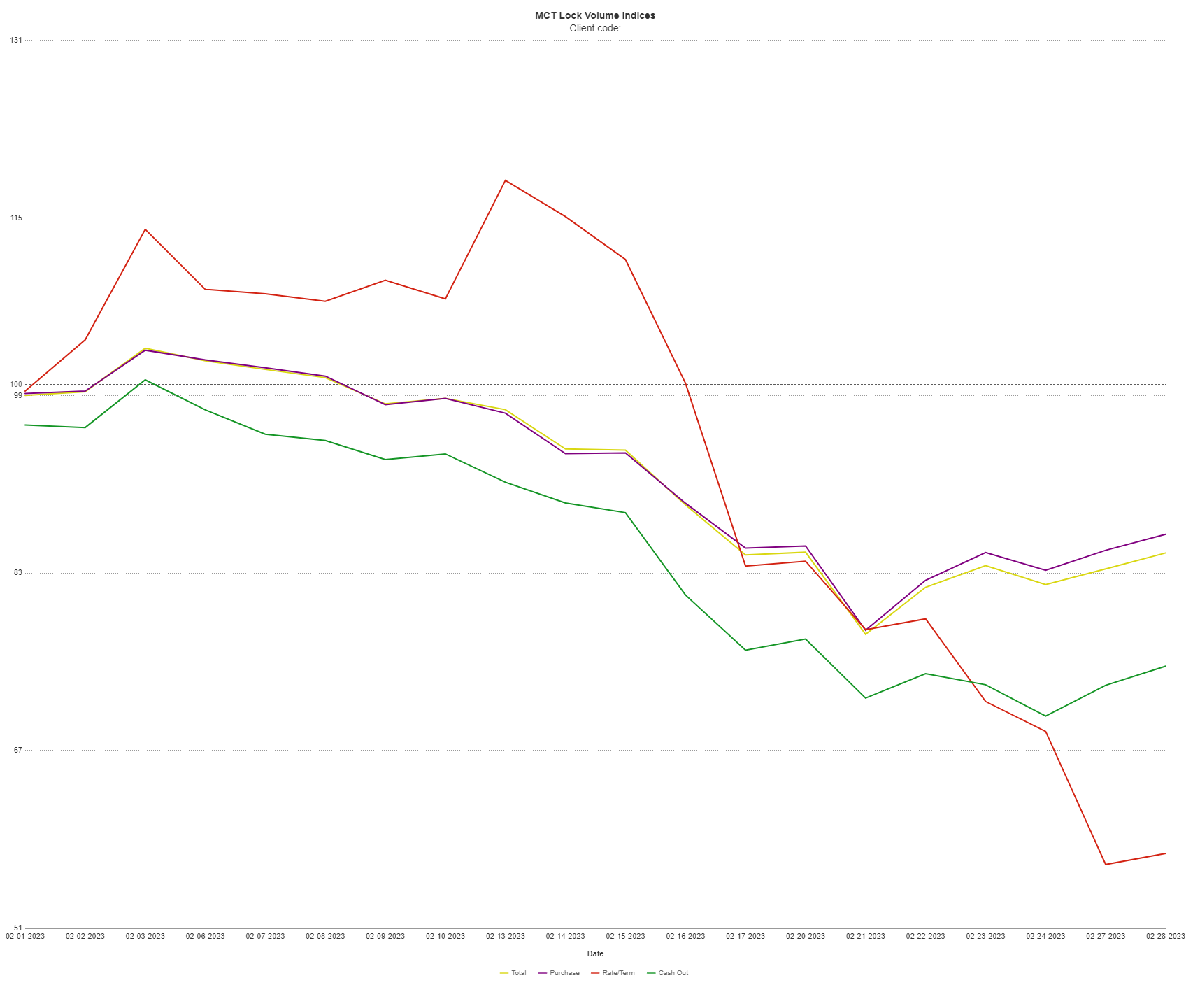

MCTlive! Mortgage Lock Volume Indices covers the period from February 1 through February 28, 2023, and represents a broad and balanced cross section of several hundred lenders of various sizes and business models in the mortgage industry across retail, correspondent, wholesale, and consumer direct channels.

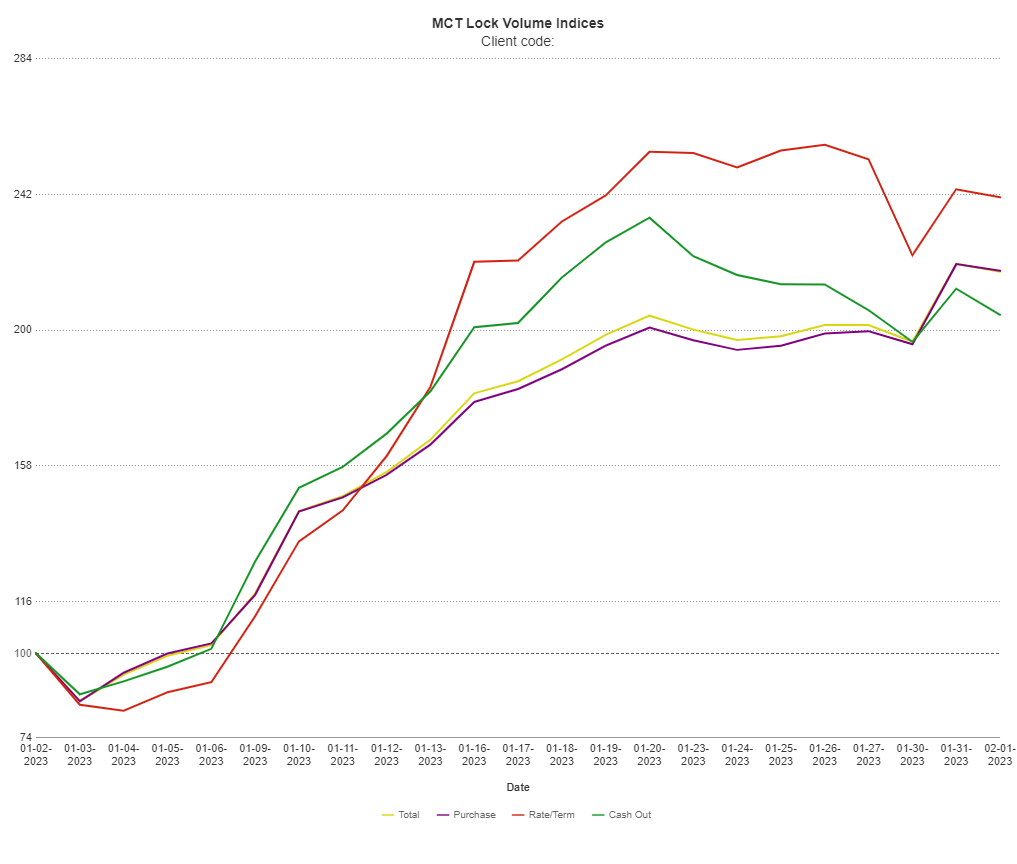

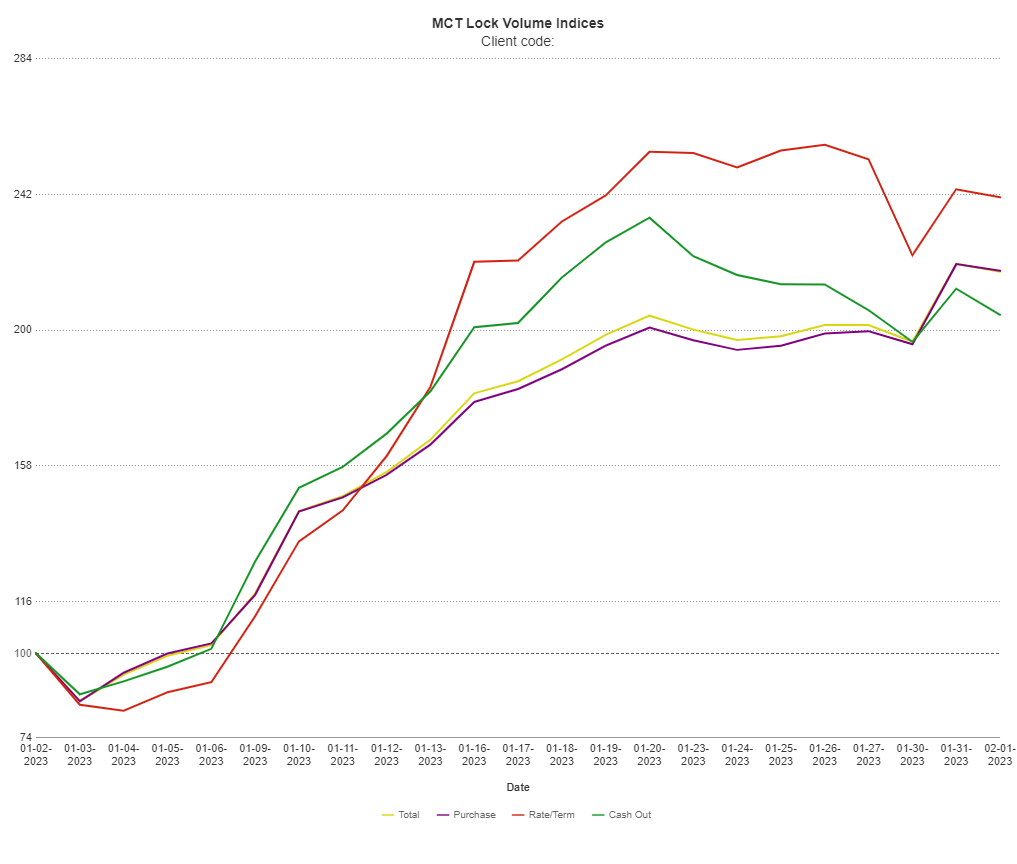

MCTlive! Mortgage Lock Volume Indices covers the period from January 1 through January 31, 2023, and represents a broad and balanced cross section of several hundred lenders of various sizes and business models in the mortgage industry across retail, correspondent, wholesale, and consumer direct channels.

This whitepaper will review information on moving to mandatory loan sales through mortgage pipeline hedging, the strategy of hedging, the benefits of hedging, and how to determine if you are ready.

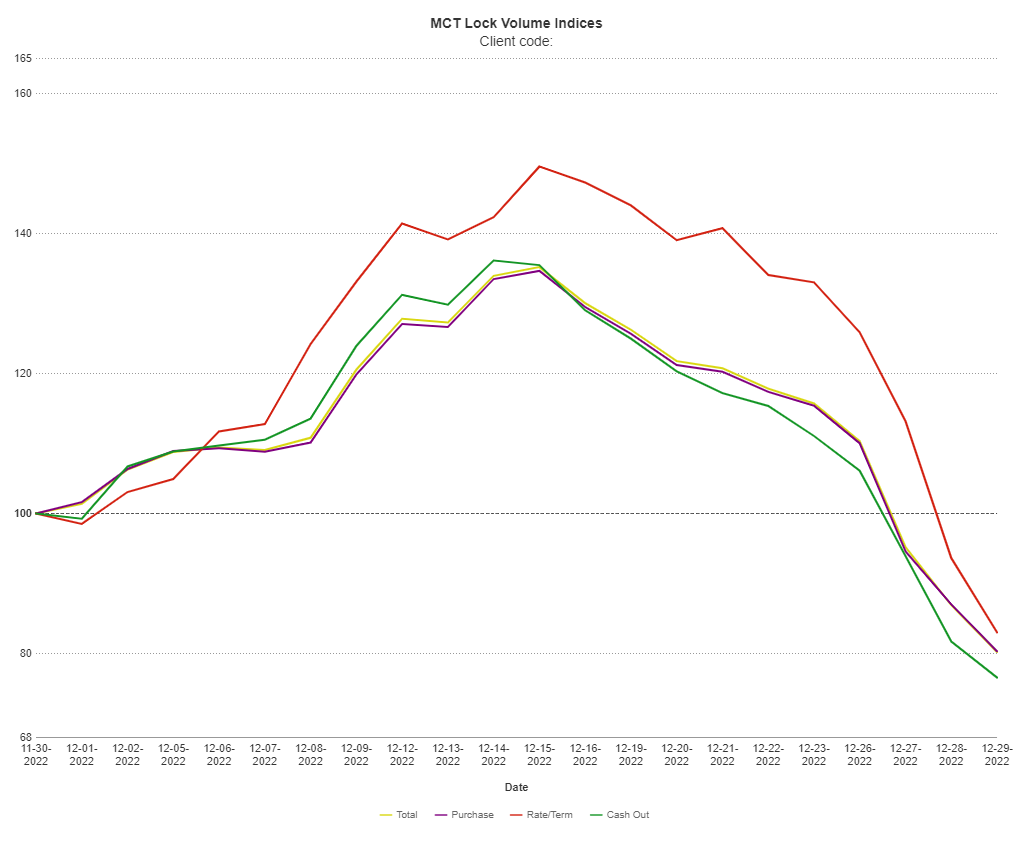

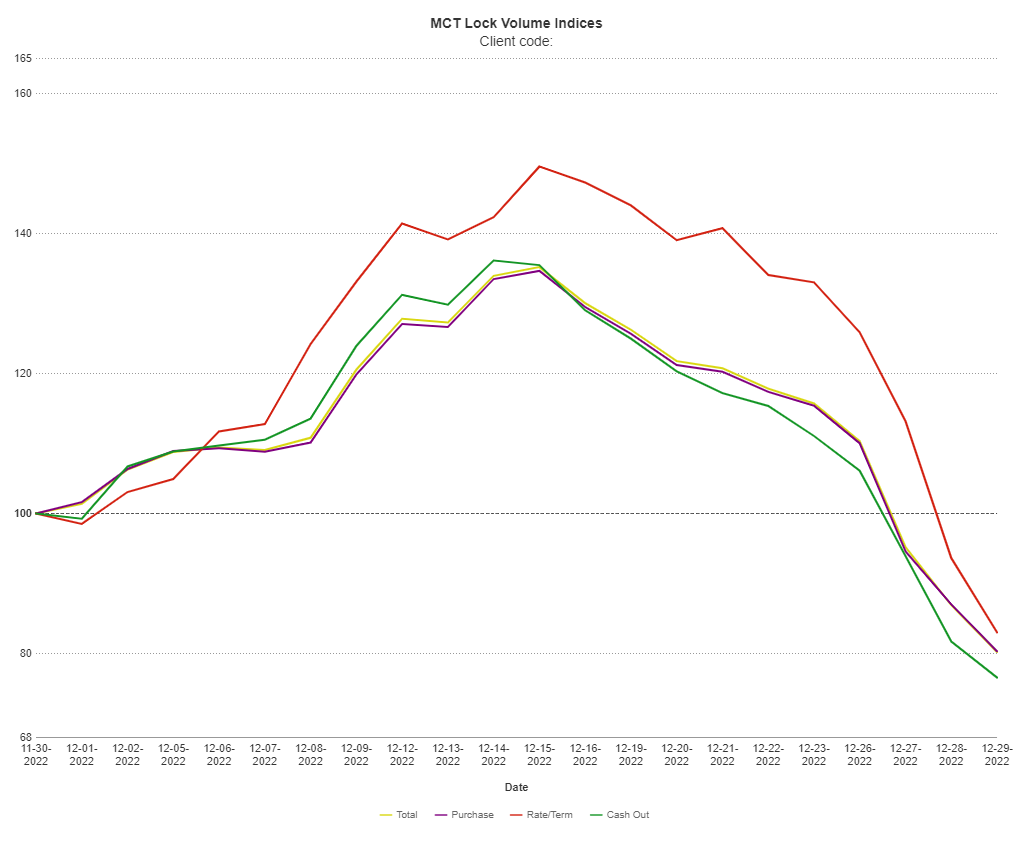

MCTlive! Mortgage Lock Volume Indices covers the period from December 1 through December 31, 2022, and represents a broad and balanced cross section of several hundred lenders of various sizes and business models in the mortgage industry across retail, correspondent, wholesale, and consumer direct channels.

MCTlive! Mortgage Lock Volume Indices covers the period from November 1 through November 30, 2022, and represents a broad and balanced cross section of several hundred lenders of various sizes and business models in the mortgage industry across retail, correspondent, wholesale, and consumer direct channels.

MCT announced the release of BAMCO, a new marketplace for co-issue loan sales. Co-issue loan sales, also known as flow-based mortgage servicing rights (MSR) sales, are a three-way transaction involving the sale of loans to one of the agencies with a simultaneous sale of the MSRs to a separate third party. BAMCO brings co-issue transactions directly into MCT’s whole loan trading platform and improves price transparency by connecting unapproved sellers to live executions from potential buyers.

![[MCT Webinar] Introducing BAMCO: New Co-Issue Marketplace](https://mct-trading.com/wp-content/uploads/2022/11/BAMCO-Webinar.jpg)

In this webinar, MCT’s Phil Rasori and Justin Grant will introduce BAMCO. BAMCO brings co-issue loan sale transactions directly into MCT’s whole loan trading platform, making the process of selling co-issue more convenient and transparent.

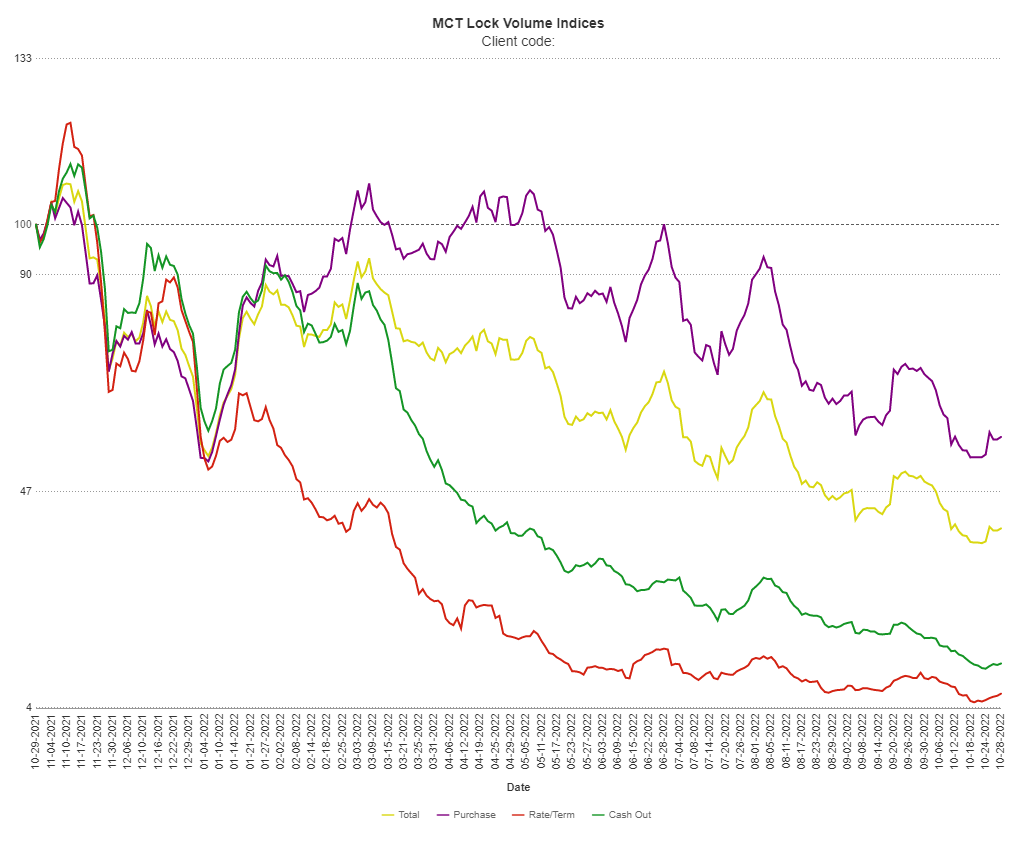

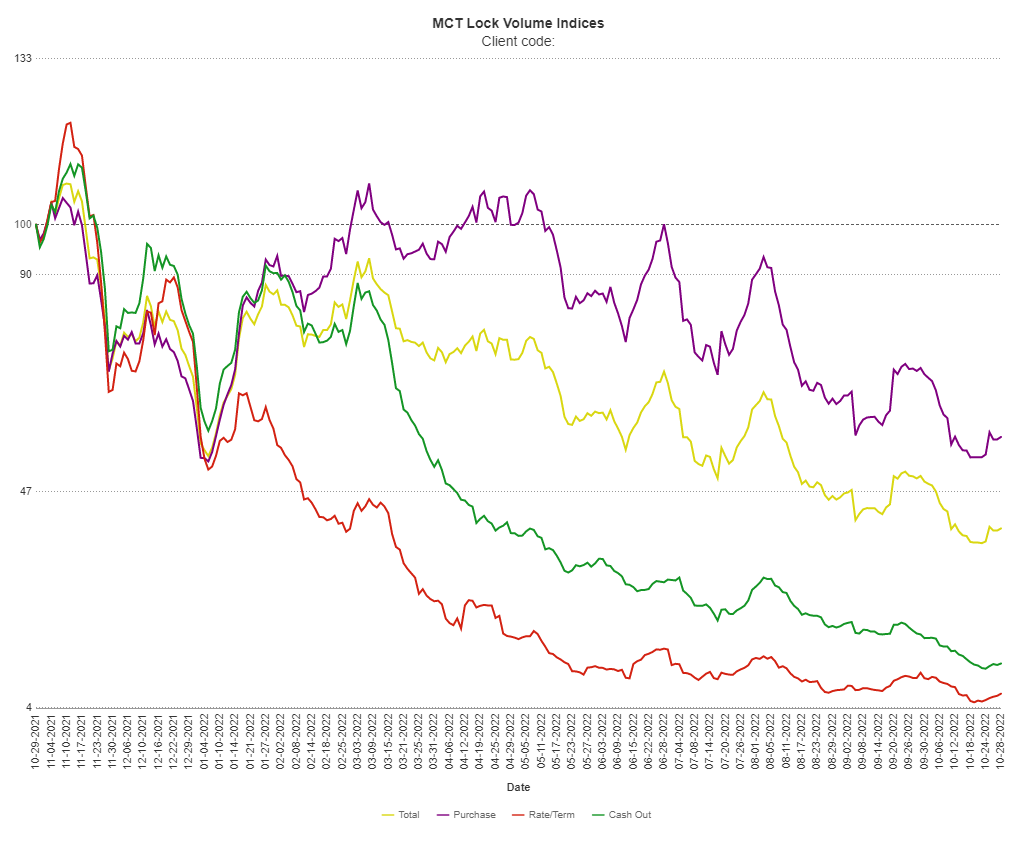

MCTlive! Mortgage Lock Volume Indices covers the period from October 1 through October 31, 2022, and represents a broad and balanced cross section of several hundred lenders of various sizes and business models in the mortgage industry across retail, correspondent, wholesale, and consumer direct channels.

In this article, we will discuss current market outlook. Even though the headlines say, “Everything is down, down, down,” we have some recommendations.

MCTlive! Mortgage Lock Volume Indices covers the period from September 1 through September 30, 2022, and represents a broad and balanced cross section of several hundred lenders of various sizes and business models in the mortgage industry across retail, correspondent, wholesale, and consumer direct channels.

![QE to QT: Current Market Recommendations [MCT Industry Webinar]](https://mct-trading.com/wp-content/uploads/2022/09/QE-to-QT-play-sign.png)

Register for this industry webinar on Friday, September 23 at 10AM Pacific, as we analyze the current market and provide recommendations as the Fed continues its transition to quantitative tightening.

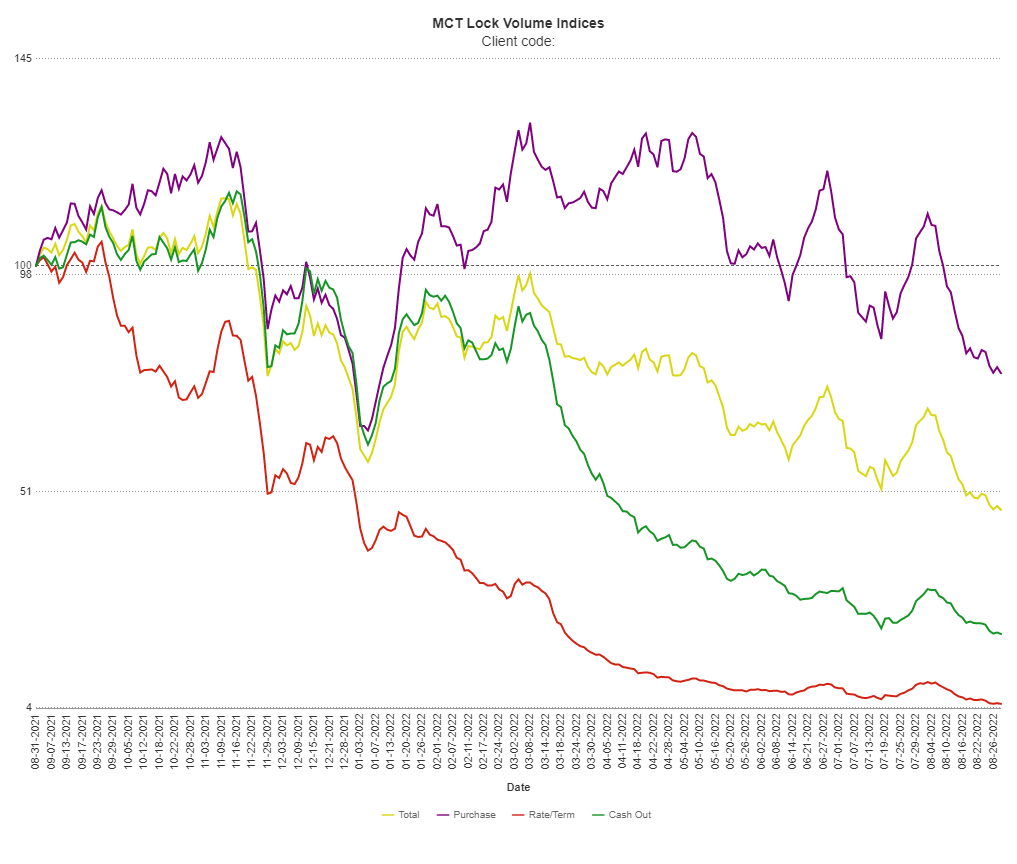

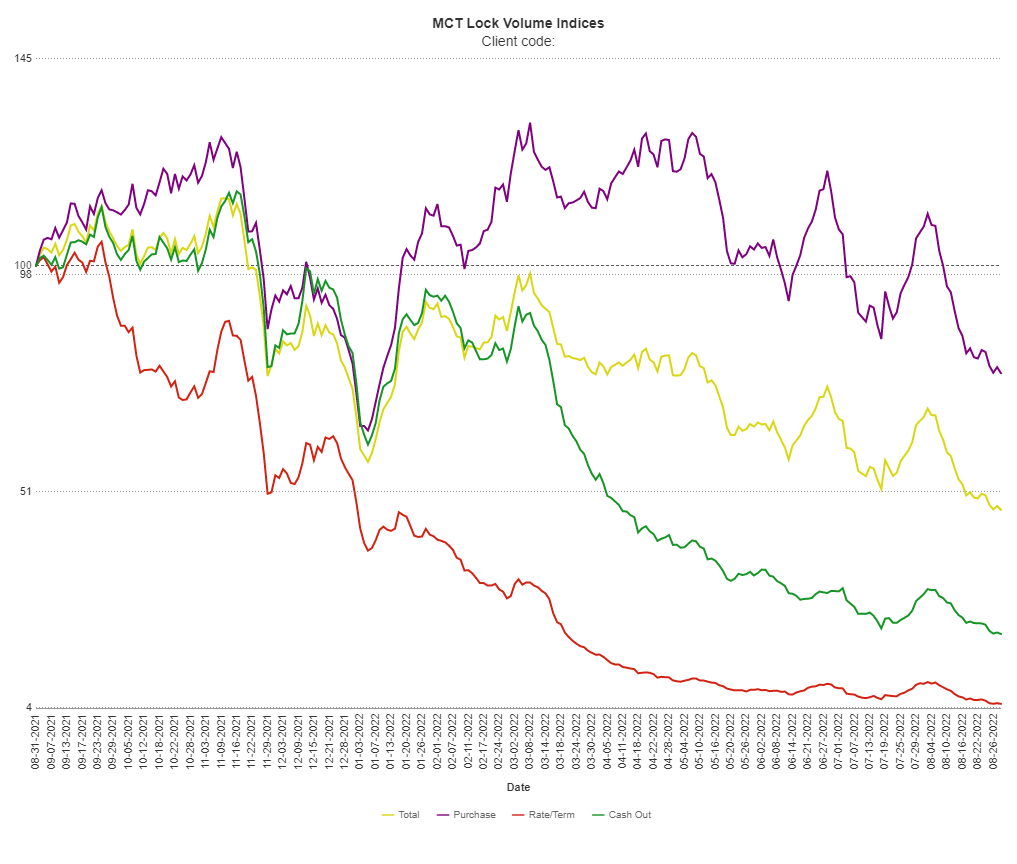

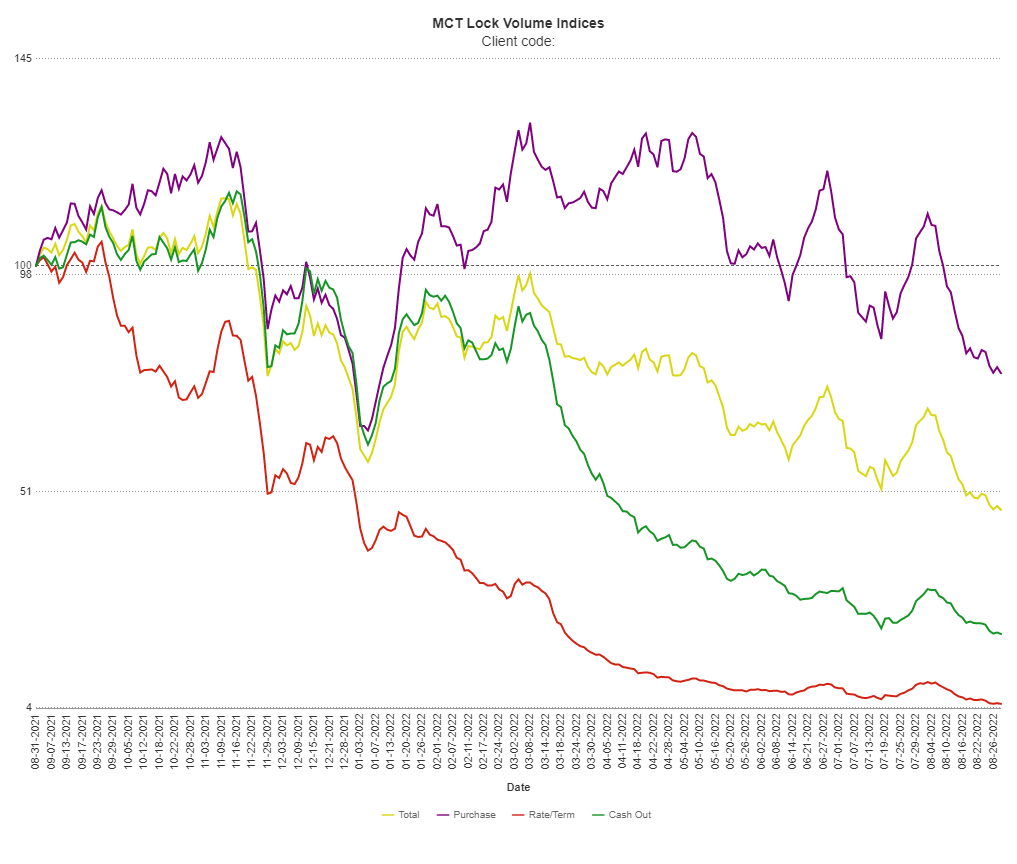

MCTlive! Mortgage Lock Volume Indices covers the period from August 1 through August 31, 2022, and represents a broad and balanced cross section of several hundred lenders of various sizes and business models in the mortgage industry across retail, correspondent, wholesale, and consumer direct channels.

In this article, we will discuss hedge considerations in a volatile market, current hedging best practices, and lock desk policy recommendations.

In this two-part video series, Freddie Mac and MCT’s MSR division team up to discuss strategies for managing a MSR portfolio in a volatile market. Watch Part 1 and Part 2 of the video series below or contact us today for strategic MSR guidance.

In this webinar on September 8th at 10am PT, MCT’s Phil Rasori and Paul Yarbrough team up with Fannie Mae’s Mike Toner to discuss the features of MCTlive! integrations with Fannie Mae technology and the benefits to mutual customers.

Page 3 of 8«12345...»Last »

![[MCT Webinar] Introducing BAMCO: New Co-Issue Marketplace](https://mct-trading.com/wp-content/uploads/2022/11/BAMCO-Webinar.jpg)

![QE to QT: Current Market Recommendations [MCT Industry Webinar]](https://mct-trading.com/wp-content/uploads/2022/09/QE-to-QT-play-sign.png)