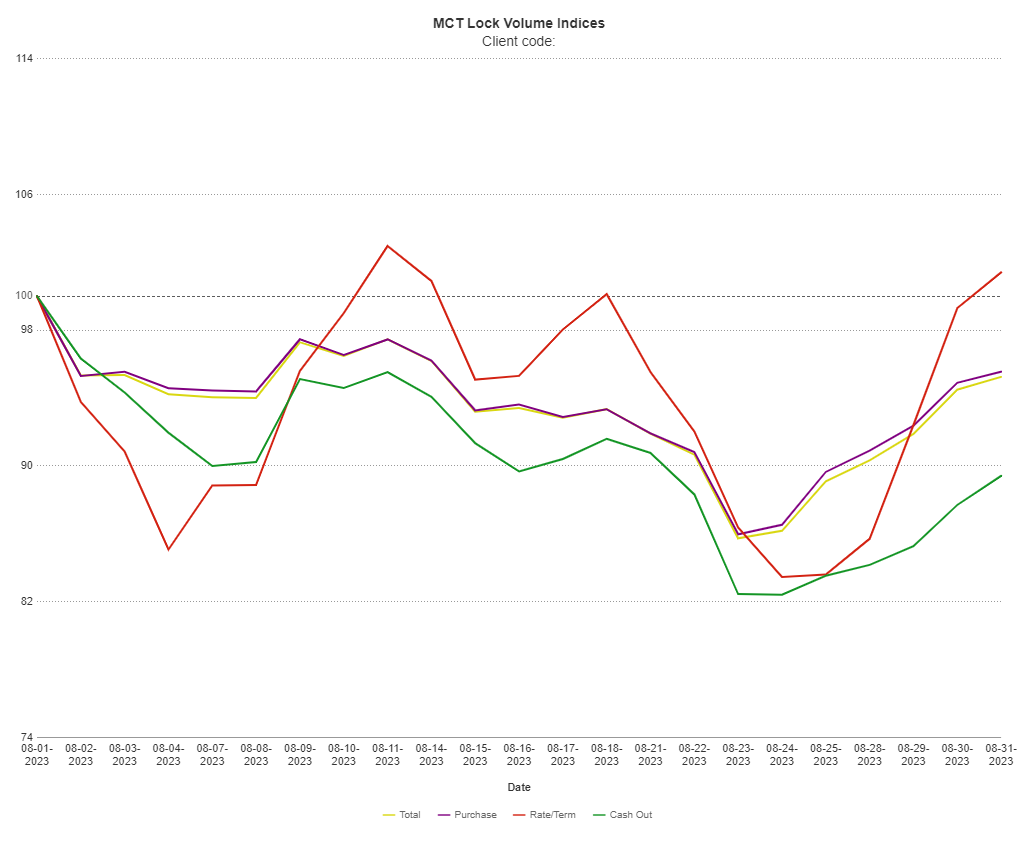

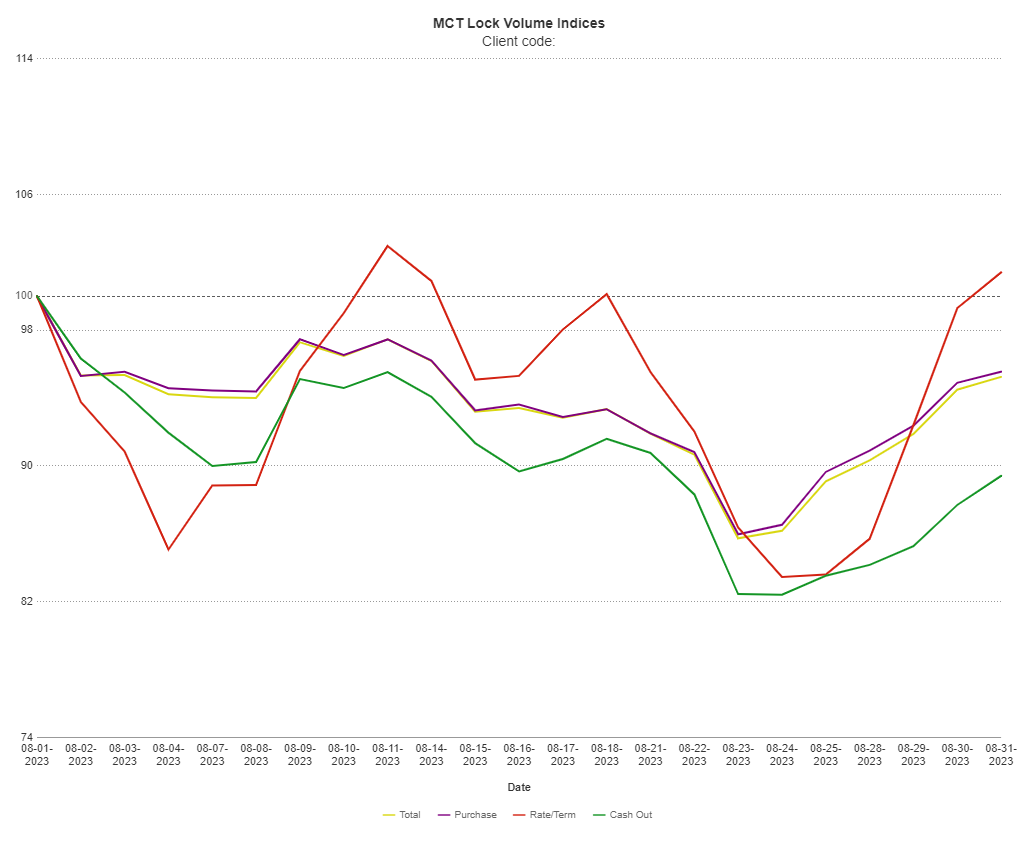

MCTlive! Mortgage Lock Volume Indices covers the period from August 1 to August 31, 2023, and represents a broad and balanced cross section of several hundred lenders of various sizes and business models in the mortgage industry across retail, correspondent, wholesale, and consumer direct channels.

SAN DIEGO, Calif., Aug. 10, 2023 – Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, today announced the appointment of Steve Pawlowski as Managing Director, Head of Technology Solutions.

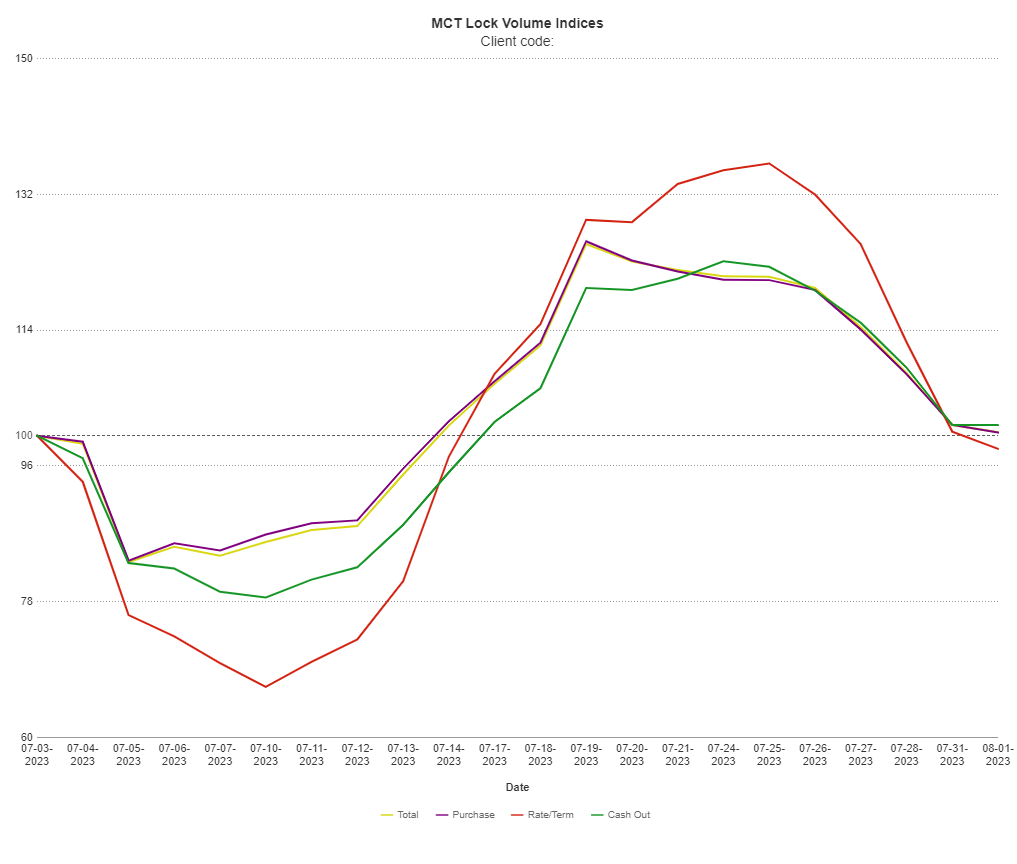

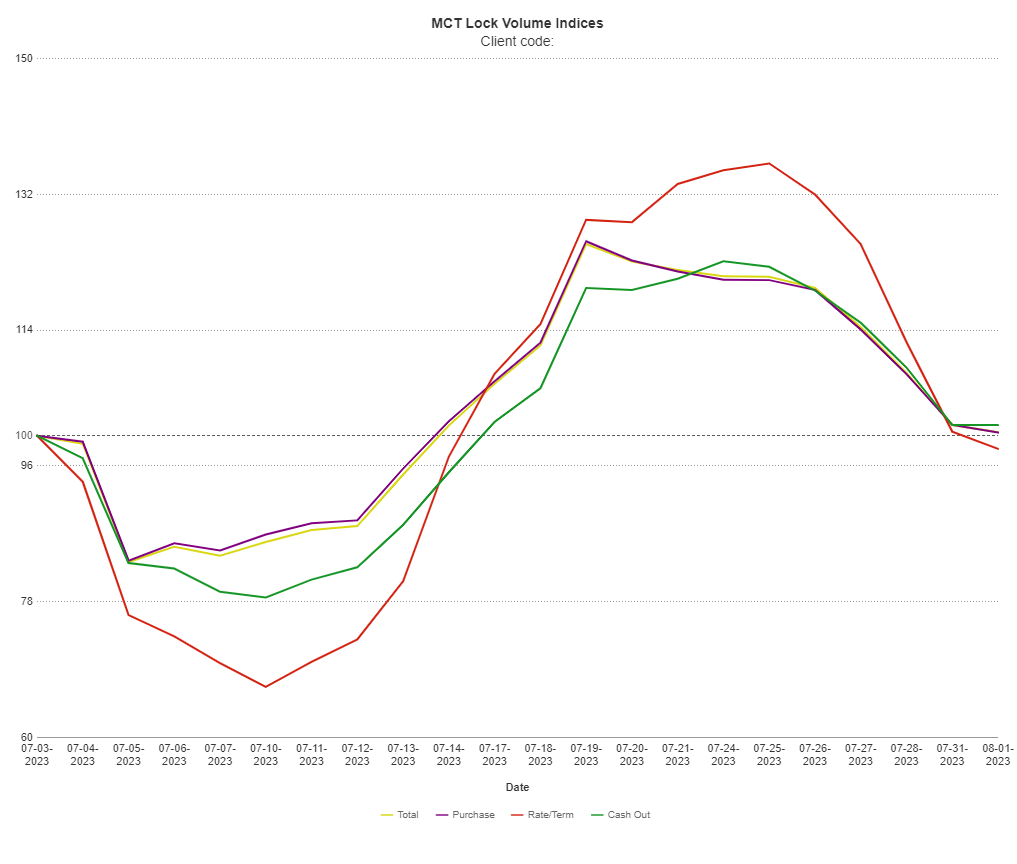

MCTlive! Mortgage Lock Volume Indices covers the period from July 1 through July 31, 2023, and represents a broad and balanced cross section of several hundred lenders of various sizes and business models in the mortgage industry across retail, correspondent, wholesale, and consumer direct channels.

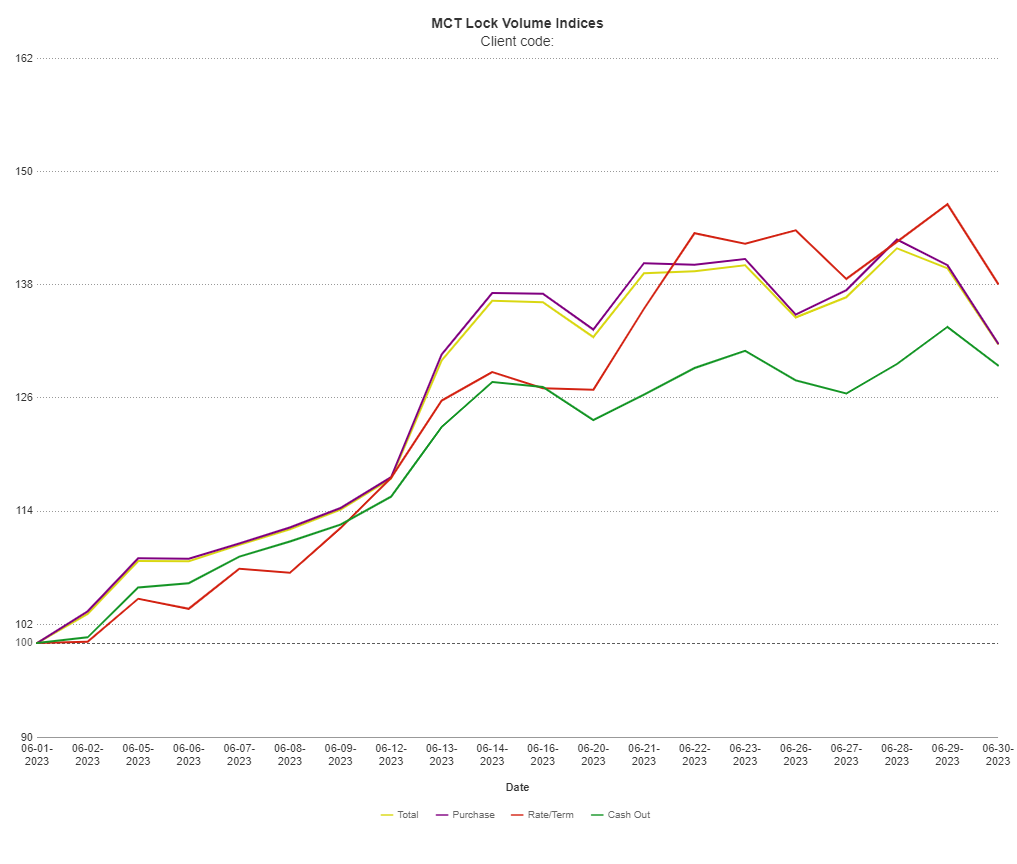

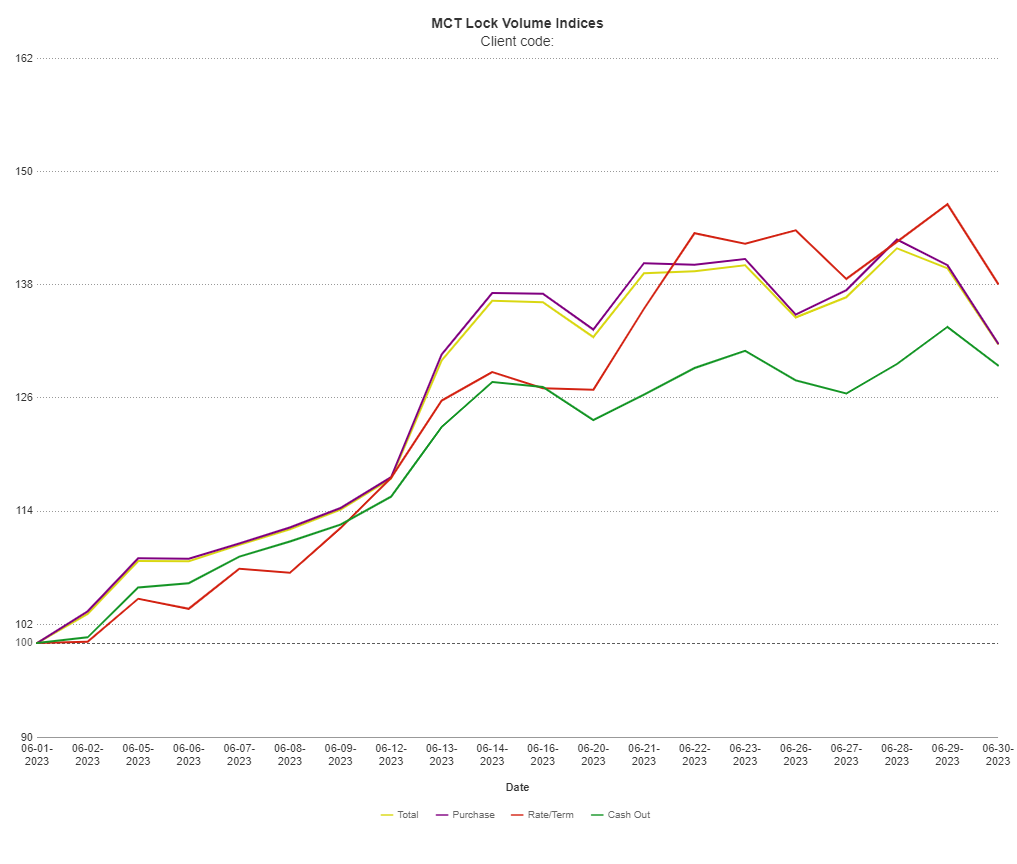

MCTlive! Mortgage Lock Volume Indices covers the period from June 1 to June 30, 2023, and represents a broad and balanced cross section of several hundred lenders of various sizes and business models in the mortgage industry across retail, correspondent, wholesale, and consumer direct channels.

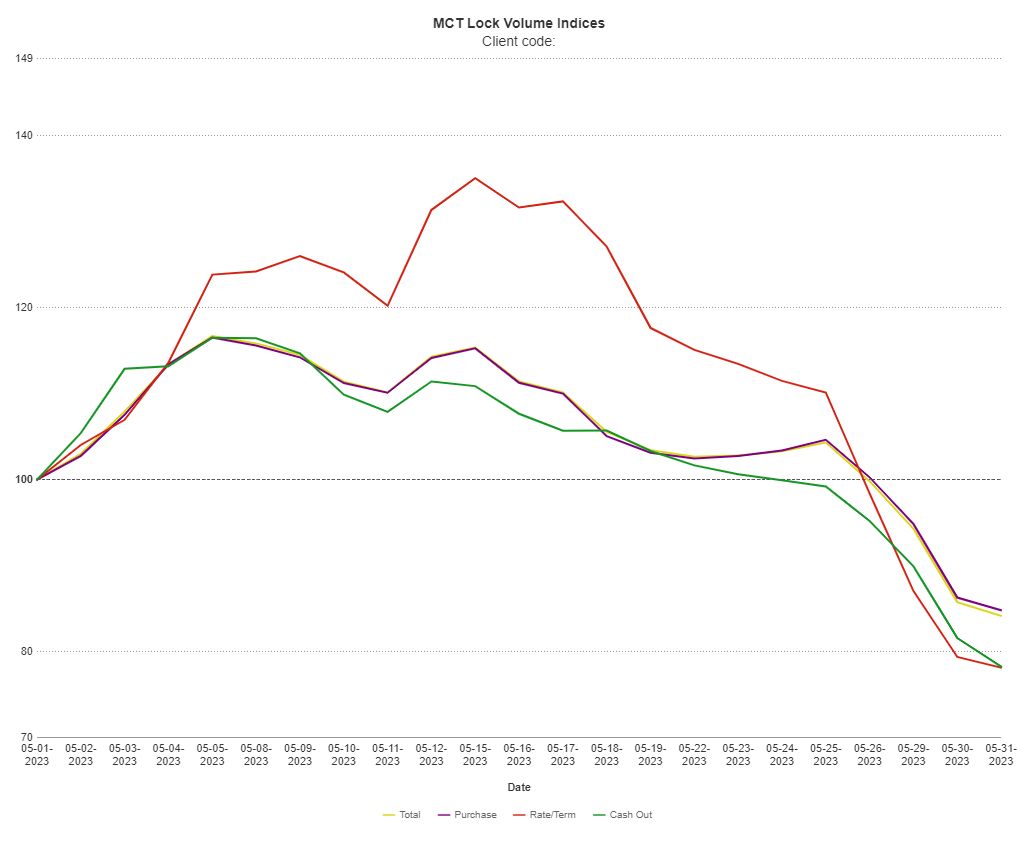

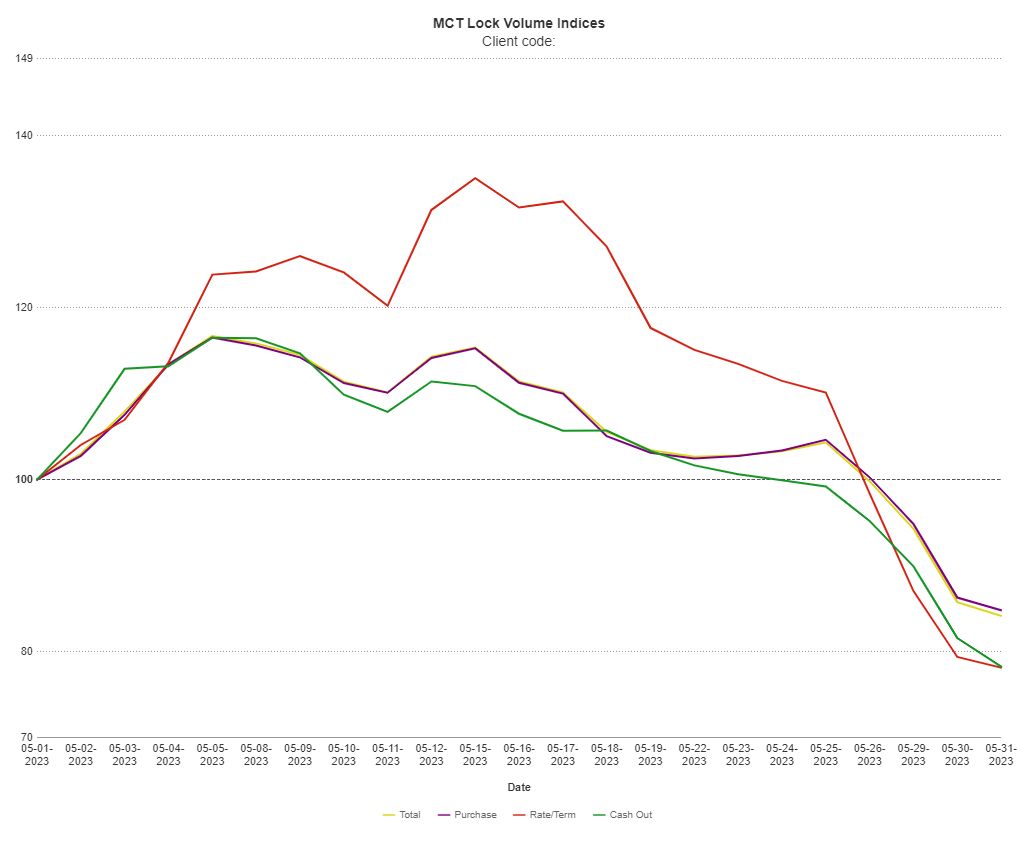

MCTlive! Mortgage Lock Volume Indices covers the period from May 1 through May 31, 2023, and represents a broad and balanced cross section of several hundred lenders of various sizes and business models in the mortgage industry across retail, correspondent, wholesale, and consumer direct channels.

Mortgage Capital Trading, Inc. (MCT®), a leading mortgage hedge advisory and secondary marketing software firm,, announced that its Senior Manager of Data Integration Services, Miguel Nava-Tapia, was named to San Diego Metro (SD Metro) Magazine’s prestigious Top 40 Under 40 list for 2023.

Mortgage Capital Trading, Inc. (MCT®), a leading mortgage hedge advisory and secondary marketing software firm, announced that it has automated the process of digital TBA trade assignment during the loan sale process for both mortgage lenders and participating correspondent investors.

MCT® was announced as a 2023 HousingWire Tech100 Mortgage Winner. The Tech100 Mortgage Award recognized the most innovative and impactful technology companies serving the mortgage industry and forever changing the home sales process.

BSI Financial Services (BSI) has become the latest investor to join BAMCO, MCT’s new marketplace for co-issue loan sales. BAMCO brings co-issue transactions directly into MCT’s whole loan trading platform and improves price transparency by connecting unapproved sellers to live executions from potential buyers.

MCT is pleased to announce it is the first secondary marketing platform to integrate with Freddie Mac’s Income Limits application programming interface (API) created for the first-time home buyer area median income (AMI) limits. Income Limits allows for the accurate pricing of Credit Fee in Price (Exhibit 19, or “Credit Fees”) waivers. This is the latest in a series of successful API integrations between MCT and Freddie Mac, and helps promote both pricing transparency and housing affordability.

MCT COO Phil Rasori was named to National Mortgage Professional Magazine’s Industry Titans list for 2023. NMP recognizes the key players who have dedicated their expertise and years of experience to the mortgage business, and represent the industry with professionalism and pride.

Justin Grant, was recognized by National Mortgage Professional Magazine’s (NMP) for his industry accomplishments, landing him on the 2022 ‘Top 40 Most Influential Mortgage Professionals Under 40’ list.

Azad Rafat, MCT’s Senior Director of MSR Services, has been selected as a 2022 HW Tech Trendsetter. Azad is credited with driving innovation in the housing market specifically with his work on MCTlive! 2.0, a new software update to the original MSRlive! MSR software trading platform and portfolio system.

Natalie Martinez, Manager of the MSR Services Department & Client Success, was selected as one of the finalists for San Diego Business Journal’s 2022 Business Women of the Year.

MCT announced the release of BAMCO, a new marketplace for co-issue loan sales. Co-issue loan sales, also known as flow-based mortgage servicing rights (MSR) sales, are a three-way transaction involving the sale of loans to one of the agencies with a simultaneous sale of the MSRs to a separate third party. BAMCO brings co-issue transactions directly into MCT’s whole loan trading platform and improves price transparency by connecting unapproved sellers to live executions from potential buyers.

MCT announced that Jennifer Kennelly has been appointed as the new Senior Director of MCT’s quickly expanding Investor Services team. Jennifer will leverage her unique background to grow MCT’s Bid Auction Manager (BAM) MarketplaceTM, the nation’s first open mortgage loan exchange where buyers can bid regardless of approval status, and sellers receive automated live pricing from every buyer on the platform.

MCT announced that it has been named Best Places to Work 2022 by the San Diego Business Journal (SDBJ). MCT was ranked number seven in the medium-sized company category (50 – 249 U.S. employees).

SAN DIEGO, Calif., September 2, 2022 – Mortgage Capital Trading, Inc. (MCT®), a leading mortgage hedge advisory and secondary marketing software firm, announced that Inc. 5000 named MCT to its 2022 list of winners for the nation’s fastest-growing private companies.

National Mortgage Professional’s Mortgage Women Magazine selected Natalie Arshakian, Senior Director and Head of Lock Desk Operations at MCT, to its annual 2022 Mortgage Star Awards. This year’s award recognizes 31 women who rise above the rest to do more for their clients, serve as better mentors, and are committed to making the industry more welcoming through both traditional and creative ways.

MCT’s award-winning capital markets platform, MCTlive!, is now integrated with the Freddie Mac’s Whole Loan Purchase Advice Seller API. This API connection allows MCT Mark-to-Market and Hedge Accounting Reports to be updated with Freddie Mac purchase data instantly, instead of waiting to run reports through a Loan Origination System (LOS).

Natalie Arshakian has been selected to Mortgage Professional America (MPA) magazine’s list of Elite Women in Mortgage for 2022. The annual awards, now in their sixth year, celebrate 67 successful women who are taking on gender inequality in leadership by continuously challenging societal expectations

Curtis Richins, President of MCT, has been selected to Mortgage Banker Magazine’s inaugural “Legends of Lending” list. The magazine’s inaugural class was compiled to highlight the most talented, ambitious, and legendary individuals who are achieving excellence and making a difference in the mortgage industry.

Mortgage Capital Trading (MCT®), a leading mortgage hedge advisory and secondary marketing software firm, has announced today a new technology for mortgage servicing rights (MSR) buyers to produce more granular pricing for mortgage servicing. The feature leverages an application programming interface (API) to connect MSRlive!, MCT’s state-of-the-art MSR valuation platform to clients’ systems for more precise and accurate loan-level pricing in real time.

MCT® was announced as a 2022 HousingWire Tech100 Mortgage Winner. The Tech100 Mortgage Award recognized the most innovative and impactful technology companies serving the mortgage industry and forever changing the home sales process.