May ended with a BAM!

Originally launched to support existing MCT sellers during the 2020 pandemic liquidity crisis, BAM MarketplaceTM now welcomes new buyers and sellers as the world’s first truly open loan exchange between unapproved counterparties. BAM Marketplace connects sellers with would-be buyers, particularly agency-approved lenders within the MCT client base, without previous correspondent investing experience. Learn more about BAM Marketplace!

MCT firmly holds its position as the gold standard in best execution and moves one step closer to the ultimate goal – when every loan can be priced by every investor.

– Curtis Richins, President, MCT

Press Release: MCT Launches BAM Marketplace, the First Truly Open Loan Exchange

Sellers benefit by reducing liquidity constraints, growing investor outlets, and increasing loan sale profitability. MCT clients have noted materially improved execution across all loan types. The average spread to cover bids on BAM Marketplace is thirty-two basis points. Read more…

Blog Post: How to Grow from a Mortgage Broker to Mortgage Banker

It can be a daunting task to shift from an operation focused almost solely on loan origination to one that also underwrites, documents, closes, funds, settles and sells its loans into the secondary market. Read more…

Press Release: MCT’s Enhanced Best Execution (EBX) Technology Now Automates MSR Retain-Release Decisions

This new automation eliminates the need entirely for secondary marketing professionals to manually upload data and provides users with real-time execution to inform their servicing retain-release decisions Read more…

Blog Post: How Mortgage Prices are Determined

MCT’s latest blog provides a detailed explanation for how mortgage prices are determined, why the capital markets staff’s decisions are important in mortgage pricing, and why your rate sheet is not showing the same MBS prices as a screen on your competitor. Read more…

Blog Post: How the Federal Reserve Affects Mortgage Interest Rates

Before the Federal Reserve begins to taper its $120 billion a month in asset purchases that is helping support the economy, it is of upmost importance for buyers and sellers in the secondary market to get their ducks in a row. Read more…

MCT U Webinar: MCTlive! Workshop Level 2

This MCT client-exclusive webinar is based on the MCTlive! Level 2 User Guide and provides a comprehensive overview of the platform. The webinar, featuring Paul Yarbrough of MCT’s Director of Client Success, reviewed scenarios to see the impacts on your overall hedge position. Learn more…

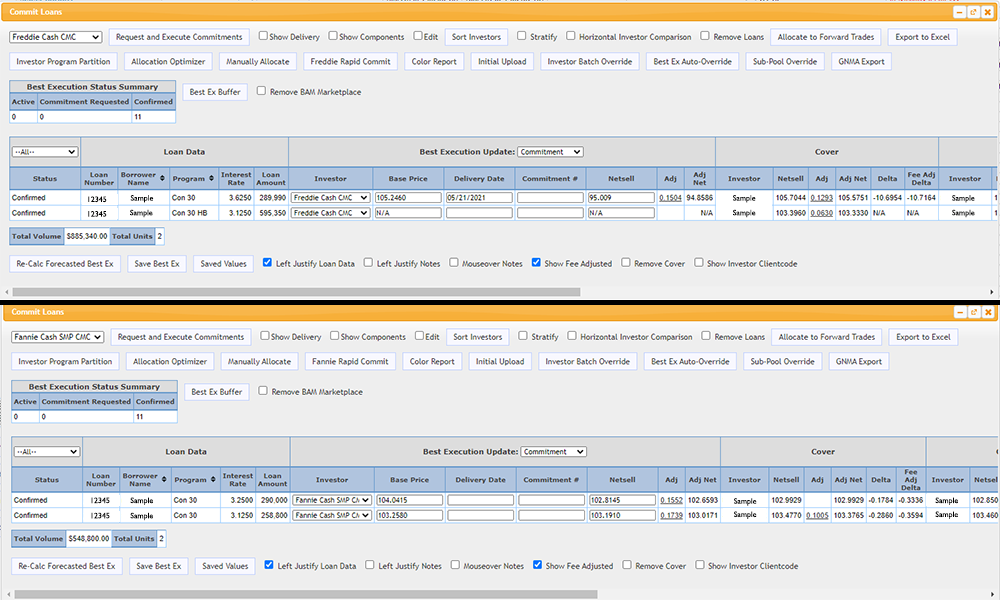

Case Study: Ruoff Mortgage Adds Efficiency with MCT's Rapid Commit & Fannie Mae

How long does it take you to commit loans to Fannie Mae? 15 minutes? 20 minutes? More? In a recent case study, Jeffrey Cassetta of Ruoff Mortgage discusses how he’s committing loans to Fannie Mae in less than 3 minutes. Read more…

MCT U Webinar: Margins & Management

This MCT client-exclusive webinar. Successful secondary marketing departments are always looking to squeeze every extra basis point of profitability into their bottom lines. With the upward pressure on rates over the last few months, we have seen margin management come to the fore. Learn more…

Upcoming Events & Conferences

We are excited to continue our participation in virtual events and hope vaccine distribution will allow us to meet in person again soon.

| Event | Date | Location | Meet with Us |

| BAM Marketplace Webinar | June 9, 2021 | Industry Webinar | ★ Register for Webinar |

| MCT University: MCTlive! Workshop Level 3 | June 10, 2021 | Client-Only Webinar | ★ Learn More |

| MCT University: Best Execution Loan Sales | June 24, 2021 | Client-Only Webinar | ★ Learn More |

| Eastern Secondary Market Conference and Annual Convention | June 22 – 24, 2021 | Orlando, FL | ★ Schedule a Meeting |

| Lenders One Summit | August 8 – August 11, 2021 | Orlando, FL | ★ Schedule a Meeting |

Schedule a meeting with us today. We would love to connect. Want to see other events industry events? Visit our event calendar!

Did You Know?

Lenders can automate Fannie Mae and Freddie Mac Loan Pricing With Rapid Commit®

MCT’s Rapid Commit leverages the power of MCTlive! and Bid Auction Manager for loan pricing and commitment to GSEs. Clients using Bid Auction Manager within MCTlive!® receive loan-level pricing and reduce time committing loans. Once the loan has been sold, the technology automatically writes back loan sale information to many LOS systems.

MCT provides summary tables of major characteristics as well as key risk factors in your MSR portfolio so you can make educated decisions on whether to release or retain.

GSEs applications are automatically synced via MCTlive! API, no need to log into separate GSE applications