Treasury yields moderated a bit at the end of a week punctuated by a Fed meeting and the April employment report. The 10-year yield ended the week at 2.526%, just under 3 basis points higher than where it closed on April 26th.

*The MBS Weekly Market Profile Report corresponds to the commentary below.*

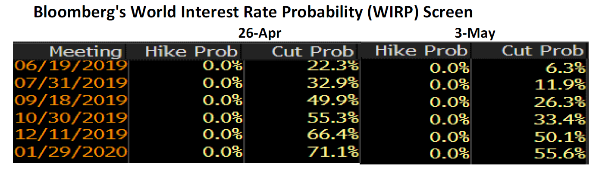

The short end of the market had a tougher week, with the 2-year yield rising by over 5 basis points, pushing the 2-5 spread back into inverted territory and leaving the 2-10 spread about 2.5 bps flatter. The impact of the strong employment report combined with expectations for a less accommodative Fed was most clearly seen in the Fed Funds futures market, where the probability of a rate cut at the 1/29/20 meeting went from 71% on April 26th to under 56% at the end of last week, as indicated from Bloomberg’s World Interest Rate Probability (WIRP) screen shown below.

MBS spreads didn’t change much last week. The Fannie Mae 30-year current coupon spread was unchanged to the interpolated 5-10 year Treasury, while the Ginnie II spread over Treasuries closed about 2 basis points wider. Primary mortgage rates reported mixed on the week, possibly reflecting differences in the timing of the different surveys. (The Bankrate.com national average rate for 30-year conventional loans rose by about 5 bps, while the Freddie Mac survey rate reported a 7 bp drop.) Coupon swaps were little changed, although Ginnie II/Fannie swaps improved by 2-3 ticks, possibly due to news about a renewed crackdown on questionable refinancing practices in the government sector. Lower-coupon rolls are modestly special, although the Fannie 3 May/June roll looks to be heating up a bit, offered at 3 ¾ ticks this morning.

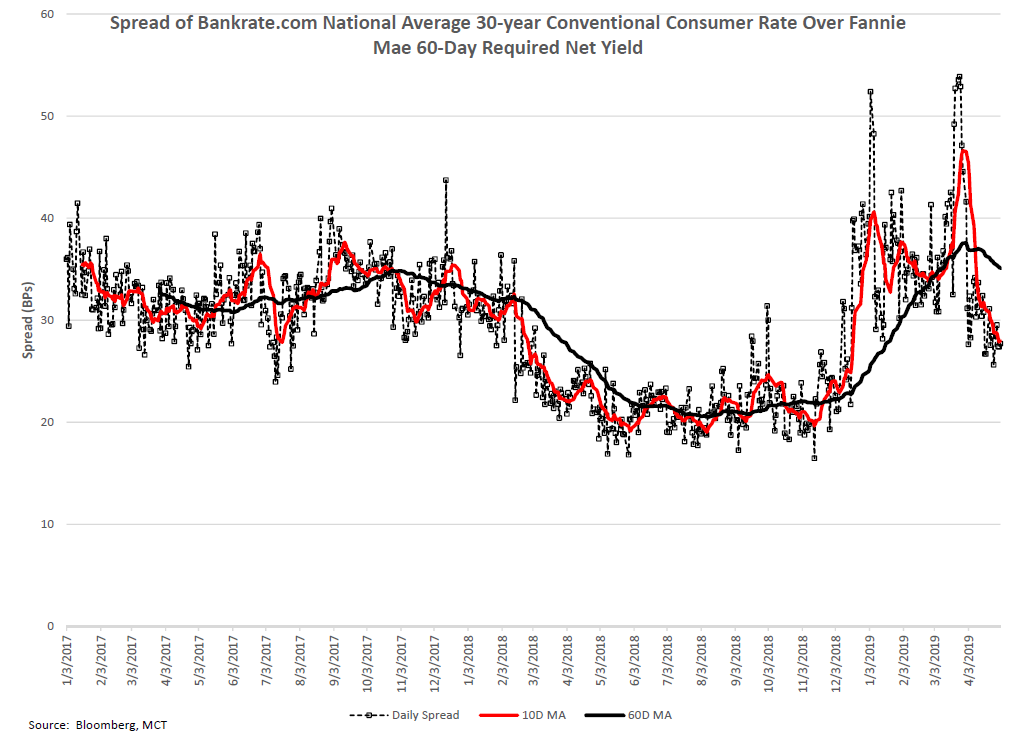

A trend we observed in April was the tightening of the spread between primary (consumer) rates and the Fannie Mae Required Net Yield (RNY), a measure of the “yield” that Fannie Mae uses to price loan purchases. As shown in the chart below, the spread (which we view as a good proxy for industry profitability) had widened noticeably after last November and through the first quarter of 2019. However, beginning in early April the spread has contracted, coincidental with the decline in application volumes after the late March spike in activity. (The MBA’s Composite application index has declined 19% since March 29th.) This unfortunately suggests a renewed squeeze on lender profitability resulting from lower issuance volumes and the resulting increase in competitive pressures.

A unique and important milestone will be reached in the next few weeks. Class A and B settlement for May will almost certainly mark the end of trading in Freddie Mac Gold TBAs, as the market transitions toward the implementation of the Single Security Initiative (SSI) and trading of Uniform Mortgage-Backed Securities (UMBS) TBAs and pools. Although issuance of UMBS pools will commence on June 3rd, 30- and 15-year conventional TBA markets will transition to the new environment after notification this month (May 9th and 14th for Class A and B, respectively). While it’s possible that some dealers may support trading in Gold TBAs, we view it as unlikely, and volumes for Gold TBAs have been virtually zero for settlement after May. We will be changing our Market Profile report to reflect the new regime; those unclear on the changes and their implications should view MCT’s webinar on the SSI, available here.

About the Author: Bill Berliner

As Director of Analytics, Bill Berliner is tasked with developing new products and services, enhancing existing solutions, and helping to expand MCT’s footprint as the preeminent industry-leader in secondary marketing capabilities for lenders.

Mr. Berliner boasts more than 30 years of experience in a variety of areas within secondary marketing. He is a seasoned financial professional with extensive knowledge working with fixed income trading and structuring, research and analysis, risk management, and esoteric asset valuation.

Mr. Berliner has also written extensively on mortgages, MBS, and the capital markets. He is the co-author, with Frank Fabozzi and Anand Bhattacharya, of Mortgage-Backed Securities: Products, Structuring, and Analytical Techniques, which was named one of the top ten finance texts in 2007 by RiskBooks. He wrote and edited chapters for The Handbook of Mortgage-Backed Securities, The Handbook of Fixed-Income Securities, Securities Finance, and The Encyclopedia of Financial Models. In addition, Mr. Berliner co-authored papers published in The Journal of Structured Finance and American Securitization. He also wrote the monthly “In My View” column for Asset Securitization Report from 2008-2012.