Treasury yields ended the week higher, although the 10-year yield managed to close below 2.50%.

*The MBS Weekly Market Profile Report corresponds to the commentary below.*

Treasury yields ended the week higher, although the 10-year yield managed to close below 2.50%. The yield curve maintained its conspicuous “bowed” shape, with yields on the 3- and 5-year notes below that of the 2-year, leaving the 2-5yr spread slight inverted (-3.5 basis points) while the 2-5-10 butterfly decreased by another 2.5 bps to end at -22.5 bps. The Fed Funds futures market has scaled back its expectations for a Fed rate cut by the beginning of 2020. According to Bloomberg, the markets are currently projecting a 58% probability of an easing by the January 29th meeting, as opposed to a 75% probability forecast at the end of last month. (Of course, this contrasts with the 45% probability of a rate increase by September of this year that was forecast after the December OMC meeting.)

MBS spreads were mixed on the week, with 30-year Fannie and Ginnie II current coupon spreads tightening by 2 basis points versus interpolated Treasuries while 15-years widened by 3 bps versus the 5-year yield. The most important development in the MBS market for originators was the Fannie 3 roll, which blew out to 6.75 ticks (7/32nds on Bloomberg) or more than 5+ special. The roll market dislocation reflected both hedging of issuance in the back months (May and June) as well as uncertainty over how much older issuance is available for delivery against April purchases. (The roll has eased this morning in front of today’s Class A notification deadline, and is currently offered at 5 ¾ ticks. It’s also notable that the GNII 3% roll remains within a plus of its break-even level.)

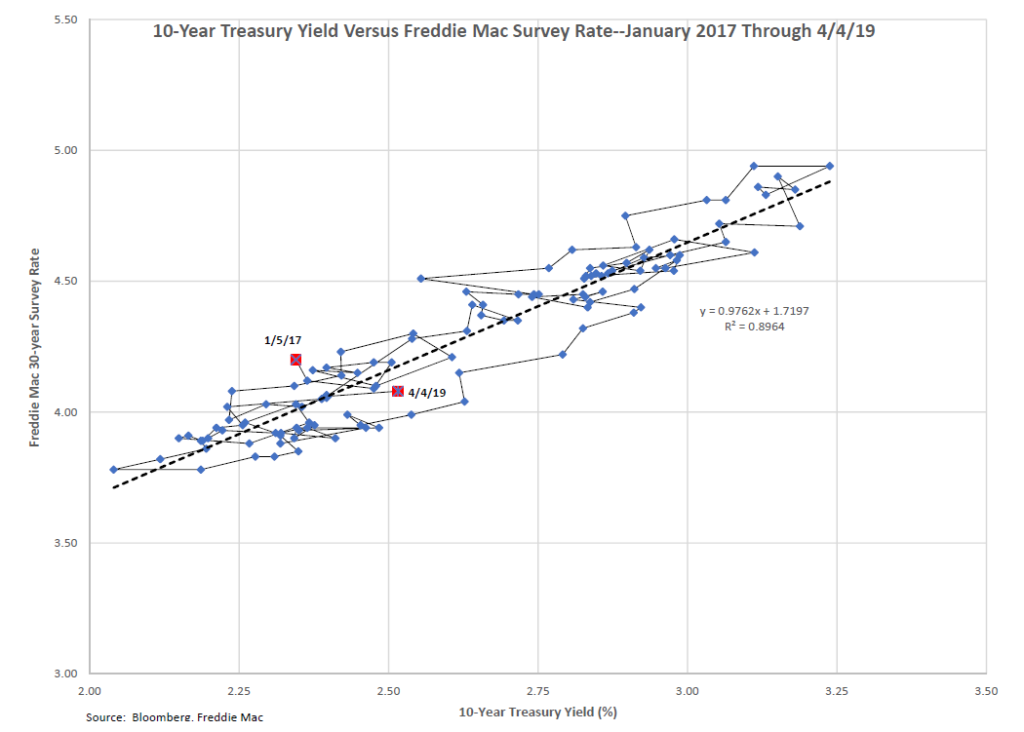

With the Freddie Mac survey rate printing at 4.08%, primary mortgage rates remain at their lowest level since January 2018. The last time the survey rate was in this area was the week of 1/18/18, when it reported at 4.04%. The accompanying chart, which shows the survey rate plotted versus the 10-year Treasury yield, indicates that mortgage rates are roughly in line with their level relative to Treasuries over the past 2+ years.

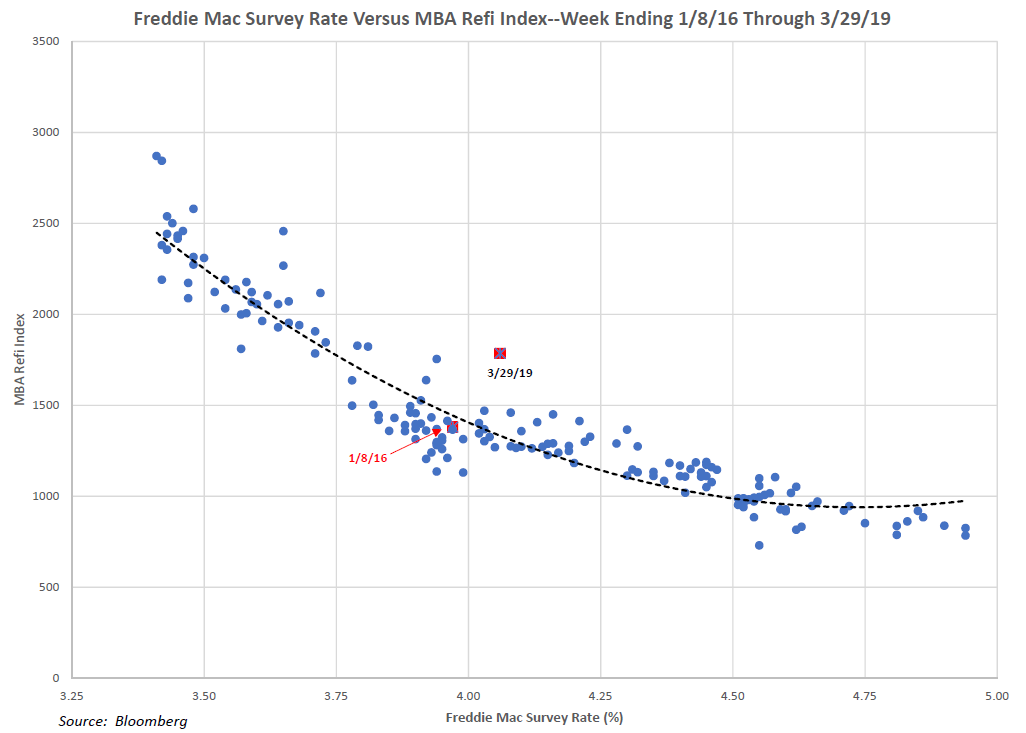

By contrast, last week’s MBA refi index was well in excess of expectations. The refi index reported at 1786, its highest level since November of 2016 and 53% higher than its average over the prior four weeks. While we expected refi activity to increase as mortgage rates approached 4%, last week’s refi index was well above the fitted value relative to the Freddie survey rate over the past 3+ years, as indicated in the chart below. (The regression implied a print of 1310, more than 25% below last week’s report.)

It’s unclear whether the spike in refi applications represented a short-term aberration resulting from the convergence of low rates and seasonal factors. Alternatively, it could indicate pent-up refi demand for refis stoked by 2 ½ years of high rates combined with gains in home prices, facilitating a surge in both rate-and-term and cash-out refinancings. A sustained increase in refi activity and overall applications, while welcome, will serve to dampen some of the enthusiasm for alternative mortgage sectors such as jumbo and non-QM lending.

About the Author: Bill Berliner

As Director of Analytics, Bill Berliner is tasked with developing new products and services, enhancing existing solutions, and helping to expand MCT’s footprint as the preeminent industry-leader in secondary marketing capabilities for lenders.

Mr. Berliner boasts more than 30 years of experience in a variety of areas within secondary marketing. He is a seasoned financial professional with extensive knowledge working with fixed income trading and structuring, research and analysis, risk management, and esoteric asset valuation.

Mr. Berliner has also written extensively on mortgages, MBS, and the capital markets. He is the co-author, with Frank Fabozzi and Anand Bhattacharya, of Mortgage-Backed Securities: Products, Structuring, and Analytical Techniques, which was named one of the top ten finance texts in 2007 by RiskBooks. He wrote and edited chapters for The Handbook of Mortgage-Backed Securities, The Handbook of Fixed-Income Securities, Securities Finance, and The Encyclopedia of Financial Models. In addition, Mr. Berliner co-authored papers published in The Journal of Structured Finance and American Securitization. He also wrote the monthly “In My View” column for Asset Securitization Report from 2008-2012.