Treasury yields moved in a narrow band last week, with intermediates maturities lagging both the short and long end of the curve. The reshuffling of the curve left the 2-5 spread inverted by less than a basis point, while the 2-10 year spread moved wider by roughly 4 basis points.

*The MBS Weekly Market Profile Report corresponds to the commentary below.*

The MBS market generally lagged Treasuries last week. The 30-year Fannie and Ginnie Mae current coupon spreads over interpolated Treasuries widened by about 7 basis points on the week, while the 15-year Fannie current coupon was about 3 wider versus the 5-year yield. Dollar rolls remain well-behaved, with only lower coupons (30-year 3s, 15-year 2.5s) rolling modestly special. The uptick in rates was accompanied by some expanding of coupon swaps, leaving for example the Fannie and Ginnie II 4/3.5 swaps wider by 7 and 8 ticks, respectively.

A brief examination of historical 10-year Treasury yields gives an interesting perspective on the market’s implicit outlook. The chart below shows that since bottoming out in late March, the yield on the 10-year note has drifted higher, although it remains basically in the middle of bands that delineate 2 standard deviations of price movements, using a 40-day lookback. (These are sometimes referenced as Bollinger bands and often used by technical analysts as a forecasting tool.)

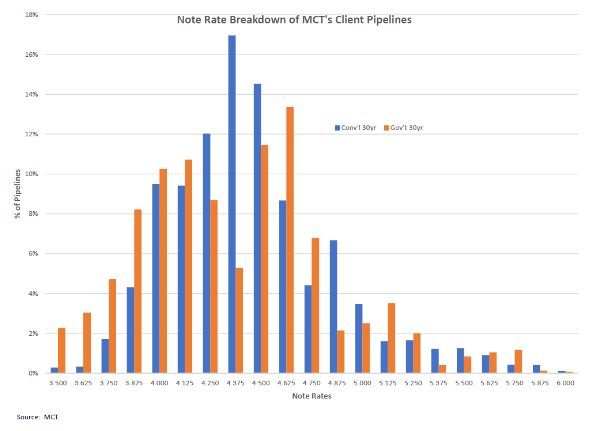

Client pipelines for 30-year conventional and government loans are displaying some interesting differences. The distribution of note rates (by balance) for 30-year conventional and government loans is shown in the chart below, and the different shape of the distributions is quite noticeable—while the note rates for conventional loans appear to be distributed normally (i.e., the “bell curve”), the government pipeline has large amounts of locks both above and below the central rates. (For example, while 6% of the locks by loan count in the 30-year conventional pipelines have rates below 4%, approximately 16% of conventional locks have similarly low rates.)

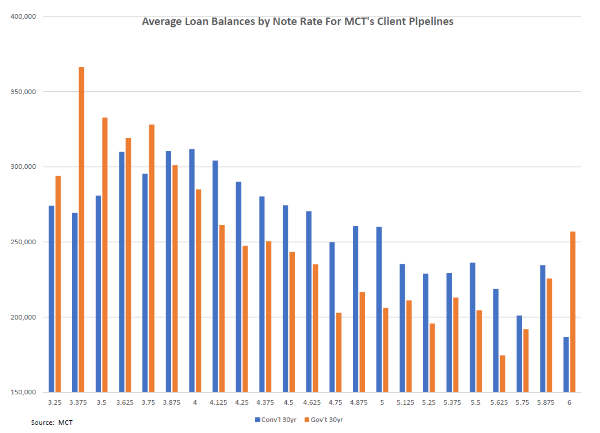

Loan balances for the two pipelines are also noticeably different and reflected in differences between the arithmetic mean rates and the weighted average rates for the two products. The weighted average rate for 30-year conventional and government rates is 4.48% and 4.36%, respectively, while the mean rates are 4.49% and 4.43%. The difference between the mean and weighted average rate in the government pipelines is, interestingly, attributable to a population of low-rate government loans with unusually large balances. The accompanying chart shows the average balance by note rate for the two products, and it indicates that the balances of government loans with note rates below 4% are noticeably larger than for conventional products.

It’s unclear why so many large low-rate government loans are being locked, but if it represents an industry trend it could impact coupon swaps and dollar rolls for lower-coupon Ginnie Maes.

About the Author: Bill Berliner

As Director of Analytics, Bill Berliner is tasked with developing new products and services, enhancing existing solutions, and helping to expand MCT’s footprint as the preeminent industry-leader in secondary marketing capabilities for lenders.

Mr. Berliner boasts more than 30 years of experience in a variety of areas within secondary marketing. He is a seasoned financial professional with extensive knowledge working with fixed income trading and structuring, research and analysis, risk management, and esoteric asset valuation.

Mr. Berliner has also written extensively on mortgages, MBS, and the capital markets. He is the co-author, with Frank Fabozzi and Anand Bhattacharya, of Mortgage-Backed Securities: Products, Structuring, and Analytical Techniques, which was named one of the top ten finance texts in 2007 by RiskBooks. He wrote and edited chapters for The Handbook of Mortgage-Backed Securities, The Handbook of Fixed-Income Securities, Securities Finance, and The Encyclopedia of Financial Models. In addition, Mr. Berliner co-authored papers published in The Journal of Structured Finance and American Securitization. He also wrote the monthly “In My View” column for Asset Securitization Report from 2008-2012.