Last week’s Federal Reserve Open Market Committee (OMC) meeting caused a huge shift in bond market sentiment, pushing Treasury note and bond yields sharply lower while leaving money market rates (i.e., maturities less than one year) virtually unchanged.

*The MBS Weekly Market Profile Report corresponds to the commentary below.*

While 2- and 10-year Treasury note yields declined by roughly 12 and 15 basis points last week, respectively, the yield on the 3-month Treasury bill actually ended the week a basis point higher. This led to a lot of hand-wringing in the financial press over the inverted Treasury yield curve and its history as a precursor to recessions, although the 2-10 spread (a different measure of yield curve slope) nonetheless ended the week at +12. The intermediate sector of the Treasury curve continues to perform well, led by the 5-year note; the 2-5 spread inverted by another 3 basis points to -7 bps, while the 2-5-10 butterfly moved further into negative territory at -27.

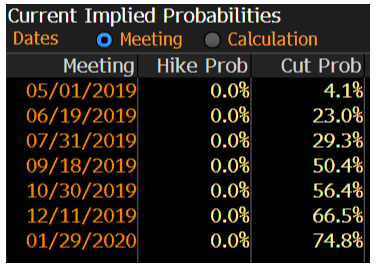

The poor relative performance of money-market rates likely reflected the market’s collective view that while the next Fed move is probably a cut in the funding target, it’s unlikely to happen soon. As shown below on Bloomberg’s World Interest Rate Probability (WIRP) screen, the Fed Funds futures market is currently indicating a 29% probability of a rate decrease by the 7/31 OMC meeting, but a 75% likelihood of an easing at the first meeting in 2020. (The probably of a rate cut at the 1/29/20 meeting was 10.2% on March 1st, which highlights the rapid evolution of market sentiment.)

Describing the weekly MBS performance is difficult, as the sharp rally led to a complete repricing of the various MBS coupons stacks. The spread of the 30-year Fannie current coupon rate over interpolated Treasuries narrowed by 7 basis points on the week, but this was distorted by the strong performance of Fannie 3s relative to other coupons. (The current coupon rate is essentially an interpolation of the rates for MBS coupons directly above and below parity.) As shown in the accompanying Market Profile, coupon swaps reflected the changing price relationships; the Fannie 3.5/3 swaps and 4/3.5 swaps narrowed by 10 and 9 ticks, respectively, while the 4.5/4 swap only tightened by 2/32s, suggesting that these two coupons are both viewed by traders as being deeply in-the-money. Ginnie II/Fannie swaps were mixed, with the GNII/FN 3 swap surprisingly narrowing by 4/32s while the G2/FN 3.5 swap improved by a tick.

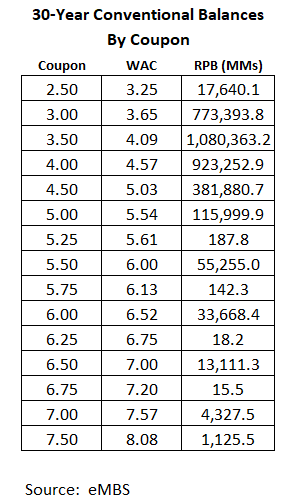

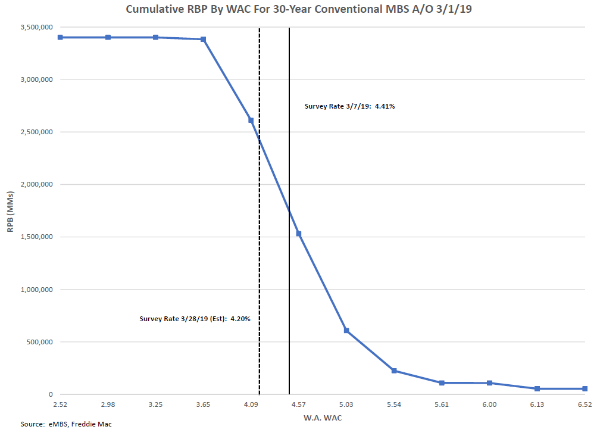

The question on all mortgage market participants’ minds is whether the decline in Treasury yields and mortgage rates will trigger a surge in refi volumes and relieve some of the competitive pressures in mortgage lending. While we continue to believe that it will take a sub-4% primary mortgage rate to kick off a full-fledged refi wave, the latest move (if sustained) should cause a material uptick in refinancing activity. A look at the current composition of the MBS market is instructive. The table below shows combined Fannie and Freddie 30-year remaining pool balances (RPBs) by coupon, along with balance-weighted (for Fannie and Freddie) WACs. It indicates that the two largest coupons outstanding are conventional 3.5%s and 4%s, with $1.08 trillion and $923 billion respectively outstanding. The chart below uses that data to illustrate the balances of loans that have refinancing incentives at different rate levels. It shows the coupon RPBs converted to cumulative balances and charted by WAC; for example, there is about $600 billion outstanding in 30-year conventionals with note rates of 5.03% or higher, but over $1.5 trillion in pools with rates equal to or greater than 4.57%.

The analysis suggests that the 20 basis point drop in 30-year rates this month (assuming current rates around 4.20%) created a refinancing incentive for roughly an additional $500 billion in loans, or about 15% of the market. While these numbers are approximations and don’t take account of loan age or borrower equity, they suggest that an uptick in refi applications should be experienced beginning in the next few weeks. It’s reasonable to believe that the MBA’s refi index should get back into the area of around 1500 from last week’s 1146 print, which would represent a 30% increase in refinancing application volumes.

About the Author: Bill Berliner

As Director of Analytics, Bill Berliner is tasked with developing new products and services, enhancing existing solutions, and helping to expand MCT’s footprint as the preeminent industry-leader in secondary marketing capabilities for lenders.

Mr. Berliner boasts more than 30 years of experience in a variety of areas within secondary marketing. He is a seasoned financial professional with extensive knowledge working with fixed income trading and structuring, research and analysis, risk management, and esoteric asset valuation.

Mr. Berliner has also written extensively on mortgages, MBS, and the capital markets. He is the co-author, with Frank Fabozzi and Anand Bhattacharya, of Mortgage-Backed Securities: Products, Structuring, and Analytical Techniques, which was named one of the top ten finance texts in 2007 by RiskBooks. He wrote and edited chapters for The Handbook of Mortgage-Backed Securities, The Handbook of Fixed-Income Securities, Securities Finance, and The Encyclopedia of Financial Models. In addition, Mr. Berliner co-authored papers published in The Journal of Structured Finance and American Securitization. He also wrote the monthly “In My View” column for Asset Securitization Report from 2008-2012.