The Treasury market was fairly quiet last week, with yields changing only modestly from the prior Friday. The 2-10 spread steepened by a couple of basis points to +16 bps, while the 2-5 year spread moved back into positive territory.

*The MBS Weekly Market Profile Report corresponds to the commentary below.*

MBS moved closely in line with Treasuries, leaving the 30-year Fannie current coupon spread unchanged over interpolated Treasuries. Coupon and product swaps were little changed, while dollar rolls shuffled a bit—the UM30 3.5 Jan/Feb roll moved into positive territory, if only by a quarter-tick. (The Dec/Jan roll remains negative by about a half-tick, primarily reflecting expected year-end funding pressures.) Trading volumes slowed dramatically; average trading volumes for the abbreviated week were $136 billion (including under $50 billion on Friday) compared to an average of $221 billion for the prior week.

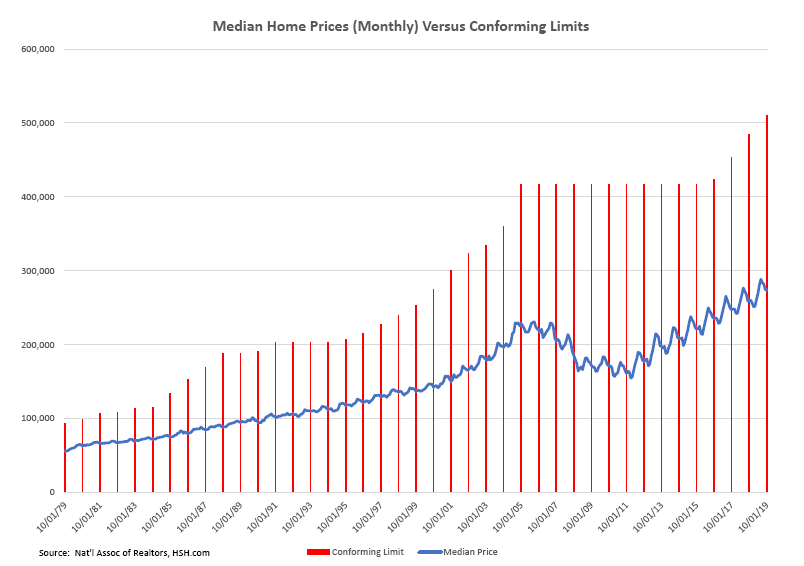

One notable development last week was the announcement of the new conforming limits for 2020. The single-family limit will increase by 5.3% to $510,400, while the jumbo-conforming limit (which represents the maximum loan value effective for high-cost areas) will jump to $765,600. Given their importance, the loan limit calculation is surprisingly simple, at least when home prices increase; the FHFA simply boosts the prior year’s limit (which was $484,350 for 2019) by the percentage change in the FHFA’s home price index.

The accompanying chart shows both the annual single-family limit and the monthly median home price (reported by the National Association of Realtors) since 1980.

The limit only decreased once (by $150 in 1990), while remaining unchanged at $203,150 from 1993-1995 and $417,000 from 2006-2016. Even though home prices declined almost 30% from their mid-2006 peak to their lows at the beginning of 2010, the limit stayed unchanged at $417,000 over that period (and well after prices began to recover); the consensus was that dropping the conforming limit during the recession would have further damaged the overall economy and exacerbated the pressure on home prices. However, the chart also indicates that since 1980 the increase in the conforming limit has outpaced the actual long-term appreciation in home prices. (The conforming limit represented 166% of the median home price in 1980, while it will be 188% of the limit for 2020.)

The increase in the jumbo-conforming limit is also noteworthy, as it breached the $750,000 mark for the first time. Increases to the jumbo-conforming limit and the growth of this sector of the market have several implications. For one thing, it suggests that the agencies will remain dominant in high-cost states such as California. In addition, annual increases of about 5.5% will leave the jumbo-conforming limit in excess of $1mm by 2025. We can expect that in addition to debating the corporate structure and government backing of the GSEs, the discussion will also address whether having government support for million-dollar mortgages makes sense from a policy standpoint.

About the Author: Bill Berliner

As Director of Analytics, Bill Berliner is tasked with developing new products and services, enhancing existing solutions, and helping to expand MCT’s footprint as the preeminent industry-leader in secondary marketing capabilities for lenders.

Mr. Berliner boasts more than 30 years of experience in a variety of areas within secondary marketing. He is a seasoned financial professional with extensive knowledge working with fixed income trading and structuring, research and analysis, risk management, and esoteric asset valuation.

Mr. Berliner has also written extensively on mortgages, MBS, and the capital markets. He is the co-author, with Frank Fabozzi and Anand Bhattacharya, of Mortgage-Backed Securities: Products, Structuring, and Analytical Techniques, which was named one of the top ten finance texts in 2007 by RiskBooks. He wrote and edited chapters for The Handbook of Mortgage-Backed Securities, The Handbook of Fixed-Income Securities, Securities Finance, and The Encyclopedia of Financial Models. In addition, Mr. Berliner co-authored papers published in The Journal of Structured Finance and American Securitization. He also wrote the monthly “In My View” column for Asset Securitization Report from 2008-2012.