Treasury yields moved lower last week, reflecting growing concerns over the economic outlook as well as equity market woes. The yield on the 10-year Treasury note declined by 15 basis points on the week, while the 2-10 Treasury spread widened by about 7 basis points to +12 bps. The rally in Treasuries was a bit aberrant compared to other sovereign debt, as yields for the major European countries, as well as Japan, were little changed on the week. The Fed Funds futures market currently projects around a 70% chance of an easing at the next Fed meeting on 10/30, up from less than a 50% market-implied probability at the end of September.

MBS continue to struggle in the current rate environment amid high dollar prices, elevated prepayment expectations, and (mostly) poor carry. The Fannie current coupon spread over interpolated Treasuries ended the week 3 basis points wider, its widest level in well over a year. Rolls for 30-year Fannie/UMBS continue to trade at less than 2/32s, with 3.5s and higher rolling at negative levels. However, a few coupons, such as GNII 2.5s and Dwarf 2s, are rolling more than 5/32nds special, reflecting their illiquidity. (The average daily volume for GNII 2.5s was $383 million last week, as compared to $8.3 billion for GNII 3s and $2.6 billion for Fannie/UM 2.5s.) Coupon swaps were under pressure last week, as the rally hurt the relative value of higher coupons. The Fannie and GNII 3.5/3 spreads tightened by around 8 and 12 ticks last week, respectively, although the GNII 4.5/4 swap appeared to expand last week by around 7/32s.

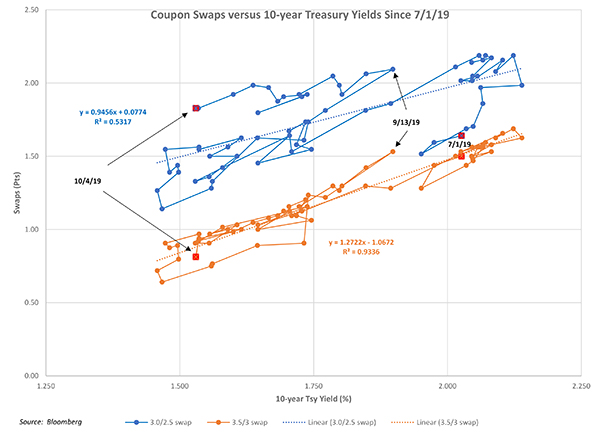

The relative value of 30-year 2.5s is an important consideration, given current rate levels and pooling economics. An interesting and useful exercise is to compare the recent behavior of the Fannie 3.5/3 swap with the 3/2.5 swap given 10-year Treasury yields, as a means of evaluating the recent price performance of Fannie 2.5s relative to higher-coupon Fannies. The scatterplot below shows both swaps on the vertical axis given yields on the 10-year note, as shown on the horizontal axis.

The chart indicates that the 3/2.5 swap has been much more volatile than the 3.5/3 swap over the period beginning on July 1st, and its statistical fit versus 10-year yields (as indicated by the R-square value) is considerably worse. In fact, it’s only since 9/13 that the 3/2.5 swap has exhibited a reasonably consistent price behavior vis a vis the 10-year yield. This arguably reflects the relative lack of an investor constituency for Fannie 2.5s relative to other coupons that are relatively far in-the-money but are more liquid and have a more established investor base. (As an example, the Fed only recently purchased a small amount of Fannie 2.5s, after not having purchased any 30-year 2.5%s since May of 2013.)

About the Author: Bill Berliner

As Director of Analytics, Bill Berliner is tasked with developing new products and services, enhancing existing solutions, and helping to expand MCT’s footprint as the preeminent industry-leader in secondary marketing capabilities for lenders.

Mr. Berliner boasts more than 30 years of experience in a variety of areas within secondary marketing. He is a seasoned financial professional with extensive knowledge working with fixed income trading and structuring, research and analysis, risk management, and esoteric asset valuation.

Mr. Berliner has also written extensively on mortgages, MBS, and the capital markets. He is the co-author, with Frank Fabozzi and Anand Bhattacharya, of Mortgage-Backed Securities: Products, Structuring, and Analytical Techniques, which was named one of the top ten finance texts in 2007 by RiskBooks. He wrote and edited chapters for The Handbook of Mortgage-Backed Securities, The Handbook of Fixed-Income Securities, Securities Finance, and The Encyclopedia of Financial Models. In addition, Mr. Berliner co-authored papers published in The Journal of Structured Finance and American Securitization. He also wrote the monthly “In My View” column for Asset Securitization Report from 2008-2012.