High Rates Leads to Recession Leads to Low Rates

As we said in our blog this week, there exist both fears of a recession that high rates could bring, and anticipation of the potential easing of interest rates that a recession would bring.

We are beginning to see the Fed’s policy moves take hold, with slowing productivity growth, marginal gains in labor force participation, and home builder sentiment continuing to drop as higher interest rate costs price out a large number of prospective buyers.

QE4 Impact on Homebuilding

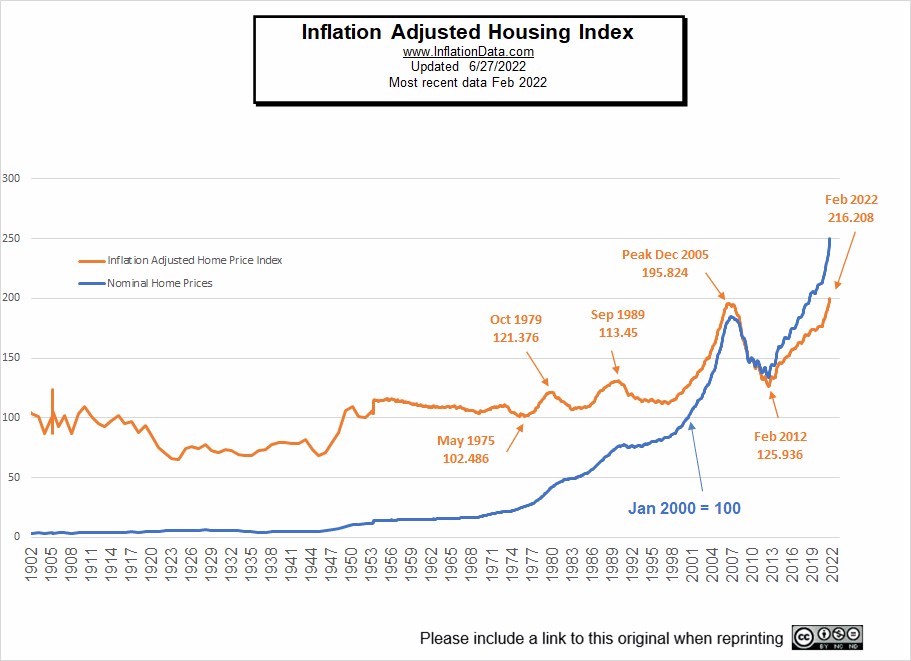

QE4 sent lending rates to record lows and mortgage bond issuance to record highs, but was bad for actual home building, a long running theme in the housing industry. QE eras are normally anathema for home construction. The last two years were a perfect storm of a flight to the suburbs during the pandemic and a shortage of homes for sale, combining to send home prices to record highs (home values rose 43% during QE4, per the S&P Index), but lack of affordability for buyers and supply chain problems have been challenges for home builders.

From 2010 until 2019, single-family home building sat at an annual rate of just 682,000 new units, the lowest decade since at least the 1950s, when the U.S. population was 60% smaller. Since the beginning of 2020, the run rate has increased to an annualized rate of 1.07 million units, equal to the annualized rate from 1960 until 2009. Estimates put the shortage of single-family homes in this country at between 3 and 4 million units, and the ratio of single family to multi-family home starts stands at 1.46, its lowest level in at least the last three decades.

It’s not just mortgage rates that continue to rise. Fears of a recession and an increase in defaults have pushed up the yields on credit risk transfer securities, insurance for MBS issued by Fannie and Freddie.

The lack of single-family construction comes as home affordability has fallen to its lowest level since 2006 and out of pocket costs have risen for would-be homeowners, in addition to higher rates driving up monthly payments. The median price of existing home sales is roughly $400,000 compared to $315,000 in January of 2021; so the necessary down payment has increased by over $21,000. It’s little surprise then that both new and existing home sales have fallen. New home sales are down 18% compared to the end of last year with existing home sales down 22% over the same time frame.

The lack of home starts should also help dampen supply into the mortgage bond market and push up prices, acting as a counter against rising rates. Gross issuance this year has been revised down from $2 trillion to $1.8 trillion and next year is forecast to come in around $1.2 trillion (net issuance is expected to fall to around $375 billion).

Refinance Incentive and Alternative Products

U.S. inflation will slow substantially over the next year, despite most forecasters being forced to keep raising their predictions in the near-term. As inflation slows and rates come back down, homeowners with larger loan sizes originated over the past couple of years will have refinance incentive and should react with gusto. The run up in home prices has led obviously to less rate-and-term refinances but also to less cash-out refinances as moving to a higher mortgage rate on a larger sized loan comes with greater pain than if one is in a smaller sized loan. Since QE4 kicked off in March 2020, the average loan sizes seen in a Fannie (+17%), Freddie (+30%), and Ginnie (+26%) pool have all increased substantially. The refinance incentive will be great when these high loan amount borrowers can move into a lower mortgage rate.

ARMs are increasingly attractive to homebuyers looking for the lowest monthly payment, but lenders often have a hard time including them on rate sheets due to scant market color (color is typically reported in Z-spread) and the inability to properly value them (prices are backed into approximations). Many originators may only be incorporating ARM pricing from a single source. Let us help you. White-label rate sheets can help to maximize your profits and achieve key operational efficiencies and not capitalize on decision lender solutions. If you already create a white-label rate sheet manually, MCT can help streamline the process and report on the results with our successful mortgage pricing engine. Contact us to learn more about this service.