The targeted killing of a key Iranian general put a stop to the bearish steepening that prevailed through much of December. Friday’s rally pushed the yield on the 10-year note to its lowest level in a month, closing at 1.78% after printing as high as 1.93% over the holiday period. The yield curve (i.e., 2-10s) ended the week about 3 basis points flatter at +26 after reaching as high as +34 on New Year’s Eve, its steepest level since the summer of 2018.

*The MBS Weekly Market Profile Report corresponds to the commentary below.*

While MBS had been performing well over the previous few weeks, Friday’s bond rally left the sector struggling relative to Treasuries. 30-year Fannies basically tracked their 10-year hedge ratios over the last 5 sessions after lagging by 5-6 ticks on Friday, duration-adjusted, while Ginnies had an even rougher time, with a cumulative 5-day performance 3-4 ticks behind 10s. The Fannie 30-year current coupon spread over interpolated Treasuries widened by about 2 basis points on the week, while 30-year Ginnies closed about 4 bps wider. Coupon swaps were mostly narrower, while Ginnie/UM30 spreads also contracted by as much as 4/32s. MBS dollar rolls remain fairly cheap, with only lower-coupon Ginnie IIs rolling special while fuller coupon UM30s and Ginnie IIs continue to roll at negative drops, reflecting their high dollar prices and fears of fast prepayment speeds.

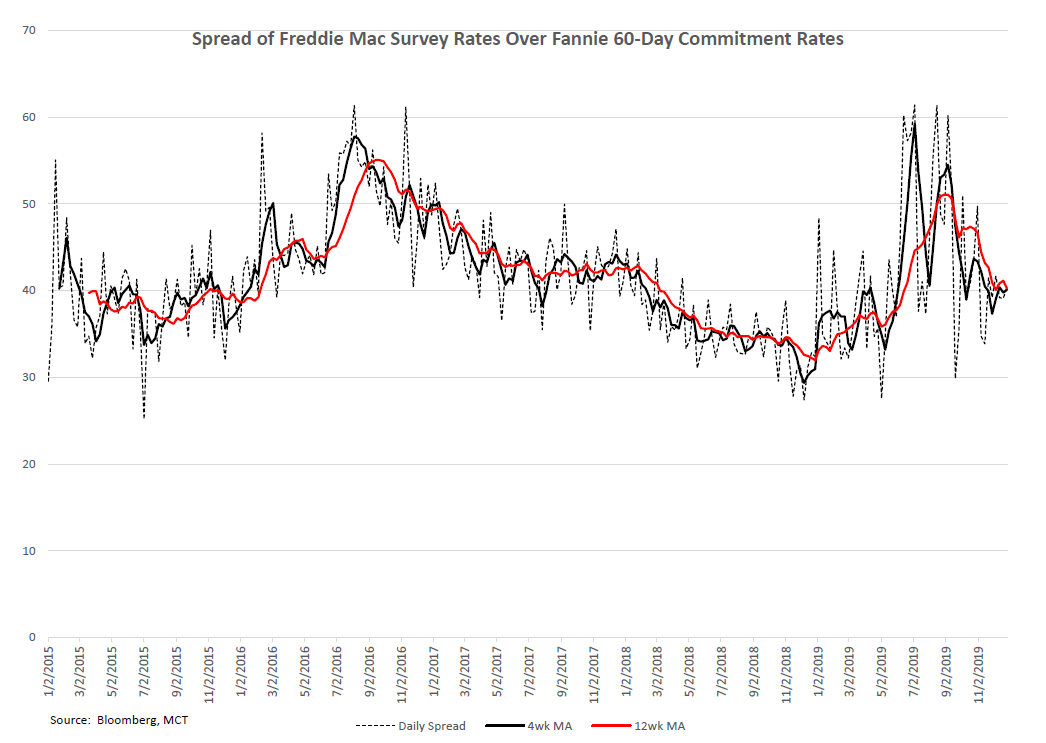

A review of recent data suggests that primary/secondary spreads, after widening in the first half of 2019, have trended tighter over the last few months. The accompanying chart indicates that the spread of the Freddie Mac Survey rate over the Fannie Mae 60-day commitment rate (a rough estimate of the “yield” on mortgage loans purchased by Fannie) has narrowed by roughly 10 basis points since peaking over the summer.

This spread is a reliable proxy for the profitability of mortgage lending, and its tightness for much of 2018 reflected the margin compression experienced by lenders over that period. While the current spread remains above its late-2018 lows, the recent tightening reflects increased competition resulting from the 25% decline in refinancing applications since their peak over the summer.

About the Author: Bill Berliner

As Director of Analytics, Bill Berliner is tasked with developing new products and services, enhancing existing solutions, and helping to expand MCT’s footprint as the preeminent industry-leader in secondary marketing capabilities for lenders.

Mr. Berliner boasts more than 30 years of experience in a variety of areas within secondary marketing. He is a seasoned financial professional with extensive knowledge working with fixed income trading and structuring, research and analysis, risk management, and esoteric asset valuation.

Mr. Berliner has also written extensively on mortgages, MBS, and the capital markets. He is the co-author, with Frank Fabozzi and Anand Bhattacharya, of Mortgage-Backed Securities: Products, Structuring, and Analytical Techniques, which was named one of the top ten finance texts in 2007 by RiskBooks. He wrote and edited chapters for The Handbook of Mortgage-Backed Securities, The Handbook of Fixed-Income Securities, Securities Finance, and The Encyclopedia of Financial Models. In addition, Mr. Berliner co-authored papers published in The Journal of Structured Finance and American Securitization. He also wrote the monthly “In My View” column for Asset Securitization Report from 2008-2012.