Treasury yields remain relatively unchanged despite minor fluctuations in both directions over the last two weeks. The Treasury yield curve steepened slightly with the 2-10 spread widening (by 4bps) to 0.54. The 10-year yield is currently 0.67%, and the 30-year is 1.42%. The 10-year TIPS yield is -0.98%, up 3bps due to CPI data showing an increase in consumer prices by 0.4%, versus the 0.3% forecasted.

Mortgage rates hit another all-time low in Freddie Mac’s Primary Mortgage Survey. Rates on 30-year fixed rate mortgages are down to 2.86%, 7bps down week over week, and 70bps lower than last year. New application activity continues to be driven by refinances, which jumped by 3%. A modest 0.2% increase was seen in purchases. Additionally, total applications are up 1.9% for the week ending 9/4, according to MBA’s Weekly Mortgage Applications Survey.

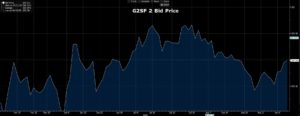

As interest rates continue to move toward record lows, the liquidity of low coupons in MBS trades remains a chief concern. On Friday, the Ginnie 2 coupon comprised a record 21% ($13 billion) of all Ginnie TBA trades. For reference, Fannie 2 coupon trades comprised 58% of all Fannie TBA trades, according to TRACE data provided by FINRA. The chart below, provided by Bloomberg, shows the Ginnie 2 coupon rally over the last few weeks.

By and large, 30-year UMBS moved in line with hedge ratios last week. The Fannie 3 and 3.5 coupon however, lagged the 10-year benchmark’s performance by 9 and 4 ticks, respectively. Lower Ginnie coupons outperformed the benchmark by 7- 8 ticks, while higher coupons Ginnies faired the same as Fannie 3 and 3.5 coupons. The 2 coupon had the strongest performance for Fannie 15-years, outperforming the 5-year benchmark by 2 ticks, while other 15-year coupons lagged the benchmark by 2-6 ticks. All in all, a better week for lower coupons, worse for higher.

In the week ahead, key reports will include July’s JOLT job openings, new inflation statistics, weekly jobless claim figures, and a highly anticipated Fed meeting on Wednesday. From the Fed meeting, investors will be looking to gain a more detailed commitment to keeping interest rates at the zero bound, as well as guidance on the stimulus policy going forward. The framework revisions provided by the Fed last month allow increased stimulus by allowing for periods of higher inflationary targets. However, if the Fed decides to use the increased capacity for stimulus to mitigate the risks of a slower recovery, the economic effects could be even less desirable in the long-term.