The US yield curve saw a sharp steepening after the Federal Reserve’s dovish statements from Jackson Hole. The plan, as described by Jerome Powell, Chairman of Federal Reserve, shifts the Fed’s focus away from a 2% inflationary target to concentrate on employment shortfalls in the US Labor Market. Implicitly, this move will allow the Fed to take any QE action necessary to support employment and potentially overshoot 2% inflation for periods of time. In short, close attention will be paid to labor statistics and upcoming reports such as the ADP National Employment Report, scheduled to release Wednesday, 9/2. Critics deem the Fed’s shift in policy incredibly dovish and believe the backstopping of companies through buying corporate bonds and other means only delays the inevitable. However, many investors have learned not to fight the Fed and stocks rose sharply as a result.

The US 30-year is currently yielding 1.52%, while the US 10-year’s yield is .74% – both reaching their highest yield since 6/17/20. The 10-year TIPS yield decreased to -1.03%, signaling that while long and intermediate-maturity yields increased in the bond market sell-off on Thursday, inflation continues to hamper real yields on most bonds.

Relative to Treasuries, duration-adjusted performance of mortgage-backed securities improved for 30 and 15-year Fannies last week. Fannie 30-year coupons outperformed the 10-year Treasury by 3-7 ticks on a cumulative 5-day basis. Fannie 15-year coupons improved by 5-9 ticks in their 5-day cumulative totals. Ginnies had a mixed 5-day cumulative performance as the 2s lagged 5 ticks, while performance of the rest of the Ginnie coupons tracked the benchmark or edged slightly above it.

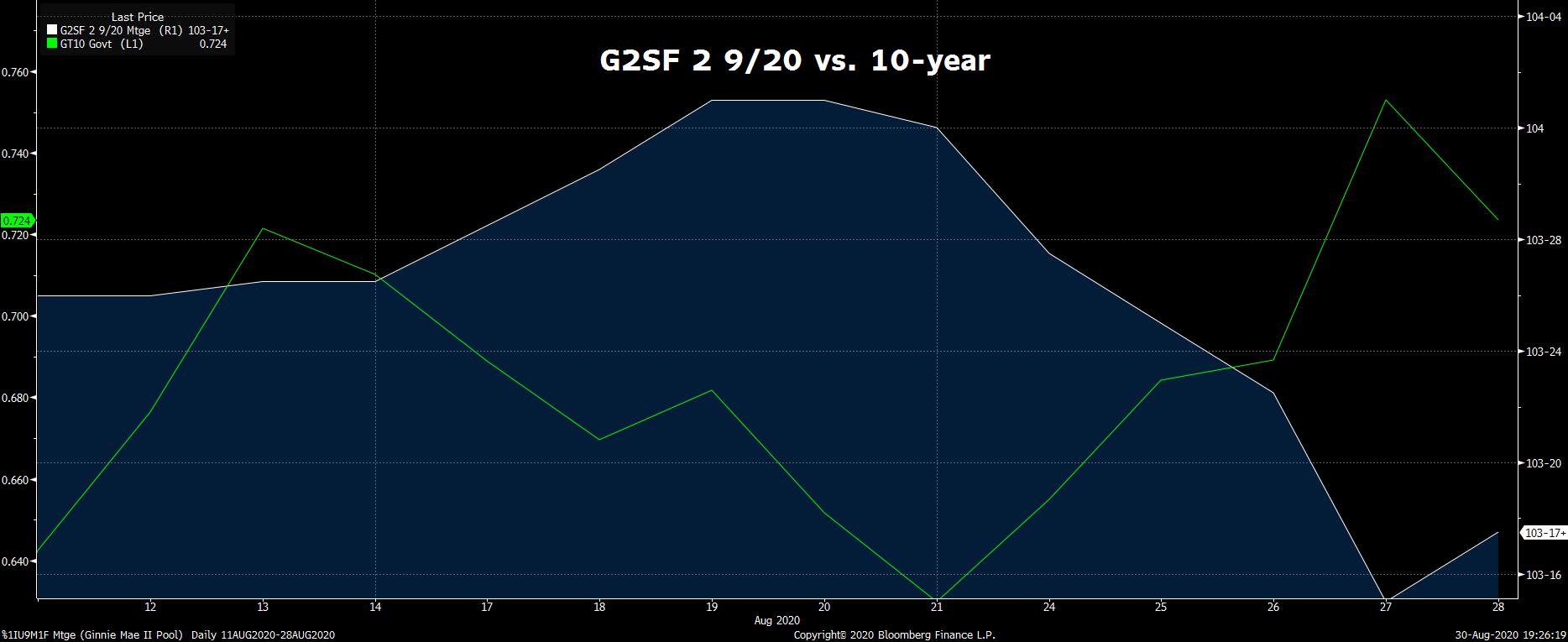

The graph below demonstrates the relationship between September Ginnie 2s and US 10-year. Liquidity in the Ginnie 2s continues to improve as 2s made up 18% of all Ginnie TBA trades on Friday.

For those unfamiliar with using duration-adjusted performance of MBS, duration-adjusted performance is used to calculate the move in MBS prices compared to an expected price change based on the security’s duration – relative to the benchmark duration. The calculation serves to provide a measurable comparison between the performance of an investment in MBS or Treasuries. If the performance of an MBS is said to “outperform” the Treasury benchmark when bonds have rallied, the price of the MBS rallied more than what was expected based on the hedge-ratio calculation of the previous day’s close and vice-versa.

According to MBA’s Weekly Mortgage Applications Survey for the week ending on 8/21, total applications fell by 7.2%. Refinance applications were hit the hardest with a 10.2% drop, while purchases fell only by 1.8%. This drop in refis was almost a certainty due to the 50bp refinance tax levied, then delayed to December 1st, by the FHFA. The FHFA’s second announcement this week extended the timeframe for Fannie and Freddie to buy loans in forbearance. They will now continue to buy loans in forbearance up until a September 30th deadline. The FHFA’s announcements were appreciated by the Mortgage Bankers Association, and they serve to delay an inevitable credit tightening during the current pandemic.