Mortgage Servicing Rights (MSR) Valuation & Hedging

Whether you are getting your agency approvals, selling through co-issue, or actively growing your portfolio, MCT® offers a suite of tools along with an experienced team to help you with all your mortgage servicing rights needs. Choose the combination of services to achieve your MSR risk management goals:

Watch the Video on MSR Services

Learn more by watching our video or click these links to read their section.

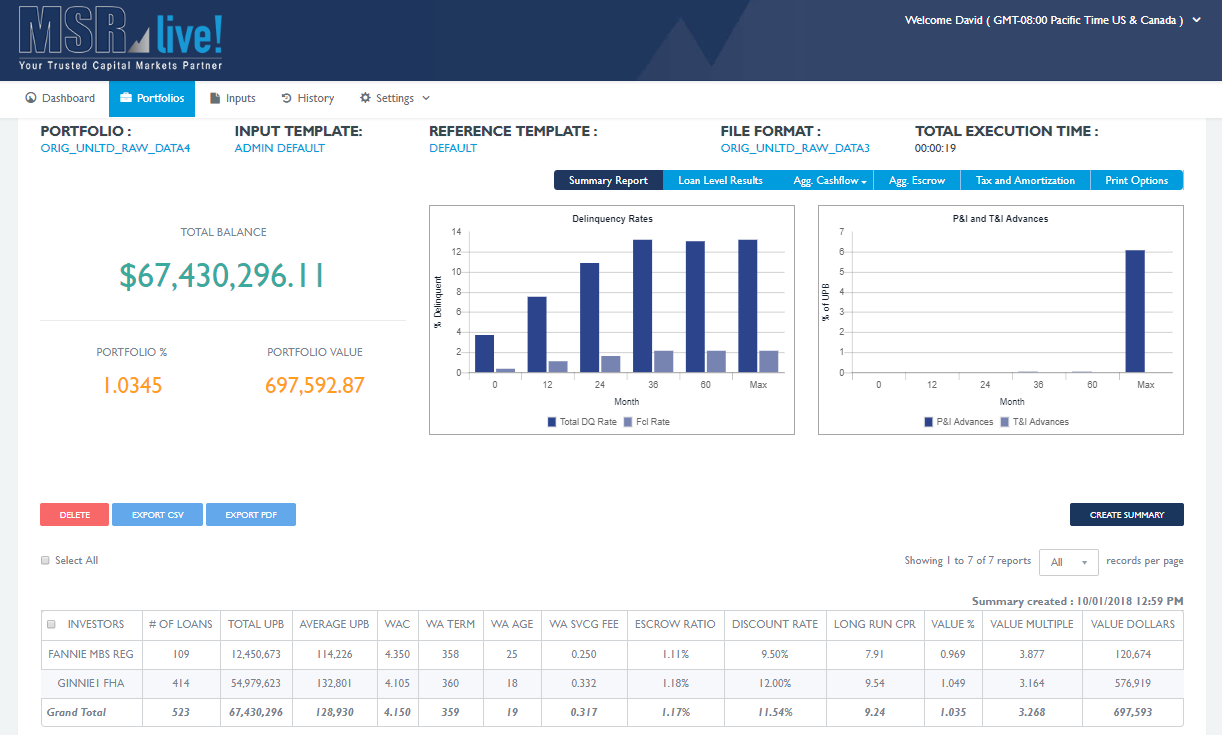

- MSRlive!™ is a new MSR portfolio valuation software tool that supports your efforts to manage your servicing portfolio.

- Portfolio Valuation Reports determine the value of your asset but also detail risk and exposure sensitivities.

- Enhanced Retain-Release Extension for MCT’s Best Execution Analysis aids in retain-release decisions.

- MSR Sales & Brokerage strategies include setup, assistance with trade decisions, and in-depth risk/return analysis.

- MSR Hedging helps protect your MSR portfolio against market change and risks.

- MSR Strategy Consulting is available for MSR Services clients along with a robust industry network.

- Custom MSR Grids let MCT calculate MSR values based on your costs and key assumptions.

Why Choose MCT for MSR Services?

We asked Bill Shirreffs why mortgage lenders should choose MCT for their MSR needs.

In this video, Mr. Shirreffs goes through key points about why MCT’s MSR team is the strongest choice and what clients have said about their MCT MSR experience.

Watch the video below to hear first hand what Mr. Shirreffs has to say about MCT’s MSR services.

MSRlive! – Mortgage Servicing Rights Valuation Software

Discover the robust valuation, analysis, and forecasting power of MSRlive!, our new cloud-based software for mortgage servicing rights valuation. With MSRlive!, users can value their portfolio at 30 loans per second. Users can also analyze the effect of predictive market scenarios on their portfolio using this MSR valuation model.

- Portfolio Valuations – Value and analyze your portfolio at 30 loans per second.

- Create Grid Pricing – Define your typical loans characteristics to generate a pricing grids in minutes.

- Run Rate Shock Analysis – View the effect of market changes on your portfolio with a range of +/- 200 basis points.

Mortgage Servicing Rights Portfolio Valuations

For those clients who do not desire the sophistication of our MSRlive! servicing model software but still need to determine the value of their MSR asset, MCT can provide timely portfolio valuation reports.

- Precise analysis and opinion of value

- Summary tables of major portfolio characteristics

- Sensitivity charts for key risk factors

- MCT offers monthly, quarterly or annual portfolio valuations.

Contact us today for more information on MSR valuations!

MCT’s MSR Services Team Now Facilitating Non-QM Loans

Non-QM loans have gained traction over the last year and continue to rise in popularity. One thing the MCT MSR team, and other secondary market professionals, recommends continuously is diversification of portfolios. Adding Non-QM loans to your portfolio can be the leverage you need to continue to excel in diversification and profitability.

As this product continues to gain traction in the market, portfolio managers will likely be uncertain about where to turn for valuations. MCT is an expert in this space and already serves a number of Non-QM Servicers.

Enhanced Retain-Release Extension for Best Ex. Analysis

- Are precisely calibrated to your internal costs and yield requirements.

- Adjust cash impact for MSR financing transactions.

- Adjust for the cash impact of a transaction by –

- Reflecting tax advantages of retention vs. release.

- Identifying breakeven point for cash for MSR transactions.

- Showing actual gain/loss in cash from different retention strategies or decisions about individual loans.

MSR Sales & Brokerage

The decision to sell your servicing asset involves many variables including market rates, liability, asset size, note rate and more. MCT’s MSR Team leverages technology and extensive Industry experience to simplify the Bulk MSR Sale activity. MCT will engage strategically to help you achieve your MSR Portfolio objectives as described in our webinar, Navigating the Waters of MSR Sales. MCT’s MSR division can help you:

- Getting Started: Learn how to review the MSRs in your portfolio to determine which loans will help you achieve your sales and portfolio goals.

-

Evaluate Bids: Discover how to evaluate the terms in the bids you receive. We will also discuss how characteristics affect pricing.

-

Negotiating Contracts: Learn how to review and negotiate the best terms for your servicing asset in order to accomplish your goals.

Contact us today for more information on MSR Sales and how MCT can help you get started!

Reduce Risk with MSR Hedging

MCT’s MSR Services division is highly experienced in mitigating the risk of an MSR asset. Our MSR whitepaper, Introduction to Hedging a MSR Portfolio | Servicing Insights Vol. 7, explains how our MSR team can help reduce the risk of your MSR asset.

This whitepaper by MCT discusses in the whitepaper how to mitigate risk of an MSR portfolio, myths surrounding msr hedging, and a tool for deciding if you should hedge your MSR portfolio.

View our whitepaper on MSR Hedging or Contact Us to learn how MCT can help.

MSR Strategy, Consulting, & Networking Services

Mortgage Service Rights (MSR) clients have access to one-on-one strategy consulting with MCT specialists and are offered a robust network of subservicers and MSR financing institutions.The MSR team can also help with any questions around mortgage servicing rights valuation.

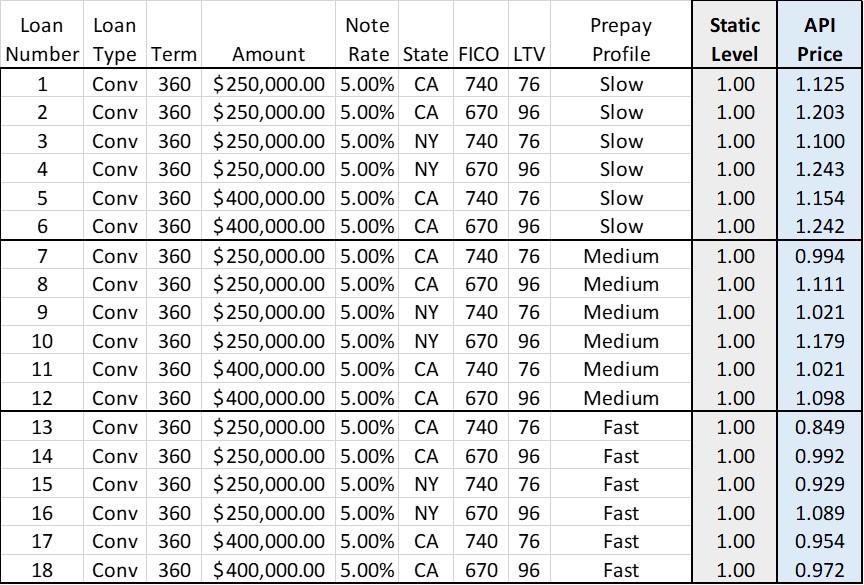

Loan-Level Characteristics Considered for Accurate MSR Pricing

With the new MSRlive! API, you can develop pricing that includes key loan-level characteristics such as location, FICO, loan-to-value (LTV), and more in real time. By factoring in these elements, there is an opportunity which allows avoiding overpaying for potentially underperforming assets.

Contact us today for more information on MSR Sales and how MCT can help you get started!

Sample Grid Level comparing static pricing vs. custom API

To illustrate the importance of loan-level characteristics in your pricing, consider the example above comprised of 18 loans with varying attributes. If a purchaser applied a four-to-one multiple to each loan, that would ultimately result in less than overall favorable returns.

With MSRlive! API, loan-level characteristics like location, FICO, LTV and prepay scenarios are factored in to produce granular pricing for each loan. By mathematically factoring in key characteristics, the MSR buyer ensures they’re not overpaying for these assets while improving the potential for favorable long-term-profitability. No more waiting days or weeks to get the data you’re looking for, MSRlive! API gets you more granular data in real time at your fingertips.

Consulting

- Consistent education and training on servicing values and principals

- Assistance with Agency Approvals

- Assistance identifying and evaluating sub-servicing options and strategy.

Networking

- Introduction to subservicers with special pricing and terms for MCT clients.

- Introduction to banks lending on Mortgage Servicing Rights assets.

MSR Services: Latest News & Educational Articles

Addition of internationally recognized model to MCT proprietary model enhances scenario testing, precision, and confidence for MSR managers.

In this webinar, MCT’s MSR experts, Bill Shirreffs, Azad Rafat, David Burruss, and Natalie Martinez will provide MSR insights, elaborate on their advantages and disadvantages, describe the difference between fair, market, and economic value, and give a current market update.

In this webinar, MQMR and MCT review operational and regulatory best practices, tips to avoid common MSR management mistakes, and current MSR pricing trends.

Getting Started

Request a quick introductory call to learn more about our MSR Services.

Schedule a Call

![MSR 101: Reviewing MSR Principles, Advantages & Disadvantages, & Key Portfolio Valuation Drivers [MCT Industry Webinar] MSR 101: Reviewing MSR Principles, Advantages & Disadvantages, & Key Portfolio Valuation Drivers [MCT Industry Webinar]](https://mct-trading.com/wp-content/uploads/2024/07/MSR-101-Webinar-300x169.png)