Mortgage Capital Markets Insights & News by MCT

Leverage secondary market strategies, daily market commentary, and mortgage indices from the MCT Learning Center to elevate your performance and your career.

Filter By Solution

Filter by Type

Filter by Topic

Filter by Learning Level

MCT and FICO expand integration of predictive FICO® Score 10T across MSR valuation, risk models, and investor pricing to enhance accuracy a (…)

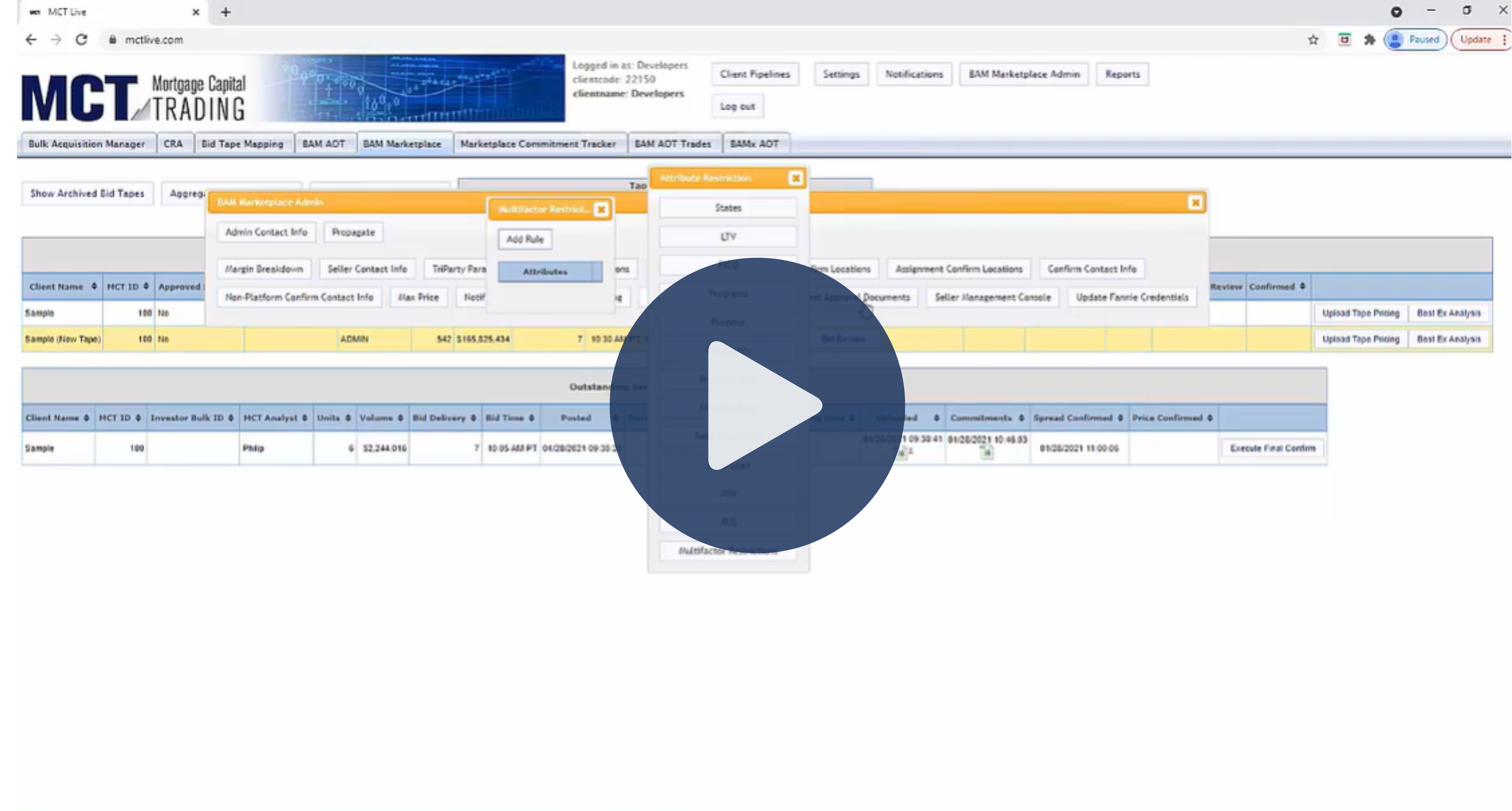

In this video, MCT’s Justin Grant, Senior Director, Head of Investor Services, discusses how to overcome what was historically a very high (…)

In this webinar, MCT’s Justin Grant, Head of Investor Services, will discuss MCT Marketplace, an open loan exchange software that optimize (…)

In this case study, Tom Bradley, Trader & Senior Correspondent Product & Pricing Analyst at Gateway Mortgage Group, LLC speaks to the benefi (…)

Watch the video to hear what MCT's Justin Grant, Senior Director, Head of Investor Services, has to say about MCT Marketplace.

In this blog, MCT’s Justin Grant, Senior Director, Head of Investor Services explains how AOT automation is paving the way for a new era o (…)

Mortgage Capital Trading, Inc. (MCT®), a leading mortgage hedge advisory and secondary marketing software firm, announced that it has autom (…)

MCT announced that Jennifer Kennelly has been appointed as the new Senior Director of MCT’s quickly expanding Investor Services team. Jenn (…)

In this blog, we will showcase how investors can utilize MCT Marketplace, to transform the traditional process of acquiring residential whol (…)

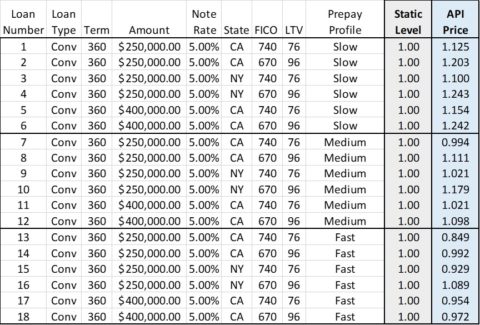

With the new MSRlive! API, you can develop pricing that includes key loan-level characteristics such as location, FICO, loan-to-value (LTV), (…)

Mortgage Capital Trading (MCT®), a leading mortgage hedge advisory and secondary marketing software firm, has announced today a new technol (…)

Buying in a rising rate environment can be difficult to maneuver, especially when volumes are declining and margins remain pressured. Strate (…)

Join the MCT Newsletter

Keep up with industry-changing innovations, MBS market movements, and growth opportunities that impact your mortgage capital markets operation.

Read Latest MCT Market Commentary

Take the Next Step for Your Company & Career

Find your secondary mortgage market growth stage and top educational content to take advantage of the next opportunity. Click on the related box for additional learning.

Semi-Autonomous Hedging & Loan Sales

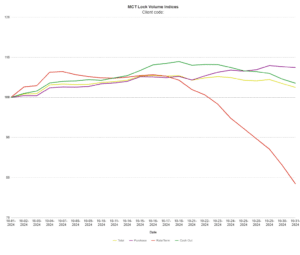

Track the Market with MCT’s Mortgage Lock Volume Index

As the leader in mortgage capital markets technology, MCT supports more lenders than any other single provider. This privileged position supports analysis of a meaningful population of data into macro insights. MCT’s mortgage lock volume indices are based on actual locked loans, not applications, and are therefore a more accurate indication compared to alternatives.