Buying whole loans in a rising rate environment can be difficult, especially when lender volumes are declining and margins remain pressured. Strategy is of the utmost importance, and ensuring you are leveraging the newest technologies available is key to bidding in a smart and efficient way so as to maximize your potential. In this post, we will review strategies for how investors can maximize their market share in a rising rate environment.

1) Focus on Technological Advancements

With the secondary marketing landscape changing rapidly, it is critical to stay at the forefront of innovation with your mandatory offering so as to not get left behind by others who are quickly adapting. This means utilizing quick or on demand bid turn times and granular pricing capabilities. MCT Marketplace brings to the table these key elements which make the bidding process with MCT streamlined, quick, and accurate to ensure you’re putting your best foot forward.

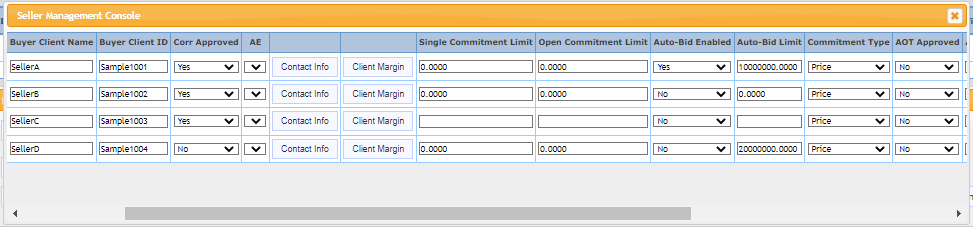

Seller Console in MCT Marketplace

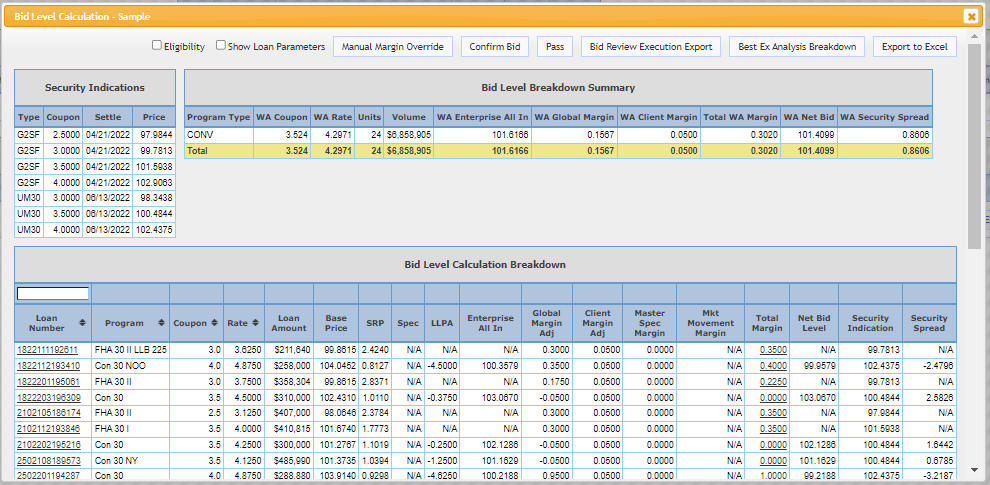

Streamlining this key part of the bidding process has never been easier than with MCT Marketplace. By using AutoBid technology, built into MCT Marketplace, pricing is as simple as a click of a button and can even be set up for automatic bidding. Time usually spent downloading and uploading files, normalizing and manually pricing tapes is eliminated, resulting in a faster and more accurate execution that ensures your bid won’t be late. This leaves more time for you to strategize and less time on monotonous details.

MCT Marketplace also offers buyers the industry’s most comprehensive suite of tools to generate bid pricing. Leverage the agencies cash window APIs to ensure real time, accurate pricing in combination with unlimited margin and restriction tools to produce your most granular price. With MCT Marketplace you can bid what you want, where you want.

2) Adding New Sellers

In a competitive market it can be tough to increase market share with your existing sellers, so another way to increase your volume is to add to the number of sellers you can bid on.

MCT Marketplace is the world’s first truly open loan exchange platform that allows buyers to transact with over 200 active sellers without an approval.

- 5 days on average to approve a new buyer or seller

- 7 billion dollars in committed volume since inception

- 205 active sellers on the MCT Marketplace platform currently

Bidding in MCT Marketplace is an efficient way to give your correspondent program exposure to these prospects and quickly identify those who would be a good match. Buyers can also load their application and points of contact in MCT Marketplace to facilitate an expedited process when interested sellers reach out.

“It has been instrumental in growing our correspondent base because MCT offers immediate exposure. If you don’t have a platform like MCT, your Account Executives are on the street requesting shadow bids, which our On Q account executives are rockstars at. But MCT Marketplace creates that exposure for you and helps facilitate a connection between the customer and on On Q sales person, so then instead of spending time up front asking for apps and requesting shadow bids, our Account Executives instead have the opportunity to spend that time having conversations – getting to know the customer’s pipeline, talking about color and building the relationship.”

3) Offer Alternative Execution Strategies

With pricing so competitive in today’s correspondent market, sellers are looking for other differentiating factors from prospective buyers. One of the ways buyers can stand out is to offer novel execution strategies that today’s sellers are adopting more and more. Two of the most common alternative forms of execution are the Bid-AOT and Security Spread commitments. Bid-AOT combines the best of both worlds of the bulk bid and assignment of trade transactions and allows buyers to get credit for the trade costs they are helping sellers to save. This means a stronger bid without having to lower your margins. The security spread commitment allows buyers and sellers without an approval in place to transact, resulting in shorter prospect times and faster approvals with new sellers.

With AutoBid in MCT Marketplace, both functionalities are fully integrated into the tools for buyers so you don’t have to do the hard work.

“Through our proprietary ‘security spread commitment’ methodology, MCT firmly holds its position as the gold standard in best execution and moves one step closer to the ultimate goal – when every loan can be priced by every investor.”

Learn More About MCT Marketplace

As the world’s largest and only loan exchange where unapproved counterparties can transact, MCT Marketplace has unlocked additional liquidity and created a turn-key, digital purchasing solution for secondary marketing participants. Especially invaluable during times of increased market volatility, MCT Marketplace is just one of the many tools that MCT offers in addition to support and a dedicated client services team.

As the world’s largest and only loan exchange where unapproved counterparties can transact, MCT Marketplace has unlocked additional liquidity and created a turn-key, digital purchasing solution for secondary marketing participants. Especially invaluable during times of increased market volatility, MCT Marketplace is just one of the many tools that MCT offers in addition to support and a dedicated client services team.

For more information on MCT Marketplace, and how it can help you grow your correspondent channel, please contact your MCT sales representative for a demo.