Mortgage Capital Markets Insights & News by MCT

Leverage secondary market strategies, daily market commentary, and mortgage indices from the MCT Learning Center to elevate your performance and your career.

Filter By Solution

Filter by Type

Filter by Topic

Filter by Learning Level

Discover how Vellum Mortgage leverages MCT's automated trading platform to scale volume, reduce risk, and operate efficiently with a lean se (…)

Learn how to respond to mortgage-backed securities market movement and how to protect margins during volatility using tools in MCTlive!

MCT helps Waterstone Mortgage scale efficiently with custom support, responsive service, and a true partnership tailored to their unique IMB (…)

Discover how MSRlive! 4.0’s enhanced reporting delivers deeper MSR insights with portfolio analysis, loan-level trends, valuation drivers (…)

In this webinar, MCT’s Justin Grant, Head of Investor Services, will discuss MCT Marketplace, an open loan exchange software that optimize (…)

Mortgage lenders using the comprehensive capital markets platform MCTlive! now have the ability to increase, review, and refine the granular (…)

In this case study, Tom Bradley, Trader & Senior Correspondent Product & Pricing Analyst at Gateway Mortgage Group, LLC speaks to the benefi (…)

Brian Gilpin, CFO and Head of Capital Markets at Embrace Home Loans, sits down to discuss his experience switching to MCT and the level of c (…)

In this video, Mr. Barnhill shows step by step how to utilize all the elements of the Base Rate Generator with a demo recording so you can r (…)

In this blog, MCT’s Justin Grant, Senior Director, Head of Investor Services explains how AOT automation is paving the way for a new era o (…)

The intricate world of mortgage pipeline hedging demands a nuanced understanding of key concepts such as duration, convexity, and the interp (…)

This whitepaper reviews the intricate world of margin management, a pivotal driver of success in the ever-transforming mortgage industry. Le (…)

Join the MCT Newsletter

Keep up with industry-changing innovations, MBS market movements, and growth opportunities that impact your mortgage capital markets operation.

Read Latest MCT Market Commentary

Take the Next Step for Your Company & Career

Find your secondary mortgage market growth stage and top educational content to take advantage of the next opportunity. Click on the related box for additional learning.

Semi-Autonomous Hedging & Loan Sales

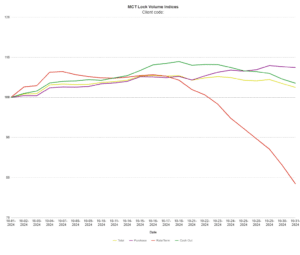

Track the Market with MCT’s Mortgage Lock Volume Index

As the leader in mortgage capital markets technology, MCT supports more lenders than any other single provider. This privileged position supports analysis of a meaningful population of data into macro insights. MCT’s mortgage lock volume indices are based on actual locked loans, not applications, and are therefore a more accurate indication compared to alternatives.