Mortgage Capital Markets Insights & News by MCT

Leverage secondary market strategies, daily market commentary, and mortgage indices from the MCT Learning Center to elevate your performance and your career.

Filter By Solution

Filter by Type

Filter by Topic

Filter by Learning Level

Learn the mortgage origination process, key loan and borrower characteristics, execution considerations, and the lasting impact of the GSEs (…)

Mandatory delivery in mortgage capital markets impacts pricing, risk, and profitability. Discover when to use it and how it can unlock great (…)

Learn how correspondent lending drives homeownership, why it’s key for market liquidity, and how mandatory loan sales can help corresponde (…)

Lincoln Federal achieved 99.9% accuracy despite 288% volume fluctuation, saving $12K annually with MCT’s full-service Lock Desk.

In this webinar, MCT will discuss how lenders are leveraging mandatory loan sale delivery to improve profitability and manage risk with pipe (…)

Last year’s regional banking crisis, pressure from the market downturn on mortgage originators, and recent events have all changed the war (…)

In this blog post, MCT experts delve into the nature of an AOT execution, the impact of bid tape AOT on TBA positions, how automation has im (…)

This whitepaper will review information on moving to mandatory loan sales through mortgage pipeline hedging, the strategy of hedging, the be (…)

In this whitepaper, we will explore the relationship between consumer loan pricing and capital market conditions to address common misconcep (…)

In this article, we examine the relationship between the 10-year U.S. Treasury yield and fixed mortgage rates.

Credit unions can leverage mandatory loan sale delivery to improve profitability and manage risk with pipeline hedging. This paper discusses (…)

In this case study, Mr. Collins describes how MCT’s BAM Marketplace enabled him to decrease his average approval times with buyers and ach (…)

Join the MCT Newsletter

Keep up with industry-changing innovations, MBS market movements, and growth opportunities that impact your mortgage capital markets operation.

Read Latest MCT Market Commentary

Take the Next Step for Your Company & Career

Find your secondary mortgage market growth stage and top educational content to take advantage of the next opportunity. Click on the related box for additional learning.

Semi-Autonomous Hedging & Loan Sales

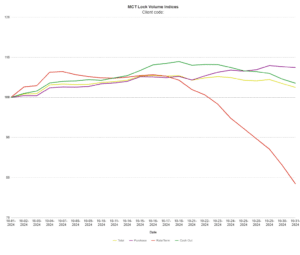

Track the Market with MCT’s Mortgage Lock Volume Index

As the leader in mortgage capital markets technology, MCT supports more lenders than any other single provider. This privileged position supports analysis of a meaningful population of data into macro insights. MCT’s mortgage lock volume indices are based on actual locked loans, not applications, and are therefore a more accurate indication compared to alternatives.