Mortgage Capital Markets Insights & News by MCT

Leverage secondary market strategies, daily market commentary, and mortgage indices from the MCT Learning Center to elevate your performance and your career.

Filter By Solution

Filter by Type

Filter by Topic

Filter by Learning Level

Learn the mortgage origination process, key loan and borrower characteristics, execution considerations, and the lasting impact of the GSEs (…)

Join MCT experts Phil Rasori, Chris Anderson, Andrew Rhodes, Paul Yarbrough, and Justin Grant, as they conduct a deep dive on navigating the (…)

Join this industry webinar to explore loan delivery methods, strategic execution, and how to maximize results using MCTlive!.

Learn how MCT is extending its legacy of innovation and technology stewardship by sharing its assessment of both the promise and the perils (…)

In this webinar, MCT’s Justin Grant, Head of Investor Services, will discuss MCT Marketplace, an open loan exchange software that optimize (…)

In this webinar, MCT’s David Burruss and Azad Rafat are joined by Lender Price’s Paul Orlando and David Colwell to discuss MSR strategie (…)

In this webinar, MCT's Ben Itkin is joined by Verity's CEO, Sam Mehta, to discuss how mortgage lenders can successfully optimize margins whi (…)

In this webinar, MCT’s MSR experts, Bill Shirreffs, Azad Rafat, David Burruss, and Natalie Martinez will provide MSR insights, elaborate o (…)

In this webinar featuring Fannie Mae’s Olga Gorodetsky alongside Phil Rasori and Paul Yarbrough of MCT, panelists discuss the goals, featu (…)

View the webinar recording featuring MCT's Phil Rasori, Chris Anderson, Rob Barnhill and Luke Chang on the latest developments in front-end (…)

In this webinar, MCT will review the current state of the MSR market and discuss more comprehensive retain vs. release strategies, in additi (…)

In this webinar, MCT will discuss how lenders are leveraging mandatory loan sale delivery to improve profitability and manage risk with pipe (…)

Join the MCT Newsletter

Keep up with industry-changing innovations, MBS market movements, and growth opportunities that impact your mortgage capital markets operation.

Read Latest MCT Market Commentary

Take the Next Step for Your Company & Career

Find your secondary mortgage market growth stage and top educational content to take advantage of the next opportunity. Click on the related box for additional learning.

Semi-Autonomous Hedging & Loan Sales

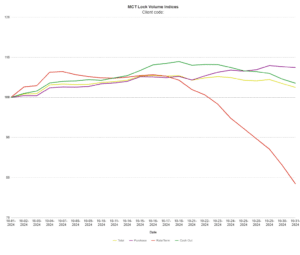

Track the Market with MCT’s Mortgage Lock Volume Index

As the leader in mortgage capital markets technology, MCT supports more lenders than any other single provider. This privileged position supports analysis of a meaningful population of data into macro insights. MCT’s mortgage lock volume indices are based on actual locked loans, not applications, and are therefore a more accurate indication compared to alternatives.