Mortgage Capital Markets Insights & News by MCT

Leverage secondary market strategies, daily market commentary, and mortgage indices from the MCT Learning Center to elevate your performance and your career.

Filter By Solution

Filter by Type

Filter by Topic

Filter by Learning Level

Watch how an expert MCT trader discusses the ease of onboarding to the platform, the quality of data, and our commitment to communication

Join this industry webinar to explore loan delivery methods, strategic execution, and how to maximize results using MCTlive!.

In this video, MCT’s Paul Yarbrough, Sr. Director, Head of Client Success Group and Jessica Visniskie, Sr. Capital Markets Technology Advisor, discuss how MCT’s Client (…)

MSR 101: Reviewing MSR Principles, Advantages & Disadvantages, & Key Portfolio Valuation Drivers (…)

In this webinar, MCT’s MSR experts, Bill Shirreffs, Azad Rafat, David Burruss, and Natalie Martinez will provide MSR insights, elaborate on their advantages and disadvantages, (…)

In this whitepaper, various hedging instruments will be explored, baseline inputs used in mortgage pipeline hedging will be examined, and recent industry advancements that have (…)

Read this blog to see why secondary market professionals continue to choose MCT for their MSR needs. Plus, view the interview with MCT's Bill Shirreffs.

In this blog post, MCT experts delve into the nature of an AOT execution, the impact of bid tape AOT on TBA positions, how automation (…)

This whitepaper reviews the intricate world of margin management, a pivotal driver of success in the ever-transforming mortgage industry. Learn how analyzing market share dynamics (…)

Through MCT’s software and services, Vellum Mortgage has improved profitability, efficiency, and added new investors. To accomplish this goal, they rely on BAM Marketplace, MCTlive!, (…)

This whitepaper outlines why having a Fannie Mae, Freddie Mac, or Ginnie Mae approval adds value to a mortgage company or depository and offers some (…)

In this case study, Ajay Timothy and Thia Kaleta of NBH Bank describe their process getting started with MCT and how they were able to (…)

This whitepaper will review information on moving to mandatory loan sales through mortgage pipeline hedging, the strategy of hedging, the benefits of hedging, and how (…)

Join the MCT Newsletter

Keep up with industry-changing innovations, MBS market movements, and growth opportunities that impact your mortgage capital markets operation.

Read Latest MCT Market Commentary

Take the Next Step for Your Company & Career

Find your secondary mortgage market growth stage and top educational content to take advantage of the next opportunity. Click on the related box for additional learning.

Semi-Autonomous Hedging & Loan Sales

Have a specific question?

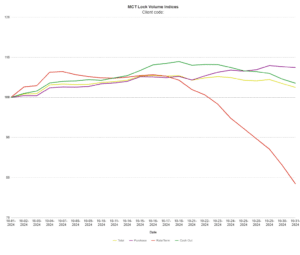

Track the Market with MCT’s Mortgage Lock Volume Index

As the leader in mortgage capital markets technology, MCT supports more lenders than any other single provider. This privileged position supports analysis of a meaningful population of data into macro insights. MCT’s mortgage lock volume indices are based on actual locked loans, not applications, and are therefore a more accurate indication compared to alternatives.