Mortgage Capital Markets Insights & News by MCT

Leverage secondary market strategies, daily market commentary, and mortgage indices from the MCT Learning Center to elevate your performance and your career.

Filter By Solution

Filter by Type

Filter by Topic

Filter by Learning Level

Master margin management with strategies to boost profitability, optimize pricing, and manage production volume for better results in any mo (…)

Join MCT experts Phil Rasori, Chris Anderson, Andrew Rhodes, Paul Yarbrough, and Justin Grant, as they conduct a deep dive on navigating the (…)

Brian Gilpin, CFO and Head of Capital Markets at Embrace Home Loans, sits down to discuss his experience switching to MCT and the level of c (…)

In this video, Mr. Barnhill shows step by step how to utilize all the elements of the Base Rate Generator with a demo recording so you can r (…)

Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, today announced the release o (…)

View the webinar recording featuring MCT's Phil Rasori, Chris Anderson, Rob Barnhill and Luke Chang on the latest developments in front-end (…)

This whitepaper reviews the intricate world of margin management, a pivotal driver of success in the ever-transforming mortgage industry. Le (…)

In this whitepaper, we will explore the relationship between consumer loan pricing and capital market conditions to address common misconcep (…)

In MCT’s latest Rasori’s Relentless Releases, we discuss new pricing granularity features in MCTlive!.

In this article, we will provide a detailed explanation for how mortgage prices are determined, reviewing all the factors that influence mor (…)

In this article, we will discuss the structure of the Federal Reserve, how the Federal reserve supports the economy, and how it influences t (…)

Lenders using MCT’s loan pipeline management software, MCTlive!, received bid tape pricing at the loan level on their open pipeline in yea (…)

Join the MCT Newsletter

Keep up with industry-changing innovations, MBS market movements, and growth opportunities that impact your mortgage capital markets operation.

Read Latest MCT Market Commentary

Take the Next Step for Your Company & Career

Find your secondary mortgage market growth stage and top educational content to take advantage of the next opportunity. Click on the related box for additional learning.

Semi-Autonomous Hedging & Loan Sales

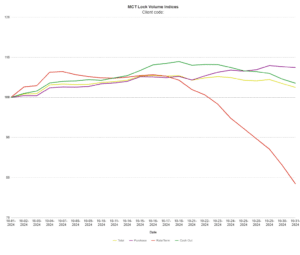

Track the Market with MCT’s Mortgage Lock Volume Index

As the leader in mortgage capital markets technology, MCT supports more lenders than any other single provider. This privileged position supports analysis of a meaningful population of data into macro insights. MCT’s mortgage lock volume indices are based on actual locked loans, not applications, and are therefore a more accurate indication compared to alternatives.