Mortgage Capital Markets Insights & News by MCT

Leverage secondary market strategies, daily market commentary, and mortgage indices from the MCT Learning Center to elevate your performance and your career.

Filter By Solution

Filter by Type

Filter by Topic

Filter by Learning Level

MCT unveils upgraded MBS Pool Optimizer using CUDA GPUs to deliver real-time, large-scale execution analysis and maximize profitability.

Learn best practices for pool optimization. Join MCT's experts as they explore spec pay-ups, prepayment behavior, pricing, and hedging strat (…)

Master margin management with strategies to boost profitability, optimize pricing, and manage production volume for better results in any mo (…)

Mandatory delivery in mortgage capital markets impacts pricing, risk, and profitability. Discover when to use it and how it can unlock great (…)

Unlock hidden revenue with smarter loan delivery. Discover how the right strategy can optimize operations, reduce risk, and boost margins.

MCT helps Waterstone Mortgage scale efficiently with custom support, responsive service, and a true partnership tailored to their unique IMB (…)

Learn how correspondent lending drives homeownership, why it’s key for market liquidity, and how mandatory loan sales can help corresponde (…)

MCT and Calyx launch enhanced, no-cost API integration to streamline data flow, empowering mortgage lenders with faster, more customizable c (…)

Join MCT experts Phil Rasori, Chris Anderson, Andrew Rhodes, Paul Yarbrough, and Justin Grant, as they conduct a deep dive on navigating the (…)

Join this industry webinar to explore loan delivery methods, strategic execution, and how to maximize results using MCTlive!.

Jointly developed Loan Pricing API delivers more granular, transparent pricing for mutual clients by combining various price factors and uti (…)

In this video, MCT’s Justin Grant, Senior Director, Head of Investor Services, discusses how to overcome what was historically a very high (…)

Join the MCT Newsletter

Keep up with industry-changing innovations, MBS market movements, and growth opportunities that impact your mortgage capital markets operation.

Read Latest MCT Market Commentary

Take the Next Step for Your Company & Career

Find your secondary mortgage market growth stage and top educational content to take advantage of the next opportunity. Click on the related box for additional learning.

Semi-Autonomous Hedging & Loan Sales

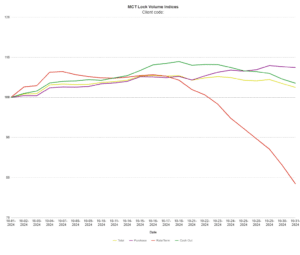

Track the Market with MCT’s Mortgage Lock Volume Index

As the leader in mortgage capital markets technology, MCT supports more lenders than any other single provider. This privileged position supports analysis of a meaningful population of data into macro insights. MCT’s mortgage lock volume indices are based on actual locked loans, not applications, and are therefore a more accurate indication compared to alternatives.