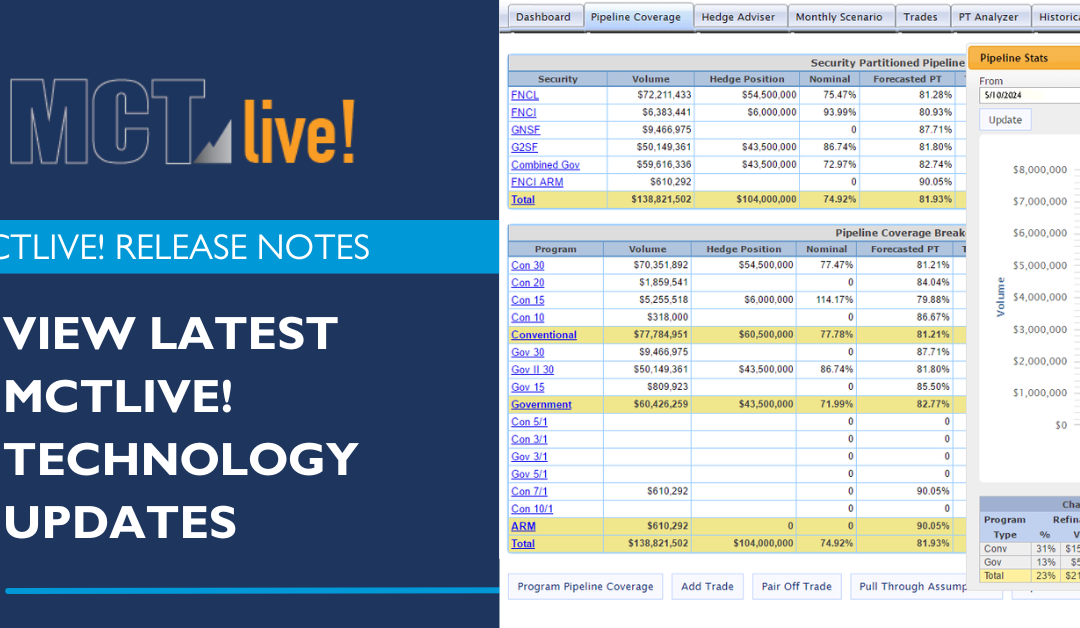

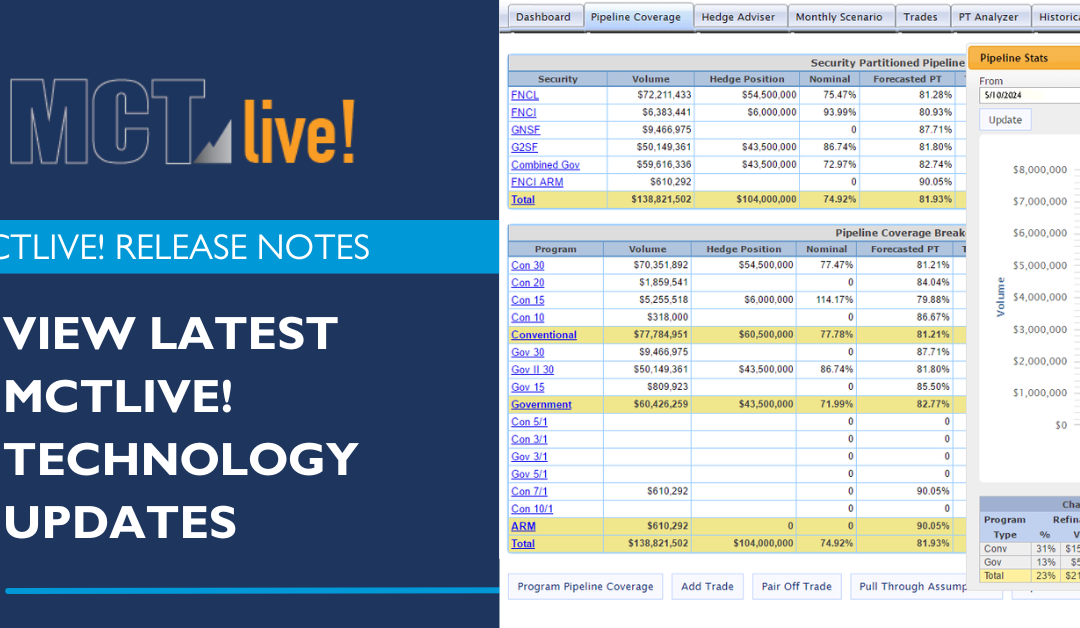

MCTlive! Quarterly Release Notes in Q3 2024

Described below within relevant tabs, you’ll find a listing of our Q3 2024 technology developments. This update also includes technology release notes for MCT’s MSRlive! and Business Intelligence tools.

Described below within relevant tabs, you’ll find a listing of our Q3 2024 technology developments. This update also includes technology release notes for MCT’s MSRlive! and Business Intelligence tools.

The Fed has finally cut the overnight rate by 50 basis points, a larger cut than what was anticipated. The mortgage market had already built in the rate cut in their offerings; Mortgage rates continued their downward trend during the month of September;

Click to read the most recent MSR Market Update! – Finally, inflation data signals that the Fed’s anticipated rate reduction action is coming very soon, and probably during their meeting in September. Mortgage rates have already dropped by about 48 basis points since July 31, 2024, and 65 basis points lower since the end of Q2. The industry has already experienced some robust refinancing activity since July 2024 which could continue as the market awaits the Fed’s announcement. The real estate industry is anticipating robust mortgage/housing activity once the Fed’s announcement becomes a reality.

We asked Natalie Martinez, MCT’s Manager of the MSR Services Department & Client Success, to sit down and provide insight into MCT’s enhanced retain-release analysis tool, Enhanced Best Execution (EBX). Watch the video below to see what Ms. Martinez has to say about EBX.

Watch the video to hear what MCT’s Justin Grant, Senior Director, Head of Investor Services, has to say about MCT Marketplace.