Scale Your Correspondent Market Share with MCT Marketplace

Watch the video to hear what MCT’s Justin Grant, Senior Director, Head of Investor Services, has to say about MCT Marketplace.

Watch the video to hear what MCT’s Justin Grant, Senior Director, Head of Investor Services, has to say about MCT Marketplace.

Click to read the most recent MSR Market Update! – The Fed’s recent announcement indicated no changes to the current Fed Funds rate, hence opening the possibility for a rate decline during their next meeting in September. It appears that the market has already built a 25 basis points decline in the mortgage offerings as we observe continuous easing in the 10 Year Treasury rate and the entire yield curve. As of July 31, 2024, the 30-year primary mortgage rate has retreated by 15 basis points while float income rates have declined by an average of about 45 basis points.

In this video, MCT’s Paul Yarbrough, Sr. Director, Head of Client Success Group and Jessica Visniskie, Sr. Capital Markets Technology Advisor, discuss how MCT’s Client Success Group goes above and beyond to create the most memorable and valuable experience possible for clients.

Click to read the most recent MSR Market Update! – Mortgage rates and other rate indices have managed to remain at relatively about the same level as they were at the closing in the month of May. Mortgage rates managed to end the month of June with a marginal increase of about three (3) basis points, while float income rates decreased by about eight (8) basis points during the same period. MSR portfolio holders should expect values to remain about the same level as they were at the end of May results. However, those levels could vary depending on portfolio vintages and other portfolio characteristics such as agency and GNMA mix. The downrate risk and its potential impact on MSR values continue to persist as we navigate through the balance of 2024.

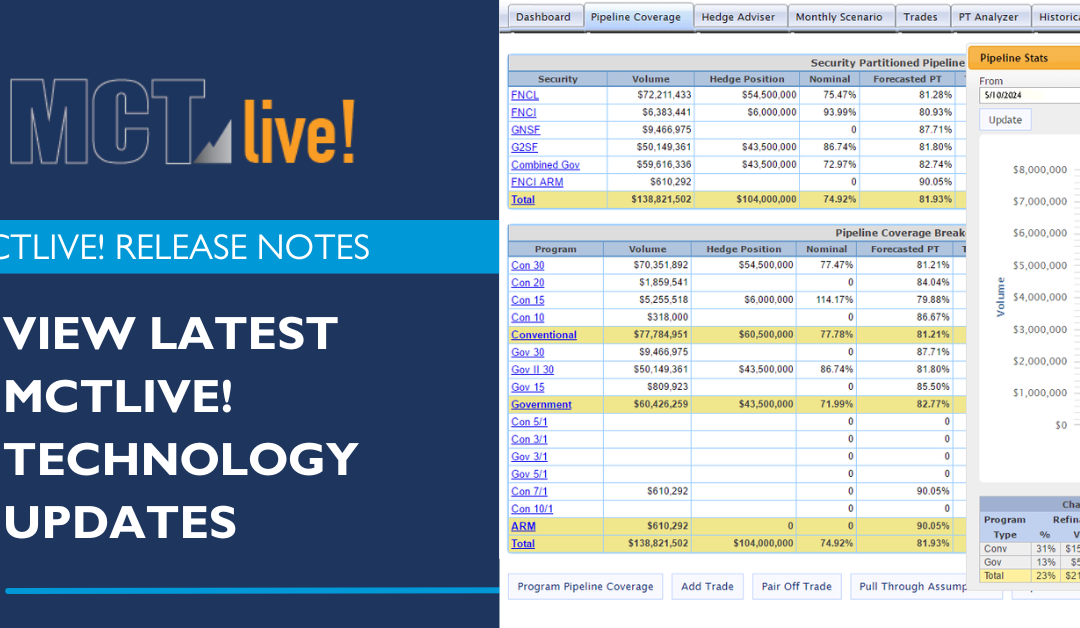

Welcome to MCT’s Quarterly Release Notes! Described within relevant tabs, you’ll find a listing of our Q2 2024 technology developments. This update also includes technology release notes for MCT’s MSRlive! and Business Intelligence tools. Improvements span general platform maintenance, feature and function enhancements, and entirely new development. Should you have questions or comments about our latest releases, please reach out to your MCT representative.