Full Service Hedging Success with MCT

Watch how an expert MCT trader discusses the ease of onboarding to the platform, the quality of data, and our commitment to communication

Watch how an expert MCT trader discusses the ease of onboarding to the platform, the quality of data, and our commitment to communication

![MCT’s Atlas AI Makes First Hedge Recommendation for Pike Creek Mortgage Services [VIDEO]](https://mct-trading.com/wp-content/uploads/2025/05/atlas-hedge-recommendation-1080x675.png)

Watch how Pike Creek Mortgage uses MCT’s generative AI, Atlas, to request and act on a live hedge recommendation in the MCTlive! platform.

Learn how correspondent lending drives homeownership, why it’s key for market liquidity, and how mandatory loan sales can help correspondent lenders scale.

Mortgage rates continued their moderate volatility during the month of April. MCT’s mortgage rates model reflected a slight increase in mortgage rates of about two (2) basis points, on average. Read the full release for the May 2025 MSR update.

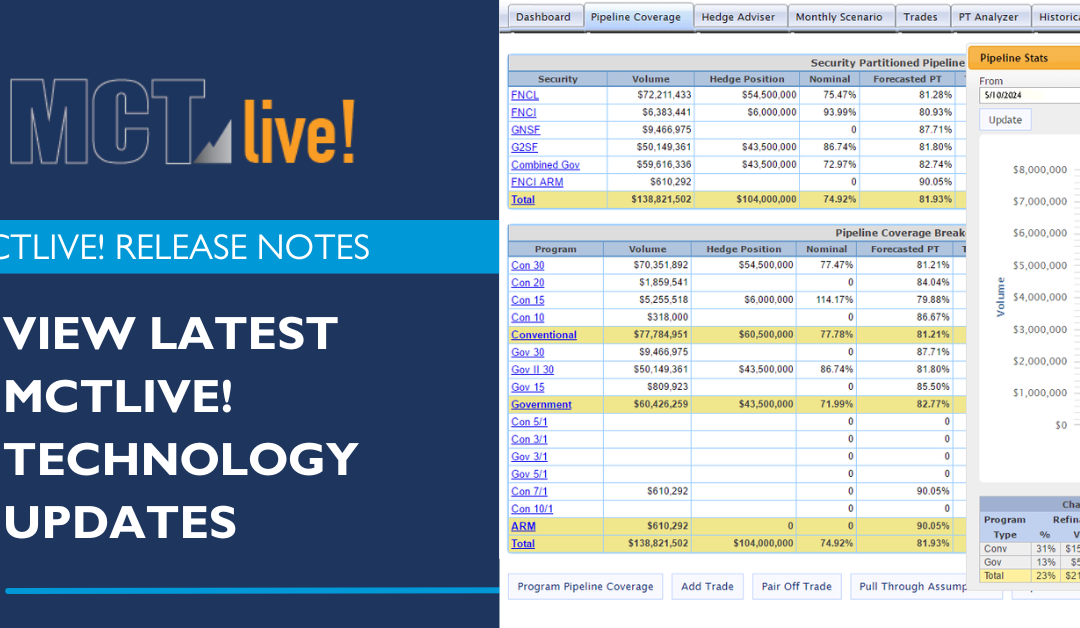

Described below within relevant tabs, you’ll find a listing of our Q1 2025 technology developments. This update also includes technology release notes for MCT’s MSRlive! and Business Intelligence tools.