Weekly Technology Improvement Series:

Data “Writeback” in MCTlive!

Published 9/24/2021

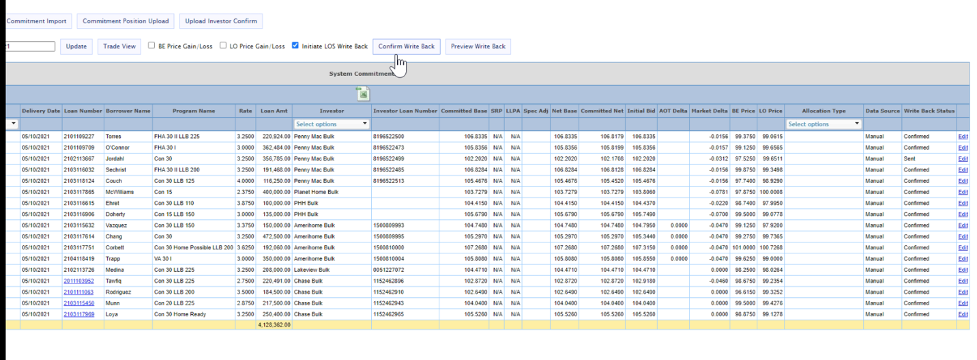

Looking to conduct your “write backs” from the MCTlive! platform?

Our Commitment Tracker Tab confirms come in via API or are uploaded by investors.

All that information is organized and displayed on a loan level in the commitment tracker.

You can initiate, preview, and confirm data write back to your LOS.

We conduct error checking to catch things such as duplicate sends or missing data to prevent mistakes.

Differentiators MCTlive! has that others may not include: populating custom fields, doing custom calculation and doing write backs at the loan-level rather than the trade-level.

In an effort to inform you of these real time enhancements this series will review the latest MCTlive! innovations and functionality updates. Join our newsletter to be updated on new releases.

This series focuses on technology updates to MCTlive!, MCT’s award-winning loan pipeline management software.

MCTlive! Features include:

- 100% Cloud-Hosted, Web-Based, Real-Time Functionality

- Multidimensional Pull-Through Analytics

- MCT Marketplace loan trading exchange

- Electronic TBA Trading

- Rapid Commit for Agency Delivery

View All Rasori’s Relentless Releases

MCT & Fannie Mae Webinar – Approvals, Integrations & Initiatives for 2022

In this webinar, MCT’s COO, Phil Rasori, will team up with Fannie Mae’s SVP and Head of Single-Family Products & Solutions, Steve Pawlowski, to discuss getting approved with Fannie Mae, moving from cash to MBS, API integrations and initiatives for 2022.

MCT & TMS Webinar | Successfully Growing Into a Mortgage Banker

Regardless of if you’re a broker looking to become a banker, a non-delegated lender looking to become fully delegated, or a small delegated lender looking to grow, we have helped others through those very processes, and can extend our experience and knowledge to your situation as well. Learn how to properly make the transition in this joint webinar from MCT and TMS.

Agile Pooling Functionality – Paul’s Tip of the Week

MCT is now the first company to be able to leverage the pooling functionality powered by Agile Trading Technologies. Agile, the new way to quote MBS, is bringing mortgage lenders and broker dealers on to a single electronic platform.

Top 5 Takeaways for Bulk MSR Market: Q4 2021

The economy continues to heal from the pandemic and MSR pricing has seen improvement as a result. Many servicers are still sitting on large portfolios as a result of MSR multiples/prices going to zero in early 2020, but the market is becoming ripe for MSR bulk sales and there is ample capital/liquidity from buyers ready to purchase. Continue reading below for our Top 5 Takeaways for the Bulk MSR Market.

San Diego Metro Magazine Honors Justin Grant with Top 40 Under 40 Award

SAN DIEGO, Calif., Oct. 19, 2021 – Mortgage Capital Trading, Inc. (MCT®) announced that its Director of Investor Services, Justin Grant, was named to San Diego Metro (SD Metro) Magazine’s prestigious Top 40 Under 40 list for 2021.

How to Internalize Your Best Execution Loan Sales

In this post, we’ll explain how mortgage lenders can leverage secondary market technology and expertise to internalize their best execution loan sale process.

MCT & Verity Webinar | Don’t Let Margin Compression Scare You

In this Halloween webinar, Chris Anderson is joined by Verity, Sam Mehta, to discusses labor optimization utilizing High Performance Activity (HPA) calculations, geographic workforce allocation, and utilizing technology for increased production.

MCT Deepens MSR Expertise with Hire of Azad Rafat

SAN DIEGO, CA, 10-08-2021 – MCT announced today that Azad Rafat has joined the company as the new Senior Director of MSR Services. Mr. Rafat will leverage his hands-on experience designing, building and managing mortgage servicing products to help MCT clients achieve their mortgage servicing goals.

MCT Webinar | Filling CRA Requirements with MCT Marketplace

In this webinar from October 12th, MCT staff review how you can leverage MCT’s new CRA sourcing functionality to identify and make offers on loans across the MCT client base to help meet your yearly CRA quotas.

Considerations for Internalizing Your Best Execution Loan Sales: Are You Ready?

In this post, we will explore the necessary considerations for lenders seeking to take ownership of their secondary market performance by internalizing their Best Execution Process (Best Ex).