Mortgage Capital Markets Insights & News by MCT

Leverage secondary market strategies, daily market commentary, and mortgage indices from the MCT Learning Center to elevate your performance and your career.

Filter By Solution

Filter by Type

Filter by Topic

Filter by Learning Level

After the latest Federal Reserve 25 basis points rate cut, the Fed appears divided over the frequency and amount of future rate cuts. Read t (…)

Mortgage rates initially moved lower immediately after the Federal Reserve October’s 25 basis points rate cut. However, mortgage rates hav (…)

The Federal Reserve lowered its benchmark interest rate by 0.25 percentage points in September. This was the first rate cut since December 2 (…)

All eyes are on the Fed upcoming meeting this month in anticipation of the highly anticipated rate reduction announcement. Read the full rel (…)

Mixed economic signals are causing many economists to remain cautious, even as U.S economic growth rebounded to 3.0 percent in Q2 after a Q1 (…)

The originations market struggled over the last few weeks while mortgage rates continued to hover around 7%, but now some relief is in sight (…)

Mortgage rates and most other rate indices have risen during the month of May. MCT’s mortgage rates model reflected an increase in rates o (…)

Mortgage rates continued their moderate volatility during the month of April. MCT’s mortgage rates model reflected a slight increase in mo (…)

On April 2nd, 2025, the President announced reciprocal tariffs on 186 countries ranging from 10% to 50%. Global equity and bond markets were (…)

Mortgage rates continued their downward trend during the second half of February. Freddie Mac’s weekly primary 30-year fixed rate closed t (…)

The Fed has decided not to cut the overnight rate in its recent FOMC meeting and has announced that it will pause further rate changes until (…)

The Fed has announced another 25 basis points reduction in the overnight rate after their December FOMC meeting. The reduction was in line w (…)

Join the MCT Newsletter

Keep up with industry-changing innovations, MBS market movements, and growth opportunities that impact your mortgage capital markets operation.

Read Latest MCT Market Commentary

Take the Next Step for Your Company & Career

Find your secondary mortgage market growth stage and top educational content to take advantage of the next opportunity. Click on the related box for additional learning.

Semi-Autonomous Hedging & Loan Sales

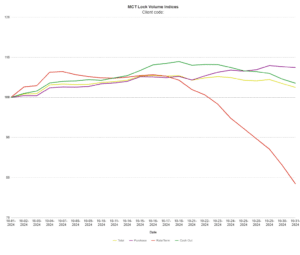

Track the Market with MCT’s Mortgage Lock Volume Index

As the leader in mortgage capital markets technology, MCT supports more lenders than any other single provider. This privileged position supports analysis of a meaningful population of data into macro insights. MCT’s mortgage lock volume indices are based on actual locked loans, not applications, and are therefore a more accurate indication compared to alternatives.