Mortgage Capital Markets Insights & News by MCT

Leverage secondary market strategies, daily market commentary, and mortgage indices from the MCT Learning Center to elevate your performance and your career.

Filter By Solution

Filter by Type

Filter by Topic

Filter by Learning Level

Unlock hidden revenue with smarter loan delivery. Discover how the right strategy can optimize operations, reduce risk, and boost margins.

Discover the fundamentals of Mortgage Servicing Rights, their benefits, risks, accounting methods, and key valuation drivers for long-term p (…)

In this whitepaper, various hedging instruments will be explored, baseline inputs used in mortgage pipeline hedging will be examined, and re (…)

The intricate world of mortgage pipeline hedging demands a nuanced understanding of key concepts such as duration, convexity, and the interp (…)

This whitepaper reviews the intricate world of margin management, a pivotal driver of success in the ever-transforming mortgage industry. Le (…)

Determining what execution is most efficient and profitable will have a big impact on the bottom line. This whitepaper reviews several key c (…)

This whitepaper outlines why having a Fannie Mae, Freddie Mac, or Ginnie Mae approval adds value to a mortgage company or depository and off (…)

This whitepaper will review information on moving to mandatory loan sales through mortgage pipeline hedging, the strategy of hedging, the be (…)

In this whitepaper, we’ll review the basics of co-issue transactions, how to get started and how to easily incorporate this strategy in yo (…)

Especially in volatile markets, it’s good to have a finger on your pipeline and trade frequently. Our latest whitepaper outlines ways to (…)

Despite the current environment, MCT® helped clients earn an extra $230,000,000 in Q1 2022, or $750,000 in additional profits per client on (…)

In this whitepaper, we will explore the relationship between consumer loan pricing and capital market conditions to address common misconcep (…)

Join the MCT Newsletter

Keep up with industry-changing innovations, MBS market movements, and growth opportunities that impact your mortgage capital markets operation.

Read Latest MCT Market Commentary

Take the Next Step for Your Company & Career

Find your secondary mortgage market growth stage and top educational content to take advantage of the next opportunity. Click on the related box for additional learning.

Semi-Autonomous Hedging & Loan Sales

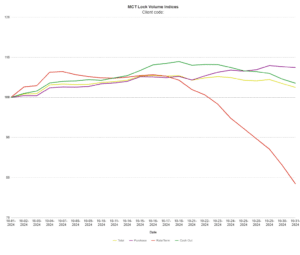

Track the Market with MCT’s Mortgage Lock Volume Index

As the leader in mortgage capital markets technology, MCT supports more lenders than any other single provider. This privileged position supports analysis of a meaningful population of data into macro insights. MCT’s mortgage lock volume indices are based on actual locked loans, not applications, and are therefore a more accurate indication compared to alternatives.