Mortgage Capital Markets Insights & News by MCT

Leverage secondary market strategies, daily market commentary, and mortgage indices from the MCT Learning Center to elevate your performance and your career.

Filter By Solution

Filter by Type

Filter by Topic

Filter by Learning Level

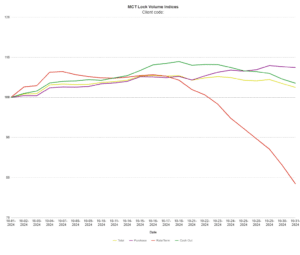

Lock volume fell 4% MoM on seasonal trends, while YoY gains persisted as markets await jobs data to guide rates and Fed policy into 2026.

After the latest Federal Reserve 25 basis points rate cut, the Fed appears divided over the frequency and amount of future rate cuts. Read t (…)

MCT and FICO expand integration of predictive FICO® Score 10T across MSR valuation, risk models, and investor pricing to enhance accuracy a (…)

MCT appoints Rick Chakra as Director of AI Solutions to accelerate agentic workflows, boost internal efficiency, and advance next-gen innova (…)

Mortgage rates initially moved lower immediately after the Federal Reserve October’s 25 basis points rate cut. However, mortgage rates hav (…)

MCT’s November Indices show mortgage pricing dip after Powell’s comments, steady October lock activity, and signs of rate stabilization (…)

Learn the mortgage origination process, key loan and borrower characteristics, execution considerations, and the lasting impact of the GSEs (…)

The Federal Reserve lowered its benchmark interest rate by 0.25 percentage points in September. This was the first rate cut since December 2 (…)

Master margin management with strategies to boost profitability, optimize pricing, and manage production volume for better results in any mo (…)

MCT’s Enhanced-Best-Execution (EBX) tool is the most comprehensive tool on the market for helping secondary market (MSR portfolio) manager (…)

Rate/term refinances surged 183% as borrowers capitalized on lower rates, with MCT advising lenders to stay disciplined amid a data blackout (…)

Mandatory delivery in mortgage capital markets impacts pricing, risk, and profitability. Discover when to use it and how it can unlock great (…)

Join the MCT Newsletter

Keep up with industry-changing innovations, MBS market movements, and growth opportunities that impact your mortgage capital markets operation.

Read Latest MCT Market Commentary

Take the Next Step for Your Company & Career

Find your secondary mortgage market growth stage and top educational content to take advantage of the next opportunity. Click on the related box for additional learning.

Semi-Autonomous Hedging & Loan Sales

Track the Market with MCT’s Mortgage Lock Volume Index

As the leader in mortgage capital markets technology, MCT supports more lenders than any other single provider. This privileged position supports analysis of a meaningful population of data into macro insights. MCT’s mortgage lock volume indices are based on actual locked loans, not applications, and are therefore a more accurate indication compared to alternatives.