Mortgage Capital Markets Insights & News by MCT

Leverage secondary market strategies, daily market commentary, and mortgage indices from the MCT Learning Center to elevate your performance and your career.

Filter By Solution

Filter by Type

Filter by Topic

Filter by Learning Level

MCT unveils upgraded MBS Pool Optimizer using CUDA GPUs to deliver real-time, large-scale execution analysis and maximize profitability.

Learn best practices for pool optimization. Join MCT's experts as they explore spec pay-ups, prepayment behavior, pricing, and hedging strat (…)

The average 30-year primary mortgage rate is currently at slightly above 6%. Just one year ago, the rate averaged about 6.86%. Mortgage rate (…)

January mortgage lock volume rebounded 8.7% after a weak December, showing fragile consumer sentiment and refinance activity lifted by modes (…)

MCT wins HousingWire’s 2026 Tech100 Award for AI-powered capital markets innovation, honored for Atlas AI driving secure, real-time hedge (…)

Learn how trending credit scores like FICO® Score 10 T impact mortgage capital markets in this MCT & FICO webinar on March 10 at 11AM PT.

Even though the Federal Reserve cut interest rates by 25 basis points in December, the third time since September 2025, consumer confidence (…)

This live session provides an inside look at the Q4 2025 MCTlive! technology/platform releases, featuring new capabilities designed to impro (…)

Steeper-than-expected December mortgage lock volume drop as seasonality, shutdown uncertainty, and stubborn rates keep borrowers cautious.

Lock volume fell 4% MoM on seasonal trends, while YoY gains persisted as markets await jobs data to guide rates and Fed policy into 2026.

After the latest Federal Reserve 25 basis points rate cut, the Fed appears divided over the frequency and amount of future rate cuts. Read t (…)

MCT and FICO expand integration of predictive FICO® Score 10T across MSR valuation, risk models, and investor pricing to enhance accuracy a (…)

Join the MCT Newsletter

Keep up with industry-changing innovations, MBS market movements, and growth opportunities that impact your mortgage capital markets operation.

Read Latest MCT Market Commentary

Take the Next Step for Your Company & Career

Find your secondary mortgage market growth stage and top educational content to take advantage of the next opportunity. Click on the related box for additional learning.

Semi-Autonomous Hedging & Loan Sales

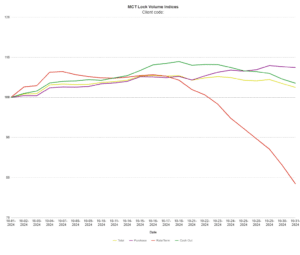

Track the Market with MCT’s Mortgage Lock Volume Index

As the leader in mortgage capital markets technology, MCT supports more lenders than any other single provider. This privileged position supports analysis of a meaningful population of data into macro insights. MCT’s mortgage lock volume indices are based on actual locked loans, not applications, and are therefore a more accurate indication compared to alternatives.