Mortgage Capital Markets Insights & News by MCT

Leverage secondary market strategies, daily market commentary, and mortgage indices from the MCT Learning Center to elevate your performance and your career.

Filter By Solution

Filter by Type

Filter by Topic

Filter by Learning Level

Join the MCT Newsletter

Keep up with industry-changing innovations, MBS market movements, and growth opportunities that impact your mortgage capital markets operation.

Read Latest MCT Market Commentary

Take the Next Step for Your Company & Career

Find your secondary mortgage market growth stage and top educational content to take advantage of the next opportunity. Click on the related box for additional learning.

Semi-Autonomous Hedging & Loan Sales

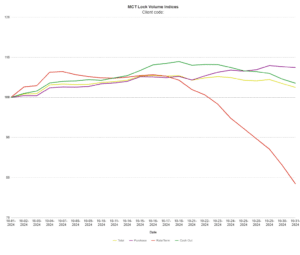

Track the Market with MCT’s Mortgage Lock Volume Index

As the leader in mortgage capital markets technology, MCT supports more lenders than any other single provider. This privileged position supports analysis of a meaningful population of data into macro insights. MCT’s mortgage lock volume indices are based on actual locked loans, not applications, and are therefore a more accurate indication compared to alternatives.