Mortgage Capital Markets Insights & News by MCT

Leverage secondary market strategies, daily market commentary, and mortgage indices from the MCT Learning Center to elevate your performance and your career.

Filter By Solution

Filter by Type

Filter by Topic

Filter by Learning Level

After the latest Federal Reserve 25 basis points rate cut, the Fed appears divided over the frequency and amount of future rate cuts. Read t (…)

MCT and FICO expand integration of predictive FICO® Score 10T across MSR valuation, risk models, and investor pricing to enhance accuracy a (…)

Mortgage rates initially moved lower immediately after the Federal Reserve October’s 25 basis points rate cut. However, mortgage rates hav (…)

The Federal Reserve lowered its benchmark interest rate by 0.25 percentage points in September. This was the first rate cut since December 2 (…)

MCT’s Enhanced-Best-Execution (EBX) tool is the most comprehensive tool on the market for helping secondary market (MSR portfolio) manager (…)

All eyes are on the Fed upcoming meeting this month in anticipation of the highly anticipated rate reduction announcement. Read the full rel (…)

NOLA Lending Group relies on MCT’s hedging, loan sale execution, MSR services, and overall client experience to drive performance.

Mixed economic signals are causing many economists to remain cautious, even as U.S economic growth rebounded to 3.0 percent in Q2 after a Q1 (…)

The originations market struggled over the last few weeks while mortgage rates continued to hover around 7%, but now some relief is in sight (…)

Discover how Mortgage Equity Partners improved execution and scaled efficiently through their partnership with MCT’s secondary marketing p (…)

Mortgage rates and most other rate indices have risen during the month of May. MCT’s mortgage rates model reflected an increase in rates o (…)

Mortgage rates continued their moderate volatility during the month of April. MCT’s mortgage rates model reflected a slight increase in mo (…)

Join the MCT Newsletter

Keep up with industry-changing innovations, MBS market movements, and growth opportunities that impact your mortgage capital markets operation.

Read Latest MCT Market Commentary

Take the Next Step for Your Company & Career

Find your secondary mortgage market growth stage and top educational content to take advantage of the next opportunity. Click on the related box for additional learning.

Semi-Autonomous Hedging & Loan Sales

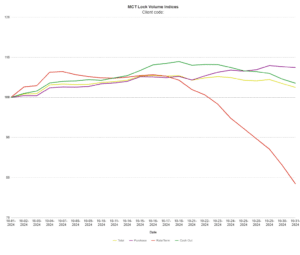

Track the Market with MCT’s Mortgage Lock Volume Index

As the leader in mortgage capital markets technology, MCT supports more lenders than any other single provider. This privileged position supports analysis of a meaningful population of data into macro insights. MCT’s mortgage lock volume indices are based on actual locked loans, not applications, and are therefore a more accurate indication compared to alternatives.