In the secondary market, a comprehensive best execution analysis will have a larger effect on profitability than any other single action. The goal is for mortgage lenders (known as “sellers” in this article) to get the best price for the loans they sell to investors.

Whether you are selling on a Best Efforts or Mandatory basis, you will need a best execution analysis to determine the outlet and method of delivery that will yield the highest net economic benefit for any given loan collateral.

In this article, we’ll explain the key concepts related to best execution analysis and discuss how sellers in the secondary mortgage market achieve the best price for their loans when selling them to agencies or aggregators. A lender who is knowledgeable about the pricing differences between delivery methods, investor differences, and subsequent Mortgage Servicing Right (MSR) retain-release decisions will be most successful in making common sense best execution decisions to achieve their individual business goals. This article is an adaptation of Chapter 4 of the Mortgage Professionals Handbook Volume 3 titled “Best Execution” by MCT’s COO, Phil Rasori.

Table of Contents – Best Execution Analysis in Secondary Mortgage Market

- What is Best Execution Analysis in the Secondary Mortgage Market?

- Why Does Mandatory Delivery Have Better Profits Than Best Efforts?

- Comparing Best Efforts and Mandatory Delivery Committments

- Methods of Execution Explained

- The Role of Investors in the Secondary Market

- Selling Loans to a Government Agency

- Selling Loans to an Aggregator

- Performing a Best Execution Analysis

- Avoiding Common Mistakes

Read on to learn all the key concepts that make up a best execution analysis.

What is Best Execution Analysis in the Secondary Mortgage Market?

Best execution, as it pertains to the secondary mortgage market, is just what it sounds like; it is the “best,” or most lucrative, price you can get for an “execution,” or sale, of your loan collateral. While everyone in the secondary mortgage market knows what Best Execution IS and what it DOES, few know all of the factors that contribute to arriving at the final numbers presented by a so-called “Best Ex” analysis. There are so many outlets of execution available to each seller with all the variables of pricing that it’s hard to imagine how sellers made Best Execution decisions before a Best Execution and loan pipeline management software like MCTlive! existed. It would have been extremely challenging to do the manual calculations and many sellers were likely fatigued by over choice and uncertainty.

Today, Best Execution analysis happens at the click of a button. However, the most competitive sellers are those who fully understand components of Best Execution to help them avoid common mistakes and to give themselves the critical thinking tools to be confident in their choices. A Best Execution analysis takes into account two main differentiators in pricing, 5 different methods of execution, and contrasting MSR retain-release decisions. In the next sections, we’ll explain the individual concepts that will help you understand how to achieve a Best Execution Analysis.

Automate Your Best Execution Analysis with MCTlive!

Built specifically for Secondary Marketing by secondary marketing professionals, MCTlive! is the most powerful platform available for day-to-day loan pipeline management, trade positions management, and loan sale best execution.

Built specifically for Secondary Marketing by secondary marketing professionals, MCTlive! is the most powerful platform available for day-to-day loan pipeline management, trade positions management, and loan sale best execution.

Many of the complex yet repetitive tasks required of secondary marketing have been automated within MCTlive!, freeing your time and resources for other high-value functions.

Learn more about MCTlive!

Why does Mandatory Delivery have better profits than Best Efforts?

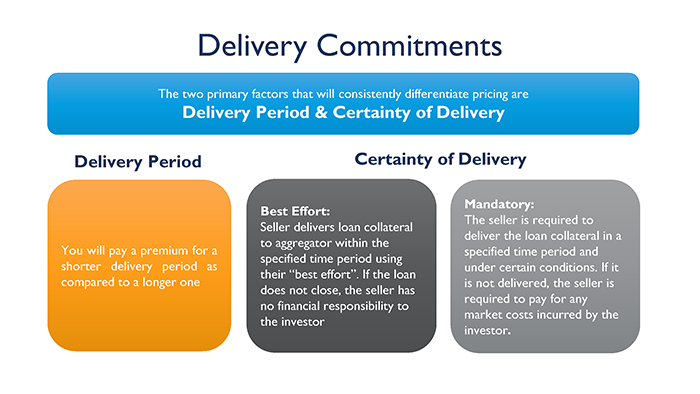

The two primary factors that will consistently differentiate pricing in Best Execution are delivery period and certainty of delivery. In other words, a longer delivery period and a greater amount of certainty that the seller will deliver the loan is correlated to a better loan price. Due to it’s longer delivery period and greater certainty of delivery, Mandatory Execution is more profitable compared to Best Execution.

Comparing Best Efforts and Mandatory Delivery Commitments

The pricing differences between Best Efforts and Mandatory execution mortgage loan delivery methods are due to the differences between who assumes risk if the loan does not fund, how long that it takes for the seller to deliver the mortgage loan to the buyer (AKA Delivery period), and whether the seller is certain they will deliver the asset in a specified time period (AKA Certainty of Delivery).

- Best Efforts: Sellers often pay a premium for a shorter delivery period. Best efforts does not require the seller to take on any risk if the mortgage loan does not go to funding. The seller says they will “do their best” to follow through on the commitment to sell to the purchaser, but there’s no guarantee that the transaction will go through to funding. As a result, the buyer agrees to purchase the Best Efforts loan at a certain price.

- Mandatory: Sellers are often paid a premium for a longer delivery time when delivery. In this scenario, the seller is certain they will deliver the asset in a specified time period and the seller assumes the risk of market movements to hold the mortgage loan from lock to funding. Therefore, buyers are willing to pay more for the product.

When comparing Best Efforts and Mandatory it’s important to remember that the entity most willing to take on the risk is the one that will be able to reap greater profits in a mortgage loan sale transaction. Although there is more risk in delivering mandatory, a seller will generally achieve a higher net execution by hedging their own production and delivering mandatory. With higher gains comes higher risks as well.

The other benefit to executing on a Mandatory basis is that the selection of possible executions expands when you have a longer delivery period. You can wait for the Best price and look at all your options, including Best Efforts pricing. That’s when Best Execution Analysis is most useful. In the next sections we will explain further why companies delivering on a mandatory basis will have a greater selection of execution outcomes available to them.

Ready to dive deeper? Download our latest whitepaper!

Methods of Execution in the Mortgage Secondary Market

When it’s time to sell, a Best Execution Analysis takes into account every possible outcome to see which buyer of mortgage loans is offering the best price to the seller for their specific product. This relationship of choices is best illustrated by the chart below, where you can see all the executions possible for both Best Efforts and Mandatory delivery.

It’s important to remember that a mortgage loan has two parts that are sometimes priced separately to achieve the Best Execution. There is the “mortgage loan asset” portion of the loan and the Mortgage Servicing Rights (MSR). The “mortgage loan asset” is the actual amount of the loan which gives an immediate and one time profit during a sale. The MSR financial asset produces smaller incremental profits over the course of the life of the loan. When you are ready to sell the loan, a robust Best Execution analysis will take into account every potential outcome of bundling or splitting of these two parts of the mortgage loan to see which combination has the highest profit outcome. In the next section we’ll outline all the potential executions that a loan can have.

The Role of Investors in the Mortgage Secondary Market

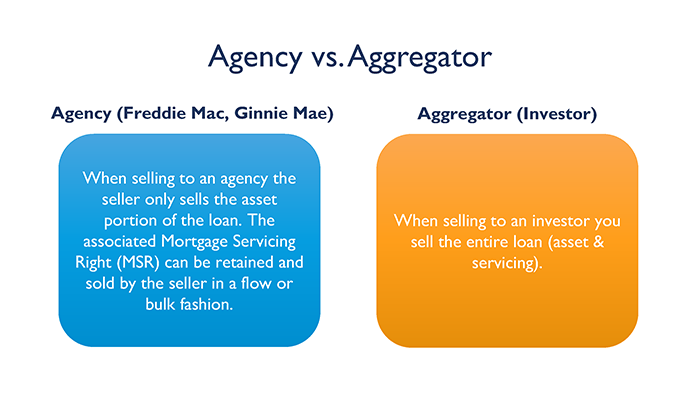

Every mortgage loan is sold to an investor, also known as a “buyer” of loans in the mortgage secondary market. There are two types of investors: an agency (like Freddie Mac, Fannie Mae, or Ginnie Mae) or an aggregator. The main difference between these two types of buyers is that agencies typically only purchase the asset portion of the mortgage loan whereas aggregators typically purchase the entire loan, including both the mortgage loan asset and servicing. When you choose executions with an agency, you will need to make further choices to either retain or release the MSR asset for the greatest financial benefit.

Selling Mortgage Loans to a Government Agency

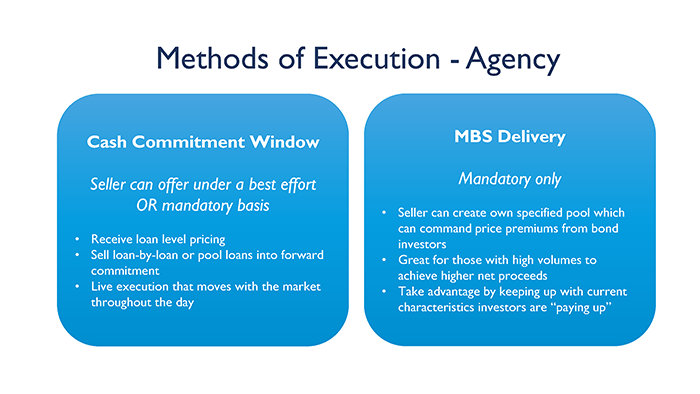

When conducting a Best Execution analysis, the many types of agency execution styles are taken into consideration to compare price. With Agencies, there is the option of selling Cash Commitment Window and MBS Delivery.

- Cash Commitment Window (Fannie or Freddie) – When delivering through the Cash Commitment Window, the seller can commit under a best-effort or mandatory basis. The seller will receive loan-level pricing. They can sell either on a loan-by-loan basis or pool loans into a forward commitment through the cash commitment window. This is a live execution that moves throughout the day with market movements. Only Fannie Mae and Freddie Mac offer this execution method.

- MBS Delivery (Ginnie) – There is no best-effort delivery option for MBS delivery. Additionally, MBS Delivery is the only option for Ginnie Mae. This means you have to have mandatory commitment capability before working with Ginnie Mae. MBS delivery allows mandatory sellers to create their own specified pools. This allows them to command price premiums from bond investors. So, particularly for sellers with higher volumes, selling specified pools is a meaningful way to achieve higher net proceeds.

Selling Mortgage Loans to an Aggregator

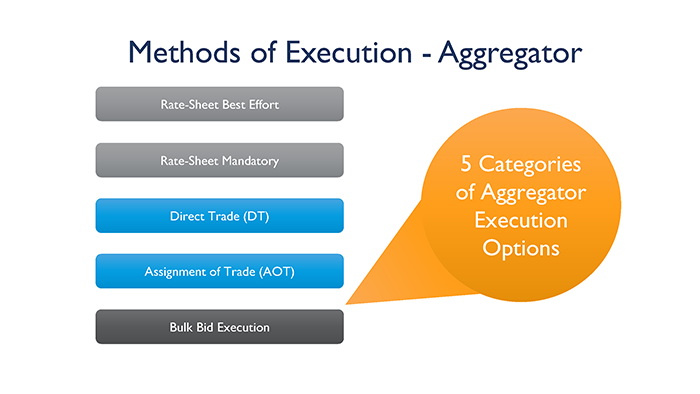

There are five categories of aggregator execution options, described below.

The most basic of these execution options are the static rate sheets:

1. Rate-Sheet Best Efforts – This is a static rate-sheet price that only requires a best-effort delivery.

2. Rate-Sheet Mandatory – This is a static rate-sheet price that only requires a mandatory delivery.

The next two aggregator execution options are generated from the same model:

3. Direct Trade (DT) – A live TBA security price is the base from which the aggregator will adjust to arrive at its note-rate pricing.

4. Assignment of Trade (AOT) – The seller will assign their TBA position to the aggregator and the original execution level of this assigned trade then becomes the security price basis from which the aggregator will adjust to arrive at note rate pricing.

Full Advantage of Assignment of Trade (AOT)

The economics of Direct Trade and Assignment of Trade are identical, except the TBA bid-offer spread is saved when assigning the trade. AOT is based off of the original trade price of the assigned hedge position whereas DT uses current-market security levels for pricing. With AOT, the gain or loss that would normally be incurred by the pair-off of the TBA position is simply incorporated into the note-rate pricing. By Assigning the TBA hedge trades to the aggregator, the pair-off is no longer necessary. So the TBA bid-offer spread will be saved when assigning the trade. This saves the seller between 1 and 5 bps, depending on the broker/dealer and trade size.

The last aggregator execution method is the bid tape execution.

5. Bid Tape Execution – The seller sends the aggregator a bid tape, which will contain all material data points from a pricing perspective, to which the aggregator will send back net pricing on the loan collateral in bulk. The benefit of Bid Tape pricing is that it will be the most accurate because the aggregator bases their pricing on all relevant loan data. It is also advantageous to the seller because there is no pool size minimum and sellers can execute on any percentage of the pool. This enables secondary-marketing managers to isolate and execute only the loans where the bulk bid execution is ahead of all other pricing levels. Then also execute the other loans with the highest execution outside of the bid. After the loan asset is sold to either an agency or aggregator, the last step is to make a decision on what is the best outcome for the attached Mortgage Servicing Rights.

About MCT’s Bid Tape AOT for Best Execution

Bid tape AOT programs are supported in our MCT Marketplace. MCT Marketplace was born out of a need for security in bid tapes and moving away from emails. This is a product that provides better execution for the lender without having to give up margins and makes you more competitive. This platform is now being used to automate the tri-party agreement between the lender, investor and broker/dealer in AOT transactions. This new functionality within MCT Marketplace is rapidly changing the best execution landscape.

Bid tape AOT programs are supported in our MCT Marketplace. MCT Marketplace was born out of a need for security in bid tapes and moving away from emails. This is a product that provides better execution for the lender without having to give up margins and makes you more competitive. This platform is now being used to automate the tri-party agreement between the lender, investor and broker/dealer in AOT transactions. This new functionality within MCT Marketplace is rapidly changing the best execution landscape.

Calculating Best Executions for MSRs in the Secondary Market

As we mentioned earlier, selling to an agency gives the seller the option of retaining servicing rights for future income or releasing the Mortgage Servicing Rights (MSR) to be sold. Servicing value exists due to the servicer being able to collect a piece of the borrower’s payment in return for administering the loan. During a best execution analysis, a release-retain decision is made the following way:

- The cost to service and discount rate are taken into account to determine the value of the MSR.

- Using the valuation of the MSR asset, the Cash Best Execution Analysis compares the cash executions.

- Then, the Economic Best Execution Analysis compares the cash released execution to the forecasted retained value.

- One last calculation called “Cash to Acquire” is reviewed to show the cash execution that is given up by the seller when choosing to retain the servicing.

- By reviewing all of these options, the decision to retain or release the MSR is then made.

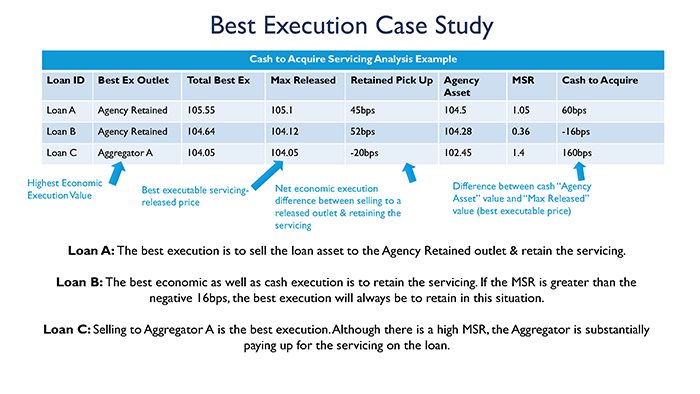

Below is an example of how Cash to Acquire can change depending on the type of execution you take.

- Mortgage Loan A: The best execution is to sell the loan asset to the Agency Retained outlet and retain the servicing.

- Mortgage Loan B: The best economic as well as cash execution is to retain the servicing. If the MSR is greater than the negative 16bps, the best execution will always be to retain in this situation.

- Mortgage Loan C: Selling to Aggregator A is the best execution. Although there is a high MSR, the Aggregator is substantially paying up for the servicing on the loan.

Performing a Best Execution Analysis

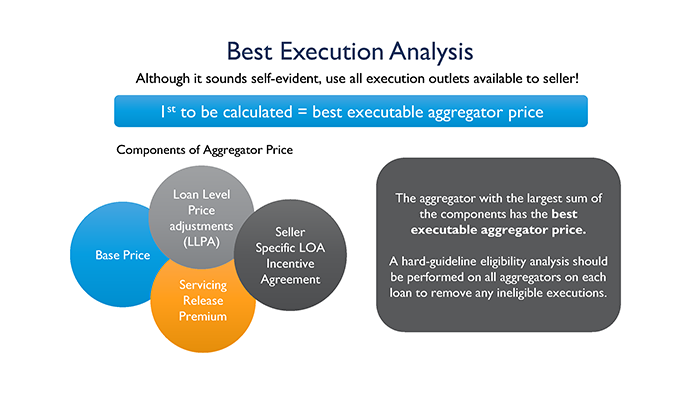

Now that we went through all the key factors, we will explain how a Best Execution Analysis is performed. Although it sounds self-evident, it’s best to use all execution outlets available to ensure maximum profitability for mortgage loans sold. We will also review some commonly overlooked features of the analysis as well as common mistakes.

Step One: Determining Best Executable Aggregator Price

The first calculation made is determining the best executable aggregator price. The aggregator that has the largest sum of these values will possess the best aggregator price. The components of an aggregator price are:

- Base Price

- Loan Level Price adjustment (LLPA)

- Seller Specific LOA Incentive Agreement

- Servicing Release Premium

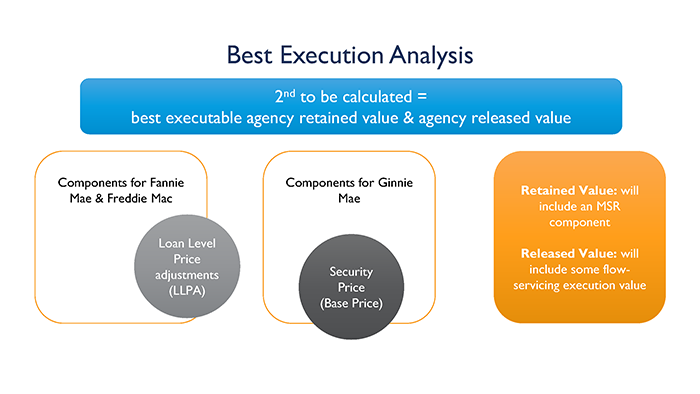

Step Two: Determine Best Executable Agency Prices

The next calculation to be made will be to determine the best executable agency retained value and the best executable agency release value. These two separate values allow the seller to compare the best executable price in two scenarios of retaining or releasing the MSR component. There are less variables to calculate in the analysis when obtaining the best agency prices. For Fannie Mae and Freddie Mac, the components needed for a Best Execution Analysis are:

- Base Price

- Loan Level Price adjustments (LLPA)

As for Ginnie Mae, the only component to look at is the Base Price (Security Price).

Avoiding Common Mistakes in Best Execution Decisions

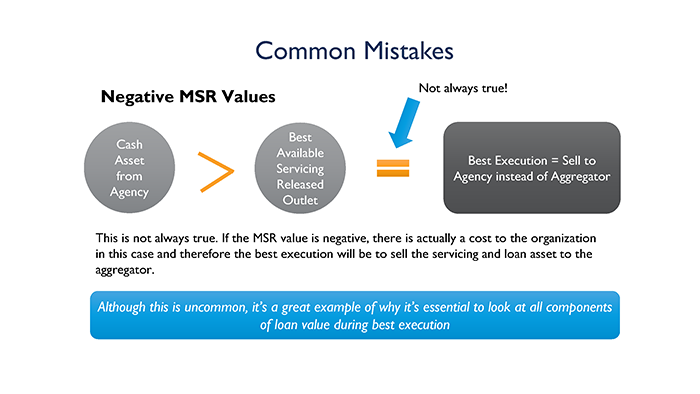

Oftentimes, while looking for the best execution sellers may forget to calculate two important factors into their analysis, which can greatly affect the overall profit.

- The first often-neglected factor in the best execution analysis is Warehouse Carry. Each note rate must be compared to the seller’s borrowing costs.

- The second often-neglected factor in the best execution is an Aggregator File Fee, which applies to most loans sold to an aggregator. This can be as much as $400 difference per file between aggregators, which makes a big difference for a small mortgage loan and is an important factor in the retain and release analysis. For example, on a $50,000 loan, a $400 difference in file feels would adjust the execution comparison by 80 bps.

A Caution About MSRs and File Fees: If the MSR valuation model has substantially reduced the forecasted retained value due to a small loan size, the file fee will have a huge effect. Some valuation models will drop the Net Present Value of the MSR below zero. Negative MSR values mean the servicing asset is worthless to the seller and will actually have a net cost impact to the organization over the expected life of the loan.

What’s the Best Price? Comparing Mortgage Secondary Market Executions

Once the best executable aggregator and agency prices have been calculated, taking file fees and warehouse carry into consideration, all the possible executions can be compared. The most important value to compare for each route is:

- Economic Best Execution – Over best net value inclusive of the MSR forecast

- Cash Best Execution – Best net execution without including MSR valuation

- Cash to Acquire Servicing – Difference between the highest released execution and the highest retained execution prior to adding MSR value

Sellers should look to the Economic Best Execution for decisions on where and how to sell their loan. When these analyses point to servicing-retained execution, the seller will then consult the Cash to Acquire Servicing analysis. With no cash restraints, the results of the economic best execution should always prevail, however, as anyone with experience in the mortgage industry knows, this is not always the case.

The Future of Best Execution in the Mortgage Secondary Market

AOT for bulk-bid executions is the future of Best Execution. When this article was written in 2016, we were dreaming of a simple price adjustment to account for the difference between the current market levels and the original execution basis of assigned trades.

Now that bid tape AOT has become the “new normal” for the secondary market, the last hurdle in bulk-bid has been removed and we can expect bid tape executions to become more prevalent. Being able to share data between sellers and buyers through MCT Marketplace will continually advance the efficacy and accuracy of mortgage loan pricing, which will further benefit all parties involved.

To bring the industry-leading Best Execution, Bid Tape AOT and MCT Marketplace to your company, contact MCT to learn more!

Related Articles: