Weekly Technology Improvement Series:

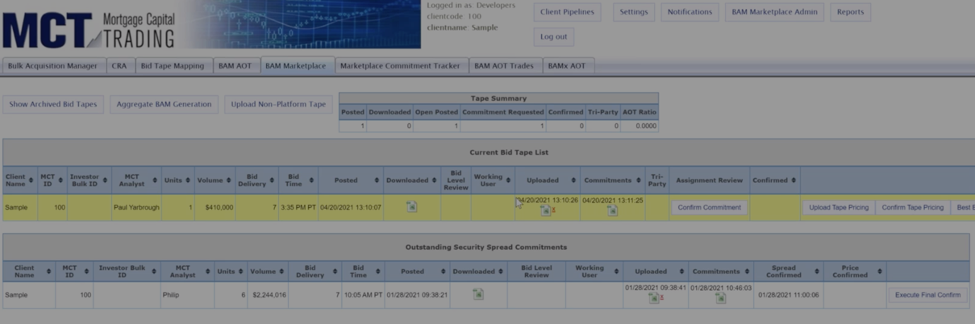

Bid Tape Mapping for Non-Platform Tapes

Published 9/17/2021

We aren’t naïve. Sellers use other services than ours, such as Resitrader, to sell loans.

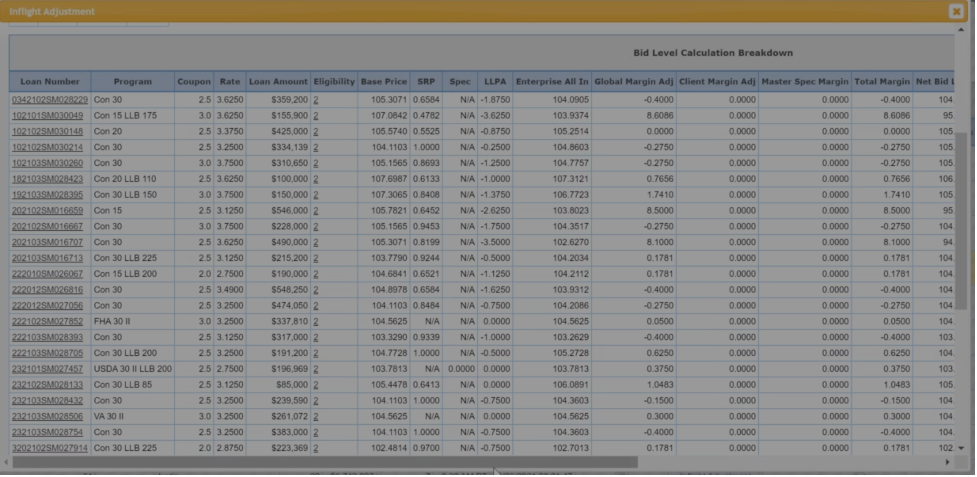

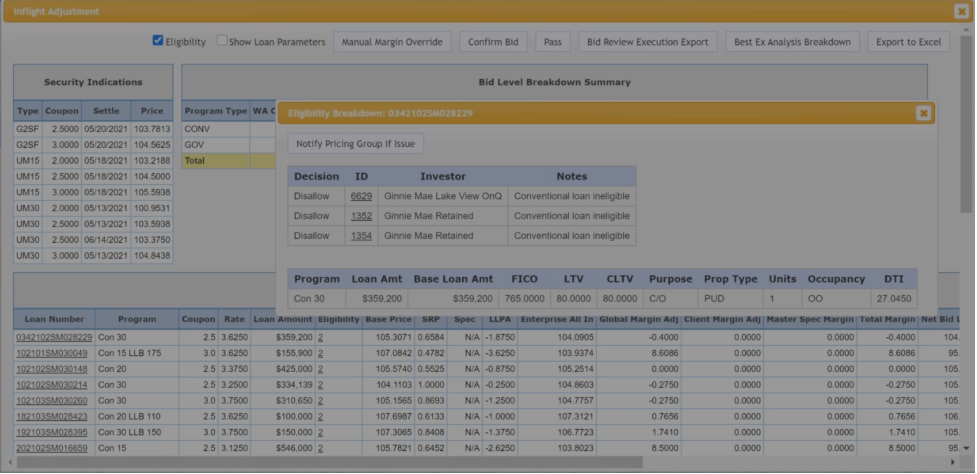

With our easy and robust tape mapping tool that includes eligibility breakdown, we map and normalize tapes for you.

Pull rules that make a loan ineligible for a particular pricing institution. It is a quick and easy way to see eligibility that lets you get as granular as you like.

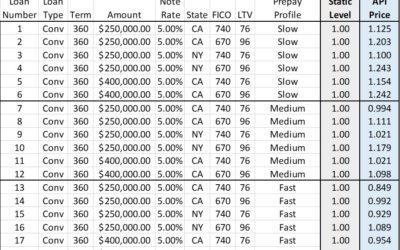

We also provide a pricing breakdown, which tells you exactly what you need to pay for a loan.

Autobid generates pricing once you hit a button, but you don’t actually need to hit a button.

You can employ Autoprice, which also has controls surrounding tape size, etc.

Price every loan without extra work, providing you with a massive time savings.

Have confidence in the ability to turn tapes without a secondary employee watching it all day.

In an effort to inform you of these real time enhancements this series will review the latest MCTlive! innovations and functionality updates. Join our newsletter to be updated on new releases.

This series focuses on technology updates to MCTlive!, MCT’s award-winning loan pipeline management software.

MCTlive! Features include:

- 100% Cloud-Hosted, Web-Based, Real-Time Functionality

- Multidimensional Pull-Through Analytics

- MCT Marketplace loan trading exchange

- Electronic TBA Trading

- Rapid Commit for Agency Delivery

View All Rasori’s Relentless Releases

Mortgage Banker Magazine Names Curtis Richins on Legends of Lending List

Curtis Richins, President of MCT, has been selected to Mortgage Banker Magazine’s inaugural “Legends of Lending” list. The magazine’s inaugural class was compiled to highlight the most talented, ambitious, and legendary individuals who are achieving excellence and making a difference in the mortgage industry.

Features Overview: Fannie Mae Purchase Advice API – Rasori’s Relentless Releases

In MCT’s latest installment of Rasori’s Relentless Releases, Phil Rasori covers the new Fannie Mae purchase advice API. View the episode to get the scoop on these timely updates.

MCTlive! Lock Volume Indices: June 2022 Data

MCTlive! Mortgage Lock Volume Indices covers the period from June 1 through June 30, 2022, and represents a broad and balanced cross section of several hundred lenders of various sizes and business models in the mortgage industry across retail, correspondent, wholesale, and consumer direct channels.

MCTlive! Mobile App Updates – Rasori’s Relentless Releases

In MCT’s latest installment of Rasori’s Relentless Releases, Phil Rasori covers the features of the MCTlive! Mobile App. View the episode to get the scoop on these timely updates.

MCT Whitepaper: Leveraging TBA Trading in your Mortgage Loan Sale Process

Especially in volatile markets, it’s good to have a finger on your pipeline and trade frequently. Our latest whitepaper outlines ways to gain more efficiencies over your TBA trading.

MSR Buyers are Improving their Pricing Strategy with Custom MSRlive! API

With the new MSRlive! API, you can develop pricing that includes key loan-level characteristics such as location, FICO, loan-to-value (LTV), and more in real time. By factoring in these elements, there is an opportunity which allows avoiding overpaying for potentially underperforming assets.

MCT Client Exclusive Webinar – Current Market Overview and Recommendations

In this client exclusive webinar from Wednesday, June 22 at 11AM Pacific, we discuss the current market including actionable recommendations and insights.

New MSR Technology Empowers MSR Buyers with Live Loan-Level Pricing

Mortgage Capital Trading (MCT®), a leading mortgage hedge advisory and secondary marketing software firm, has announced today a new technology for mortgage servicing rights (MSR) buyers to produce more granular pricing for mortgage servicing. The feature leverages an application programming interface (API) to connect MSRlive!, MCT’s state-of-the-art MSR valuation platform to clients’ systems for more precise and accurate loan-level pricing in real time.

MCT Whitepaper: Six Unique Ways to Increase Your Profitability Despite Market Headwinds

Despite the current environment, MCT® helped clients earn an extra $230,000,000 in Q1 2022, or $750,000 in additional profits per client on average. MCT leverages unique software and services like BAM Marketplace, bid tape AOT, and Trade Auction Manager to help clients squeeze every basis point from their best execution loan sale strategy.

MCTlive! Lock Volume Indices: May 2022 Data

MCTlive! Mortgage Lock Volume Indices covers the period from May 1 through May 31, 2022, and represents a broad and balanced cross section of several hundred lenders of various sizes and business models in the mortgage industry across retail, correspondent, wholesale, and consumer direct channels.