Weekly Technology Improvement Series:

Pricing Granularity

Published 9/10/2021

MCT Marketplace features recent improvements on both the buy side and the sell side.

One of the primary functionality enhancements is in the Autobid software, which has new features for granularity on pricing and margins on bids.

For certain types of loans, investors can now easily manage pricing for sellers via new margining features on loans with specified value payups that allow the user to define in either bps or as a % of the total payup.

For example, maybe you want 50 bps and 50% of the spec payup on a particular loan.

Specs for Fannie, Freddie, and GNMA are handled in different ways and the new functionality in MCTlive! provides users the ability to load their own spec payup grid or use the derived payups to margin off of.

You can now build out your own programming rules. So, for example, on a Freddie cash retained loan, you can now choose from all applicable spec values and get as granular as you want on the filters.

It will recalculate daily pickup as the spec values get updated. It will also display a hit to price on a global level, such as for a low loan amount, and can adjust on a client level for loan attributes.

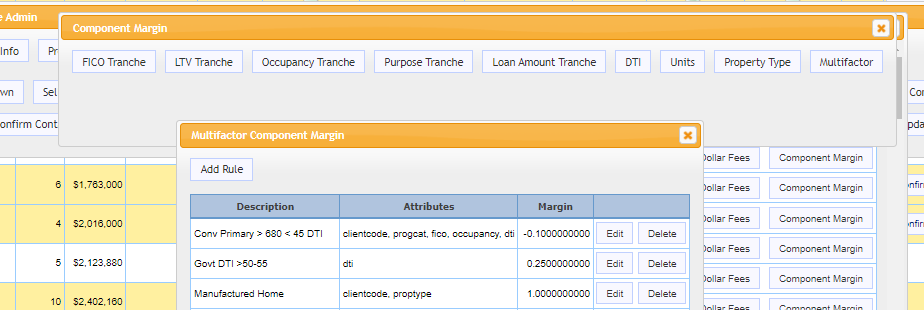

Our new multifactor rule builder for margins and overlays really drives home your point of being a self-managed, very sharp pricing tool for buyers.

This tool allows you to combine any attribute to define when a rule should apply. So, if you want a 5pt hit on loans with a PIW, TX, < 640 FICO, > 80% LTV, MH, for 5 of your sellers. You can do that!

In an effort to inform you of these real time enhancements this series will review the latest MCTlive! innovations and functionality updates. Join our newsletter to be updated on new releases.

This series focuses on technology updates to MCTlive!, MCT’s award-winning loan pipeline management software.

MCTlive! Features include:

- 100% Cloud-Hosted, Web-Based, Real-Time Functionality

- Multidimensional Pull-Through Analytics

- MCT Marketplace loan trading exchange

- Electronic TBA Trading

- Rapid Commit for Agency Delivery

View All Rasori’s Relentless Releases

MCTlive! Pool Optimizer Technology Sets New Bar for Best Execution Loan Sales

Mortgage Capital Trading, Inc. (MCT®), a leading mortgage hedge advisory and secondary marketing software firm, debuted upgraded MCTlive! Pool Optimizer functionality at its MCT Exchange client conference last month. The technology enables secondary marketing managers to use actual cash window execution for optimization on each individual loan rather than using a dealer survey for spec pay-ups.

History of Best Execution for Mortgage Loans

Learn the past and future of best execution in the secondary mortgage market so that you can get ahead of the competition and be a well-informed mortgage professional.

Alexa Voice Integration – Rasori’s Relentless Releases Episode 5

In MCT’s fifth episode of Rasori’s Relentless Releases, Phil Rasori announces the first stage of Alexa voice integration for the MCTlive! platform. This new integration will include command chains that allow for full remote secondary execution, including loan sale commitments and TBA positions.

MCT Client Webinar – MCT Marketplace Opportunities & Executions

Join us for this client webinar on October 29. 2020 at 11AM PT.

Best Execution Analysis in the Secondary Mortgage Market

A Best Execution Analysis determines the outlet and method of delivery that will yield the highest net economic benefit for mortgage loan collateral.

Industry Webinar: Election Volatility Preparedness, Part 2

Join us on October 22nd at 11AM PT to discuss the upcoming election volatility. With less than 20 days until election day, there are clear signs that this could possibly be the most-contentious U.S. presidential elections in decades. With uncertainty on the horizon, MCT will continue to fortify client preparedness before, during, and after volatility with educational and timely content.

MCT’s Business Intelligence Platform Gives Lenders Competitive Advantage with Actionable Insights & Data

MCT announced the upcoming launch of their Business Intelligence Platform, a powerful web-based analytics platform designed to empower lenders’ to understand the market, optimize their loan sales, and improve performance relative to their peers.

2020 HW Vanguard Award Winner: Leslie Winick

MCT’s Chief Strategy Officer, Leslie Winick, has been designated to HousingWire’s Vanguard Award list for 2020. The program recognizes executives who have demonstrated outstanding leadership, made a positive impact at their companies as well as the entire mortgage industry.

Case Study: Virginia Credit Union Adds Value to Members through MCT’s Services

In this case study, Mr. Jeppsen explains how MCT’s blend of industry knowledge, customer service, and award-winning software helped him achieve this goal. He also leveraged functionality in Bid Auction Manager, Rapid Commit and the InvestorMatic Program to add hours of efficiency each week.

Pull-Through Functionality for Refi Fees Reintroduction | Rasori’s Relentless Releases Ep. 4

In MCT’s fourth episode of Rasori’s Relentless Releases, Phil Rasori reviews new MCTlive! pull-through functionality which account for the market experience adjustment caused by the reintroduction of the 50 basis point Agency Refi Adverse Market Fee.