Weekly Technology Improvement Series:

Pricing Granularity

Published 9/10/2021

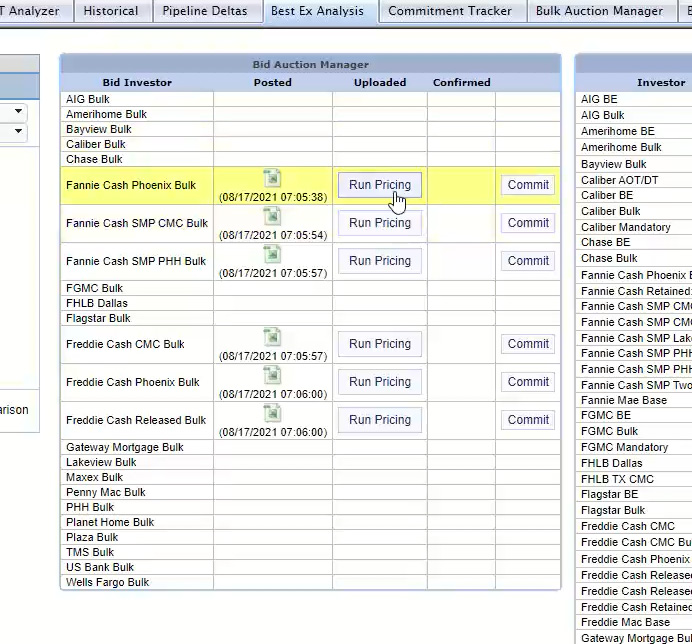

MCT Marketplace features recent improvements on both the buy side and the sell side.

One of the primary functionality enhancements is in the Autobid software, which has new features for granularity on pricing and margins on bids.

For certain types of loans, investors can now easily manage pricing for sellers via new margining features on loans with specified value payups that allow the user to define in either bps or as a % of the total payup.

For example, maybe you want 50 bps and 50% of the spec payup on a particular loan.

Specs for Fannie, Freddie, and GNMA are handled in different ways and the new functionality in MCTlive! provides users the ability to load their own spec payup grid or use the derived payups to margin off of.

You can now build out your own programming rules. So, for example, on a Freddie cash retained loan, you can now choose from all applicable spec values and get as granular as you want on the filters.

It will recalculate daily pickup as the spec values get updated. It will also display a hit to price on a global level, such as for a low loan amount, and can adjust on a client level for loan attributes.

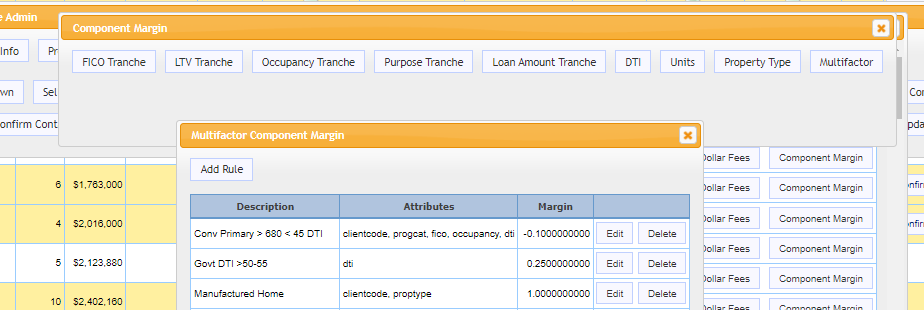

Our new multifactor rule builder for margins and overlays really drives home your point of being a self-managed, very sharp pricing tool for buyers.

This tool allows you to combine any attribute to define when a rule should apply. So, if you want a 5pt hit on loans with a PIW, TX, < 640 FICO, > 80% LTV, MH, for 5 of your sellers. You can do that!

In an effort to inform you of these real time enhancements this series will review the latest MCTlive! innovations and functionality updates. Join our newsletter to be updated on new releases.

This series focuses on technology updates to MCTlive!, MCT’s award-winning loan pipeline management software.

MCTlive! Features include:

- 100% Cloud-Hosted, Web-Based, Real-Time Functionality

- Multidimensional Pull-Through Analytics

- MCT Marketplace loan trading exchange

- Electronic TBA Trading

- Rapid Commit for Agency Delivery

View All Rasori’s Relentless Releases

Improve Margins and Price Competitiveness with the Fannie Mae Mission Score API [MCT Industry Webinar]

In this webinar featuring Fannie Mae’s Olga Gorodetsky alongside Phil Rasori and Paul Yarbrough of MCT, panelists discuss the goals, features, and benefits of this technology integration for mortgage originators and their borrowers.

MCT and Lender Price Join Forces to Improve Mortgage Pricing with Loan-Level MSR Values

Mortgage Capital Trading (MCT®), the de facto leader in innovative mortgage capital markets technology, and Lender Price, the first cloud-native provider of mortgage pricing technology, have partnered to provide mortgage lenders using the Lender Price product and pricing engine (PPE) with loan-level MCT MSR values. MCT’s industry-leading mortgage servicing rights (MSR) grids allow Lender Price PPE clients to be more granular, profitable, and efficient when generating their front-end borrower pricing and managing their MSR portfolio.

Q2 2024 Valuations Interview with David Burruss

We asked MCT’s Director of MSR Sales, David Burruss, to sit down and provide insight regarding MSR valuations as it pertains to the current market. In this video, Mr. Burruss discusses industry trends and answers the questions that the majority of clients are currently asking him. Watch the video to hear his summary and advice on MSR Valuations.

MCT Reports a 7% Mortgage Lock Volume Increase in Latest Indices Report

Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, announced today an increase of 6.78% in mortgage lock volume compared to the previous month. To gain comprehensive insights into the market dynamics, industry professionals and enthusiasts are invited to download the complete report.

MSR Market Monthly Update – June 2024

Click to read the most recent MSR Market Update! – Mortgage rates and some rate indices have experienced a slight retreat from their end of April highs, closing the month of May with robust gains over end of Q1, 2024 levels. Mortgage rates managed to end the month of May with a decrease of about thirteen (13) basis points, while float income rates decreased by about the same amount during the same period. MSR portfolio holders should expect a moderate value decline in the range of one to four (1-4) basis points from the end of April results. However, those decreases will vary depending on portfolio vintages and other portfolio characteristics such as agency and GNMA mix. The downrate risk and its potential impact on MSR values will persist as we navigate through the balance of 2024.

MSRlive! 3.0 – New Technological Advancements that Produce Better Efficiency

Join MCT’s Bill Shirreffs, Senior Director, Head of MSR Services and Sales Operations, David Burruss, Director, MSR Sales, Natalie Martinez, Manager of the MSR Services Department & Client Success, and Azad Rafat, Senior Director, MSR Services as they discuss new enhancements to the MSRlive! model, provide insight into the MSR market as a whole, and open the floor for questions from participants.

How Correspondent Investors can Leverage AOT Automation in MCT Marketplace

In this blog, MCT’s Justin Grant, Senior Director, Head of Investor Services explains how AOT automation is paving the way for a new era of efficiency and profitability in mortgage trading, especially with the help of MCT Marketplace. Read on to see how AOT can benefit investors and sellers alike.

MCT’S SARAH HELLMAN NAMED AS ONE OF HOUSINGWIRE’S 2024 RISING STARS

Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, proudly announces that Sarah Hellman, Director, Lender Business Intelligence, has been named HousingWire’s 2024 Rising Stars.

MCT Base Rate Generator Facilitates Better Pricing and Day-One Margin Preservation for Mortgage Originators

Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, today announced the release of the Base Rate Generator, an industry-changing solution that allows mortgage lenders to directly inform their front-end rate sheet pricing with their back-end capital markets executions.

Preserve Margins and Improve Pricing with the Base Rate Generator [MCT Industry Webinar]

View the webinar recording featuring MCT’s Phil Rasori, Chris Anderson, Rob Barnhill and Luke Chang on the latest developments in front-end pricing and back-end capital markets execution. The landscape and granularity of investor pricing has changed, and lenders should keep up in order to preserve and optimize their margins.

![Improve Margins and Price Competitiveness with the Fannie Mae Mission Score API [MCT Industry Webinar]](https://mct-trading.com/wp-content/uploads/2024/06/FNMA-MCT-Mission-Score-Webinar-1-400x250.jpg)

![Preserve Margins and Improve Pricing with the Base Rate Generator [MCT Industry Webinar]](https://mct-trading.com/wp-content/uploads/2024/05/Base-Rate-Generator-Webinar-Recording-1-400x250.jpg)