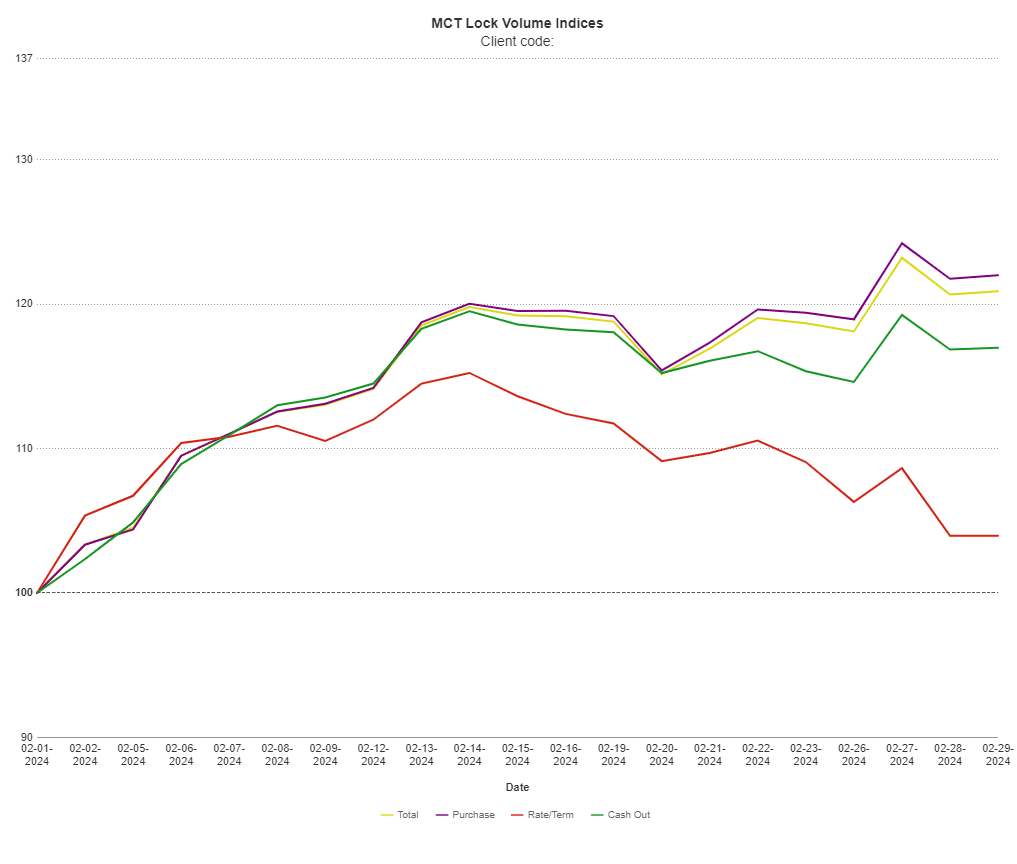

SAN DIEGO, CA – March 6, 2024 – Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, has reported a 20.9% increase in mortgage lock volume in February compared to the previous month. To gain comprehensive insights into the market dynamics, industry professionals and enthusiasts are invited to download the complete report.

This month’s increase comes against a backdrop of rising interest rates, a robust jobs market, and a stronger-than-predicted CPI report. Despite the prevailing market conditions, the twenty percent increase in mortgage lock volume showcases positive buyer sentiment within the industry. However, it’s important to note that this month-over-month uptick represents a relative change, reflective of the traditionally slower winter buying season.

Looking ahead, the Federal Reserve will closely monitor forthcoming non-farm payroll and inflation reports to inform decisions regarding potential rate adjustments. Andrew Rhodes, Senior Director and Head of Trading at MCT, emphasized the significance of these impending reports, stating, “The upcoming non-farm payroll and CPI reports will have a significant impact on the decision for the upcoming Fed meeting in terms of forward guidance. If we continue to see higher than anticipated job and inflation reports, we could see market expectations start to push rate cuts out to Q3 or later which could act to depress mortgage volume.”

Download MCT March Indices Report

To access the comprehensive insights provided by MCT’s Lock Volume Indices, interested parties are encouraged to download the full report.

MCT’s Lock Volume Indices present a snapshot of rate lock volume activity in the residential mortgage industry broken out by lock type (purchase, rate/term refinance, and cash out refinance) across a broad diversity of lenders (e.g., sizes, products/services offered, business models) from MCT’s national footprint.

For over two decades, MCT has been a leading source of innovation for the mortgage secondary market. Melding deep subject matter expertise with a passion for emerging technologies and clients, MCT is the de facto leader in innovative mortgage capital markets technology. From architecting modern best execution loan sales to launching the most successful and advanced marketplace for mortgage-related assets, lenders, investors, and network partners all benefit from MCT’s stewardship. MCT’s technology and know-how continue to revolutionize how mortgage assets are priced, locked, hedged, traded, and valued – offering clients the tools to perform under any market condition.

For more information, visit https://mct-trading.com/ or call (619) 543-5111.

Media Contact:

Ian Miller

Chief Marketing Officer

Mortgage Capital Trading

619-618-7855

pr@mctrade.net