Weekly Technology Improvement Series:

Data “Writeback” in MCTlive!

Published 9/24/2021

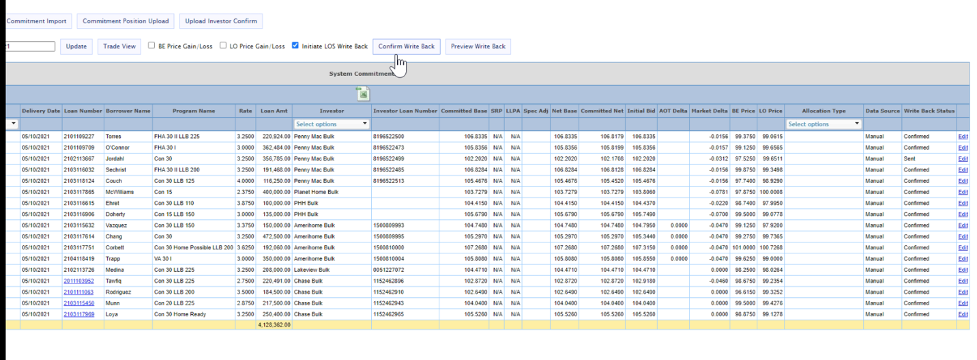

Looking to conduct your “write backs” from the MCTlive! platform?

Our Commitment Tracker Tab confirms come in via API or are uploaded by investors.

All that information is organized and displayed on a loan level in the commitment tracker.

You can initiate, preview, and confirm data write back to your LOS.

We conduct error checking to catch things such as duplicate sends or missing data to prevent mistakes.

Differentiators MCTlive! has that others may not include: populating custom fields, doing custom calculation and doing write backs at the loan-level rather than the trade-level.

In an effort to inform you of these real time enhancements this series will review the latest MCTlive! innovations and functionality updates. Join our newsletter to be updated on new releases.

This series focuses on technology updates to MCTlive!, MCT’s award-winning loan pipeline management software.

MCTlive! Features include:

- 100% Cloud-Hosted, Web-Based, Real-Time Functionality

- Multidimensional Pull-Through Analytics

- MCT Marketplace loan trading exchange

- Electronic TBA Trading

- Rapid Commit for Agency Delivery

View All Rasori’s Relentless Releases

MCT Reports Stable Purchase Lock Volume in June Despite Market Pressures

MCT reports June purchase lock volume held nearly flat, signaling steady housing demand amid high rates, as refis drop sharply due to rate volatility.

MSR Market Monthly Update – June 2025

Mortgage rates and most other rate indices have risen during the month of May. MCT’s mortgage rates model reflected an increase in rates of about 15 basis points, on average. Read the full release for the June 2025 MSR update.

Full Service Hedging Success with MCT

Watch how an expert MCT trader discusses the ease of onboarding to the platform, the quality of data, and our commitment to communication

MCT’s Atlas AI Makes First Hedge Recommendation for Pike Creek Mortgage Services [VIDEO]

Watch how Pike Creek Mortgage uses MCT’s generative AI, Atlas, to request and act on a live hedge recommendation in the MCTlive! platform.

MCT’s Atlas AI Makes First-Ever Hedge Recommendation on a Live Mortgage Pipeline

MCT’s Atlas AI becomes first generative AI to inform a live hedge execution, marking a groundbreaking step in AI-driven mortgage capital markets technology.

MCT Reports Unchanged May Lock Volume as Economic Uncertainty Continues

MCT’s May Lock Volume Indices show flat mortgage activity amid market volatility, with rate/term refis down 13% and total volume up 11% year-over-year.

Correspondent Lending 101: Essentials for Scaling Mortgage Operations

Learn how correspondent lending drives homeownership, why it’s key for market liquidity, and how mandatory loan sales can help correspondent lenders scale.

MSR Market Monthly Update – May 2025

Mortgage rates continued their moderate volatility during the month of April. MCT’s mortgage rates model reflected a slight increase in mortgage rates of about two (2) basis points, on average. Read the full release for the May 2025 MSR update.

MCTlive! Quarterly Release Notes in Q1 2025

Described below within relevant tabs, you’ll find a listing of our Q1 2025 technology developments. This update also includes technology release notes for MCT’s MSRlive! and Business Intelligence tools.

MCT and Calyx Strengthen Integration to Improve Secondary Marketing Processes for Mortgage Lenders

MCT and Calyx launch enhanced, no-cost API integration to streamline data flow, empowering mortgage lenders with faster, more customizable connectivity.

![MCT’s Atlas AI Makes First Hedge Recommendation for Pike Creek Mortgage Services [VIDEO]](https://mct-trading.com/wp-content/uploads/2025/05/atlas-hedge-recommendation-400x250.png)